Why “helicopter money” is the new whatever it takes

Seven years after Mario Draghi’s heroic “whatever it takes” speech, the European Central Bank needs to find new ways to reaffirm its ability to act. Frankfurt should clearly commit to deploying direct transfers to citizens if it needed to.

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” – Mario Draghi, 26 July 2012

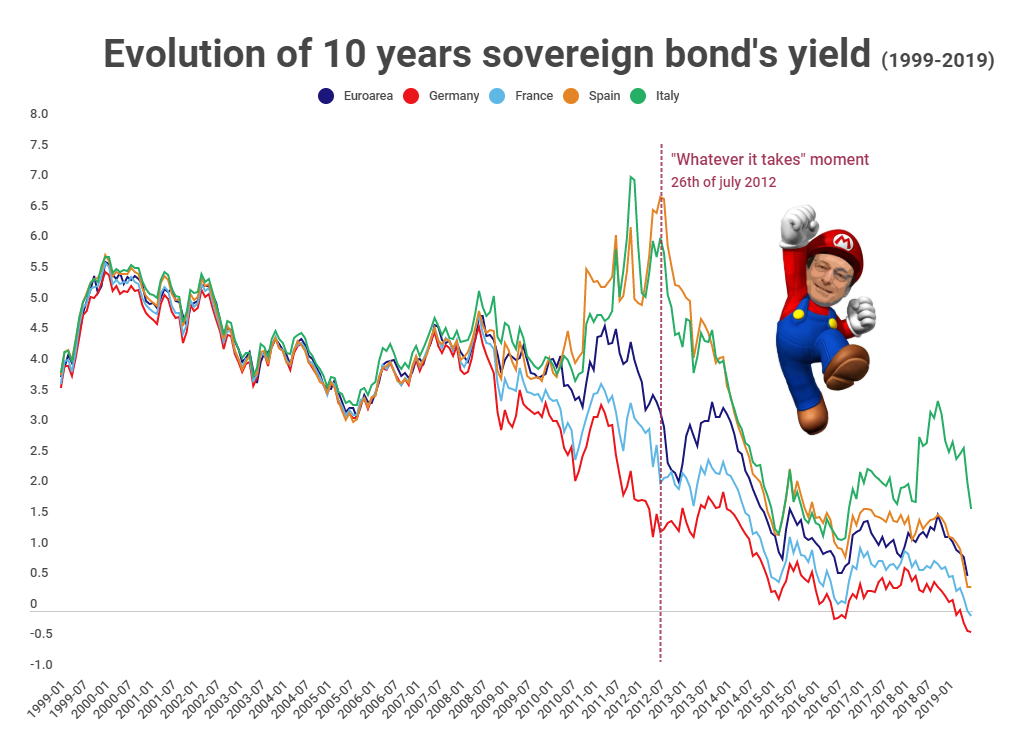

Exactly seven years ago, President Mario Draghi pledged the ECB would do “whatever it takes” to preserve the euro. Those few words will be remembered as a decisive step towards the end of the Eurozone crisis. Indeed, soon after Draghi’s remarks, market speculation against Southern Eurozone member States were muted, and interest rates spreads reduced (see the chart below).

Chart: Nicolas Hercelin – Source: ECB, Investing.com

Although the “whatever it takes” speech will be remembered as an emblematic demonstration of the power of central bank communication, Draghi’s words were effective precisely because they were not just empty words. Just a few weeks after Draghi’s speech in London, the ECB announced the framework of a new instrument – the Outright Monetary Transaction (OMT) programme. Simply put, OMT allows the ECB to intervene to support a national member states in case its government’s bond market is under stressed by undue market speculation. Under OMT, the ECB can buy an unlimited amount of bonds in order to reduce the interest rate.

Two years later, the ECB did also deliver quantitative easing – a massive 2.6 trillion euro money creation programme by which the ECB did provide liquidity to the markets by purchasing private and public debt. Quantitative Easing was unthinkable before Draghi came to power, as many central bankers and observers thought it was violating the prohibition of monetary financing rule.

There is much more the ECB did under Draghi’s leadership, but OMT and QE will certainly stand out as the two main pillars underpinning the credibility of the “whatever it takes” pledge, not least because those controversial programmes have been legally sanctioned by the European Court of Justice.

Whatever remains of whatever it takes

But as Draghi is leaving this November and Christine Lagarde will likely take over as ECB President, what remains today of the powerful whatever it takes pledge?

First, OMT has still never been used and will probably never be. The main reason for that is the fact that OMT comes with strings attached, namely the adherence by a government to a (reputationally costly) bailout programme with the ESM, which itself requires a quasi-unanimous vote between Eurozone members. In other words, the possibility to activate OMT is silted into the quicksand of EU politics made of veto powers, unanimity rules, kafkaesque intergovernmental processes and never-ending “last chance” summits.

Quantitative Easing, on the other hand, is still very well alive and active. Even though it was paused last December, the ECB continues to reinvest the repayments coming due, to the tune of 200 billion euros per year. However, the ECB has put upon itself strong limitations to how much bonds it can buy, namely by setting limits on the percentage of debt it can buy of each Eurozone country. Of course, those limits are only virtual and self-imposed constraints. But as several journalists commented yesterday, it is not very clear how surpassing them would make any difference, unless if those asset purchases would be closely coordinated with ambitious public investment plans.

Before Draghi leaves the ECB this November, he may need to demonstrate one third and last time that the ECB is indeed committed to go beyond the conventional limits of the orthodox central banking framework. Yesterday, the ECB’s Governing Council has announced that it will look at possible new measures, such as “tiered reserves” or even a new round of quantitative easing to be announced later this year, in case inflation remains too low. But is that still enough?

Fiscal policy to the rescue?

Despite the diplomatic language, the ECB and Mario Draghi are well aware of the diminishing returns of their policies. In fact, this is why Draghi has been more and more vocal in calling for an active fiscal policy. Yesterday Draghi was even more outspoken than ever, by saying fiscal policy “will be soon called into action”.

When interest rates are so low or even negative, the case for a more active fiscal policy is indeed rather unquestionable. But paradoxically, Draghi’s vocal support fiscal policy resonates very much like an admission of defeat, and a desperate call for help.

It is indeed rather odd that central bankers are now publicly admitting their dependence on government fiscal policies to achieve their monetary mandates. Given their traditional pride for their independence, central banks would not be calling for fiscal help if they were not in dire need of it. This signals how much central banks feel they are powerless.

But are they really? No.

Since central banks can create money, they have, by definition an unlimited firepower. There are still many ways in which the ECB can better use this power, as illustrated below:

No it isn't. https://t.co/1xKl3iXA1m pic.twitter.com/wY7pcaSddh

— Frederik Ducrozet (@fwred) July 16, 2019

Helicopter money is the new whatever it takes

One of those options is the so-called “helicopter money”, which could take the form of a universal monetary dividend – a lump sum of money that would be distributed directly to all residents of the Eurozone. However radical this may sound, we think the ECB will need nothing less than a commitment to use helicopter money if necessary to ensure the credibility of whatever it takes.

The case for this is rather straightforward: since the ECB is forbidden from supporting governments more directly, and since the ECB cannot (or do not want?) to force banks and market participants to transmit quantitative easing to the economy, then the last option left is to inject money directly into the economy. The distribution of a monetary dividend is the most straightforward, easy and democratic way of doing this. It is also likely to be more effective in boosting consumption and inflation than indirect tools such as QE. If helicopter money does not work in stimulating inflation, nothing else will.

Of course, the actual implementation of helicopter money will entail significant operational challenges and will come at the cost of political courage on the ECB. But what is the alternative?

Given the recent failure by the Eurogroup to achieve any significant Eurozone budget, it is fair to assume no fiscal stimulus will come out in a coordinated or centralized manner, at least not on the foreseeable term. If that is so, more monetary stimulus will be indeed necessary, and the best the ECB can do is to ensure it will be able to do it without jeopardizing its own independence.

By calling for fiscal support that is unlikely to come in the way it desires, the ECB risks to undermine its credibility vis à vis the markets, while signally to citizens that it does not actually need to be independent. This is certainly not what the ECB wants.

Direct transfers to citizens, on the other hand, would be one way for the ECB to gain the macroeconomic benefits of fiscal policy which it desires so much, without actually tying its hands to government’s budgetary decisions (or lack thereof). For the sake of its independence and to maintain the credibility of the “whatever it takes”, the ECB will need, sooner or later, to demonstrate its ability and willingness to deploy direct transfers to citizens.