EUUK

3 July 2025

Co-hosted with Green Central Banking, we launched the 2024 edition of our Green Central Banking Scorecard with a webinar on the 26th September. Featuring key figures in central banking such as Emmanelle Assouan, Suranjali Tandon and David Salles de Barros Valente, we discussed the latest G20 ranking, and how banks need to step up on climate action.

Banks are pouring billions into fossil fuels and other industries accelerating climate breakdown. But, central banks across the world have huge power to redirect private finance away from dirty sectors and towards clean ones, and set the tone for other banks to follow. Are they stepping up to the challenge?

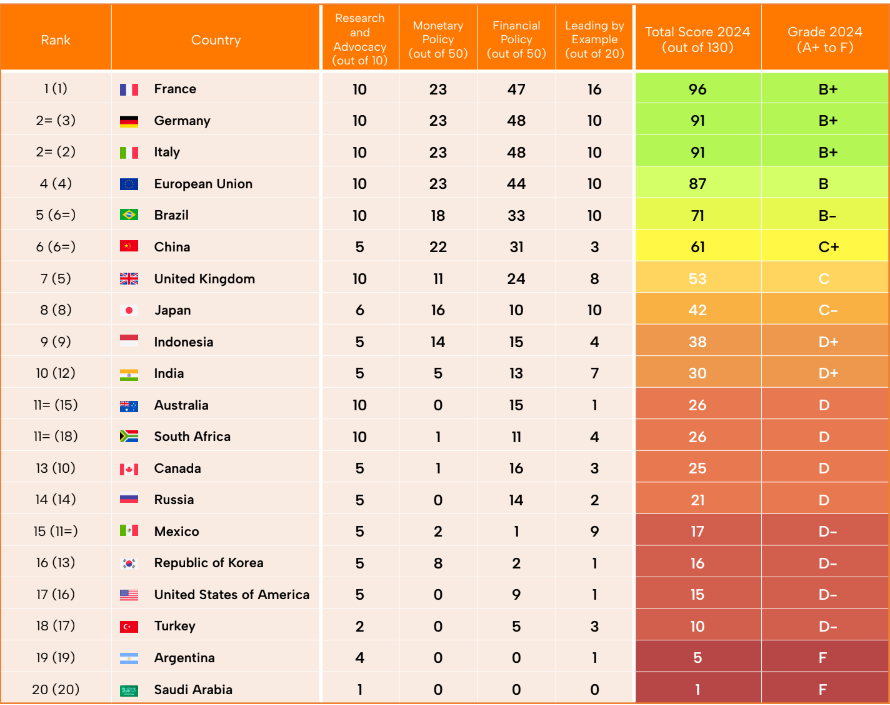

This is the question answered by the latest edition of our Green Central Banking Scorecard, which examines how G20 central banks (and related supervisory institutions) are responding to the risks posed by the climate crisis. This is the fourth edition of the Scorecard, which assesses banks' green progress across four categories: Research and Advocacy, Monetary Policy, Financial Policy, and Leading by Example. You can see the table of results below, with the ranking number in brackets showing that country’s position in the previous edition.

France tops the table thanks to aligning all its non-monetary portfolios with 1.5C and excluding some fossil fuels. However, even at first place it still only scored a B+, showing how every G20 country needs to do more, especially those most historically responsible for the climate crisis. The Bank of England has slid down the rankings to 7th, but most worryingly the US sits at an abysmal 17th. The US has both the means and the responsibility to act, but is still refusing to take action. This is a global cause for concern, and the report spotlights the urgent need for the top scorers to apply pressure on the US to act.

To launch the Scorecard, with Green Central Banking, we brought together leading figures, including representatives from top scoring banks France and Brazil, to discuss their progress and what more there is to do. Our discussion was chaired by Suranjali Tandon (Assistant Professor at the National Institute of Public Finance and Policy, New Delhi), and featured Emmanuelle Assouan (Director General Financial Stability and Operations, Banque de France), David Salles de Barros Valente (Senior Advisor for Prudential Regulation, Banco Central do Brasil) and Zack Livingstone (Researcher, Positive Money). You can watch the recording of our webinar launch event below.

Lead author of the report, Positive Money’s Zack Livingstone, gave an overview of the Scorecard and spoke to some of the highlights from the results. Notable changes he outlined since the 2022 edition include improvements from Brazil and China, and the EU and its member states of Italy, Germany and France, which topped the table. Zack also highlighted that the report overall makes the case for further action to actively shift financial flows away from fossil fuel activity, and that while top countries have made good progress in financial policy, monetary policy has not improved in the same way. Finally, he emphasised a key point from the report: central banking is not happening on a level playing field, and the countries occupying more privileged positions in monetary and financial hierarchies, as well as those most responsible for climate breakdown, should be expected to take the lead on implementing transformative green central banking policies.

Emmanuelle Assouan, General Director of Financial Stability and Operations at Banque de France, outlined some of the progress they have made, and the shifts in focus that have meant 20% of Banque de France research is now dedicated to climate and nature. She also spoke of some of the challenges remaining, including how to bridge the gap between financial system and real economy transition planning. For future work, Banque de France are trying to consider not just climate change mitigation but adaptation, and trying to address one of the biggest current blindspots which is nature, and how to include not just climate risks but nature risks in their planning.

David Salles de Barros Valente, Senior Advisor for Prudential Regulation, Banco Central do Brasil, spoke of the progress Brazil has made in getting banks to address climate risks specifically. He emphasised the need for the Basel Committee, which is the global standard setter for the prudential regulation of banks, to reach a consensus on climate disclosures, and the need for greater overall international alignment. David concluded by thanking Positive Money for creating the scorecard, and stated that, as Brazil takes over the G20 presidency, they will use the Scorecard in discussions with other countries on how to progress.

The scorecard shows more and more central banks are recognizing that they must incorporate environmental considerations into their operations, and demonstrate to institutions like the US Federal Reserve, who have huge influence and yet are stalling progress, that they need to step up. We will keep pushing all central banks to go further in their climate commitments, especially those, like the US, with the most historic responsibility for emissions. After all, there is no financial stability on a burning planet.

You can find the full Green Central Banking Scorecard 2024 here, or view an interactive version on Green Central Banking’s website here.