Busting myths about QE and its effect on inequality

The pandemic and current economic crisis exacerbate economic inequality by disproportionately burdening individuals on the lower part of the income distribution. The ECB’s asset purchases have further fueled this trend. It is time the ECB took these distributional effects into account when designing policies and instruments.

“These distributional side-effects then need to be tolerated.

But they clearly should not last too long.”

Yves Mersch, Zurich October 17 2014

The ECB’s response to the coronavirus emergency was the announcement to dedicate €870 billion – or 7.3% of euro area GDP – to asset purchases. In August and September 2020, net purchases added up to €2.7 billion in corporate bonds and more than €126 billion in public sector purchases under the Pandemic Emergency Purchase Programme (PEPP).

As we are in the midst of an unprecedented economic and health crisis, the ECB is likely to keep conducting asset purchases for the foreseeable future. As a result, the question of its effects on inequality becomes ever more pressing. And as the ECB admits market neutrality does not hold in the case of climate policy, it is time the bank abandons its assumption that asset purchases are neutral in relation to wealth inequality.

The argument is that asset purchases increase economic inequality (Metzger and Young, 2020; Domanski et al. 2016; Fontan et al. 2016) by pushing up asset prices, generally benefitting investors from the upper income brackets and thereby increasing inequality of wealth. Central banks, particularly the ECB, have unfortunately dismissed this idea.

In 2018, the ECB published a paper on investigating how monetary policy affects wealth and income inequality (see this short video summarising their findings). The paper claims that QE does not increase inequality, and is in fact positively redistributional. Asset purchases increase market liquidity, which increases employment, which benefits the lower income brackets more. So while asset prices might boost wealth inequality, this effect is offset by an increase in employment and low interest rates �– which QE helped promote.

Three myths about QE and inequality

While it is harder to prove causality between unconventional monetary policy and inequality, we can use data from the ECB’s own Household Finance and Consumption Survey (HFCS) to bust some myths about QE and its effect on both income and wealth inequality.

Myth no. 1: Asset purchases have only marginally increased wealth inequality

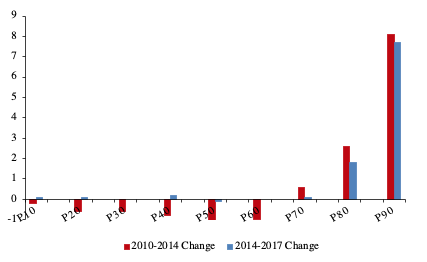

The main critique against QE is that it increases inequality through inflating asset prices and disproportionately benefits people who own assets. The below graph shows that financial wealth inequality was increasing both before and during QE.

The ECB initiated the asset purchase programs (APP) in mid-2014, and from 2015 purchased €60 billion each month. Inequality kept increasing during this period. The financial wealth of the top two deciles kept increasing, while all other deciles were stagnant.

Change in the financial wealth of households by decile

Source: HFCS. Note: C3 – change in financial wealth.

Myth no. 2: Growth in house prices reduced inequality

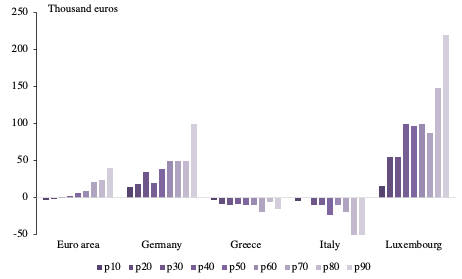

The ECB also argues that increasing prices in the housing market benefit the lower income brackets more, as they tend to hold a larger part of their wealth in real estate. The graph below shows developments in the value of real-estate during QE, which do not support this hypothesis.

While the change in the euro area as a whole is not dramatic, it clearly shows faster growth for the upper percentiles of the income distribution. This is contrasted by the fact that real estate values are decreasing in other parts of the euro area during the period – both in Greece and Italy. This shows not only divergence within countries and within income distribution, but also between countries in the context of the euro area as a whole.

Another key issue is that while real estate prices have skyrocketed in large parts of Europe, home ownership becomes an ever more distant dream for those outside of the housing market – that applies to young people and immigrants in particular, and those who fall at the very bottom of the income distribution.

Change in the value of the households’s main residence by income percentile, 2014-2017

Source: HFCS. Note: B4 – value of main residence.

Myth no. 3: Inequality has decreased

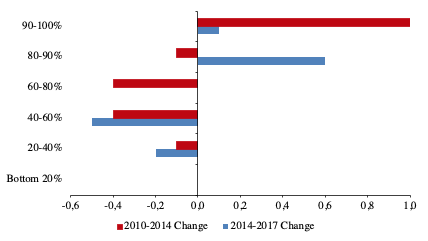

The ECB’s narrative claims that increased employment for the lower part of the income distribution has reduced inequality. In fact, the graph below shows that the share of total assets in the economy decreased, especially for those with the lowest incomes.

The top 10% increased their holdings significantly during the first period, and throughout the sovereign debt crisis. During the period of QE, the second decile increased their share of total asset holdings by a substantial amount. Meanwhile, the lower income brackets’ share of asset holdings decreases during both periods.

Change in the share of total assets across asset distribution.

Source: HFCS. Note: J1 – Share of total assets across asset distribution.

Going forward

The ECB has previously argued that the distributional effects of their policies lie outside their mandate. The mandate has often been interpreted narrowly, however, Article 127 of the Treaty on European Union states that the bank should “contribute to the achievement of the objectives of the Union” – including social justice.

Several studies have also argued that inequality reduces the efficiency of monetary policy, by weakening the transmission mechanism (i.e. Fontan et al. 2016; Ampudia et al. 2018; Auclert, 2018). This is because people in different income brackets consume at different rates. Upper income brackets save a much larger part of an increase in income or wealth – or rather they have a lower marginal propensity to consume.

As a result, loosening monetary policy weakens aggregate demand if it affects wealthier socio-economic classes – and this effect only deepens when inequality increases. Because of this, central banks need to consider monetary policy’s effects on inequality. A recent report by the International Monetary Fund (IMF) looks at the effect on inequality and concludes that central banks should take inequality into account for monetary policy decisions.

In conclusion

The traditional view is that monetary policy does not affect inequality and that adjusting imbalances in the allocation of income or wealth is a political question that should be left to governmental and fiscal policy.

Benoît Coeuré illustrated this view in a speech in 2013, when he said that central banks “should refrain from engaging in income redistribution” because they are independent and above “politics”. He then added that “these are side-effects of a strategy that aims to ensure price stability, which is by essence neutral as regards income distribution.”

However, as inequality becomes an ever more pressing global issue, “the wealth inequality literature needs better theories of idiosyncratic asset returns and to take more seriously asset price changes as a driver of wealth inequality” (Moll, 2020).

Positive Money Europe has been arguing since 2015 that instead of pumping more money into financial markets which benefit the wealthiest through asset price revaluations, the ECB should deploy helicopter money to boost aggregate demand. Helicopter money would reach those in the lowest part of the income distributions and alleviate the economic and health burden that disproportionately falls on their shoulders.