Leading economists to Chancellor: time to support alternatives to quantitative easing

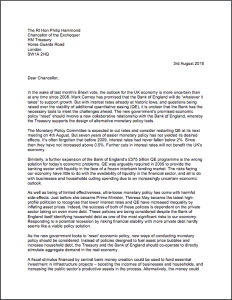

35 leading economists sent an open letter to Philip Hammond asking that he supports a new form of monetary policy. Responding to concerns expressed by the Prime Minister that low rates and quantitative easing have disproportionately benefited the wealthy, the letter argues that new monetary policy tools could stimulate the economy without contributing to inequality.

This intervention came on the day that the Bank of England voted to cut interest rates and restart its quantitative easing programme.

The letter calls on the Chancellor to investigate alternative ways of transmitting central bank money directly into the real economy, such as via a citizens’ dividend, housebuilding programme or investment in infrastructure.

The letter argues that more QE is likely to be ineffective because it relies on an already highly leveraged household sector to borrow even more. The economists “urge the new government to consider alternative policy approaches which will directly increase spending and investment in the real economy without burdening households with yet more debt.”

This letter was coordinated by Positive Money and was published in the Guardian along with an article that attracted over 1,700 comments within 24 hours. The Independent and CityAM and several other media reported about it.

Fran Boait, director of Positive Money, said:

”Theresa May recognises that low rates and QE have contributed to inequality, but the Bank of England is expected to double-down on the same failed policies. If the new Government is serious about building an economy that works for everyone, it should start by giving the Bank of England new tools to stimulate the economy without the toxic side-effects”.

The full list of signatories is as follows:

Andrew Watt, Macroeconomic Policy Institute, Hans-Böckler-Foundation

Avner Offer, University of Oxford

Biagio Bossone, Chairman of the Group of Lecce

Christian Marazzi, University of Applied Sciences and Arts of Southern Switzerland

Constantin Gurdgiev, Trinity College Dublin

David Boyle, Radix

David Graeber, London School of Economics

Ellen Brown, Pubic Banking Institute

Eric Lonergan, economist & writer

Fran Boait, Positive Money

Fulvio Corsi, City University of London

Guy Standing, School of Oriental and African Studies, University of London

Helge Peukert, University of Erfurt

Herman Daly, University of Maryland

Iqbal Asaria, CASS Business School

Jem Bendell, University of Cumbria

John Weeks, School of Oriental and African Studies, University of London

Joseph Huber, Martin Luther University of Halle-Wittenberg

Josh Ryan-Collins, New Economcs Foundation

Kaoru Yumaguchi, Doshisha Business School

Kees van der Pijl, University of Sussex

Ladislau Dowbor, Pontifical Catholic University

Laurence, Seidman, University of Delaware

Luca Ciarrocca, macroeconomic author

Livio Di Matteo, Lakehead University

Mark Blyth, Brown University

Mary Mellor, University of Northumbria

Matthias Kroll, World Futures Council

Nigel Dodd, London School of Economics

Ole Bjerg, Copenhagen Business School

Philip Haynes, University of Brighton

Lord Robert Skidelsky, Warwick University

Steve Keen, Kingston University

Thomas Fazi, Social Europe

Tim Jackson, University of Surrey

Victoria Chick, University College London