How Commercial Banks Create Money

4. Creating commercial bank money

Now lets look at how ‘commercial’ or high-street banks create the type of money that appears in your bank account.

Loans

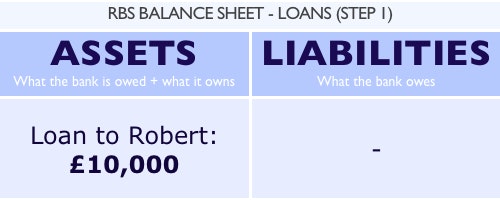

A customer, who we shall call Robert, walks into RBS and asks to borrow £10,000 to buy a new car. Robert signs a contract with the back confirming that he will repay £10,000 over a period of five years, plus interest. This legally enforceable contract represents a future income stream for the bank, and when the bank comes to draw up its balance sheet it will be included as an additional asset worth £10,000:

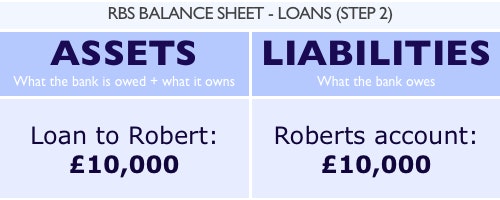

Robert, having committed to pay the bank £10,000, wants to receive his ‘loan’. So RBS opens up an account for him, and types in £10,000. This is recorded as a liability on RBS’s balance sheet as so:

Notice that no money was transferred or taken from any other account, the bank simply updated a computer database. A bank does not ‘lend money’ – to lend one must have money to lend in the first place. In reality a bank creates money – when it advances loans.

Buying Assets

Banks also create money when they buy assets, be they real or financial. For example, say Barclays Bank wished to buy a £100 government bond from a pension fund. Initially Barclays balance sheet appears as so:

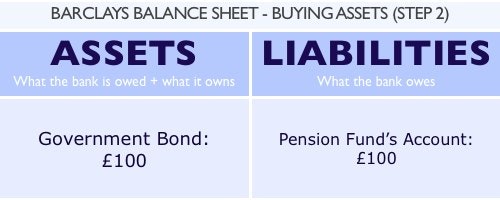

In order to buy a bond Barclays creates an account for the pension fund, and adds £100 to the balance. In exchange the bank receives a government bond worth £100. Because Barclays owns this asset it can be placed on its balance sheet of the bank:

For more details see:

Where Does Money Come From?

A guide to the UK Monetary and Banking System

Written By: Josh Ryan-Collins, Tony Greenham, Richard Werner & Andrew Jackson