The Affordability of UK Housing: Hello Debt for Life…

New data shows that growth in house prices is outpacing growth in wages. However, reports suggest that low interest-rates are making housing in the UK more affordable. Is housing really more affordable, or are there some missing pieces to this analysis of the UK housing puzzle?

House Prices

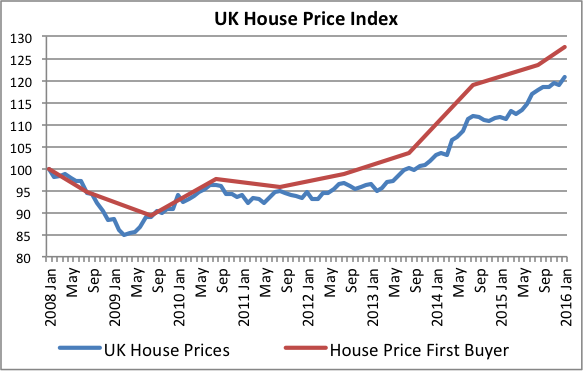

Recent data released by the Office for National Statistics (ONS) shows that UK house prices have increased by 7.9% year-on-year in January, to reach a new high of £291,505 on average. Underpinning the growth in UK house prices is London, the East, and South-East of England where average annual house prices have increased by 10.8%, 11.7%, and 9.8% respectively.

House prices have risen by 25% since 2013, and the cost of homes for first time buyers has gone up by 30% for the same time period.

Source: ONS

House Prices and Wages

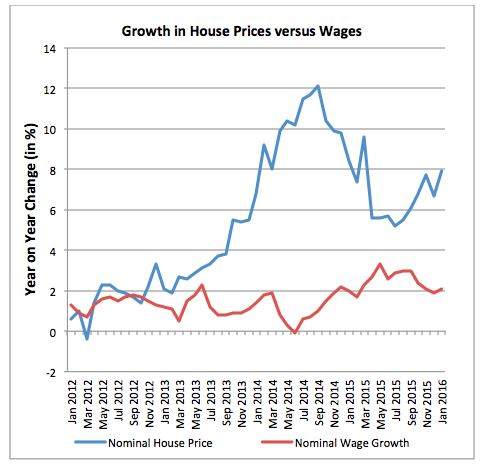

While average house prices have increased by 30% since 2013, average weekly earnings (AWE) have increased by just 5.8% in nominal terms, and 3.6% in real terms for the same period. If average wages since 2013 had risen as fast as house prices, the average wage would now be £33,200, which is £7,200 more than its current level.

Furthermore, while UK house prices increased by 7.9% last year, figures from ONS show that the UK median wage increased by just 1.8%. This suggests that house prices are growing more than four times as fast as median wages.

These calculations further suggest that the average house in London is £50,000 more expensive, but the London median wage will not have gone up by a single penny.

Sources: ONS

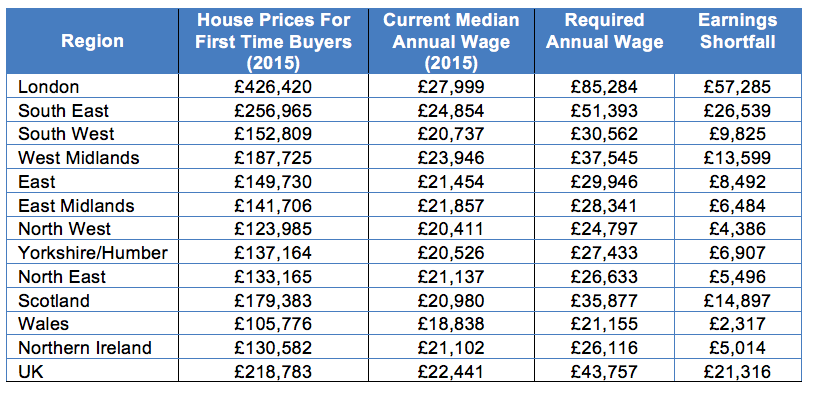

House prices for first-time buyers are currently 9.7 times the median annual wage. With average house prices for first-time buyers being £218,800, and assuming a mortgage 4.5 times the income of the borrower, the borrower would need to be earning at least £43,800[1]. However, the current UK median wage amounts to barely half of this at £22,400.

For those trying to get on the property ladder in London, with average house prices for first-time buyers at £426,400, the required annual wage would be around £85,300 – but the current median annual wage in London is £28,000.

The gap between required and actual earnings varies between the South and North. In the South, house prices for first time buyers are about 7 times that of actual median wages. In the North of England, Scotland, and Northern Ireland, the difference between the current wages and required wages is smaller than in Southern regions. Below is a full table of these statistics.

Source: Figures given by ASHE, ONS, and KPMG. Calculations for required annual wage are based on a 10% deposit and borrowing the remaining 90% at a loan to income ratio of 4.5 (consistent with new Bank of England regulations).

The Offsetting Factor: Debt Servicing Cost Are Low

The above is not necessarily new news and a number of economists might argue that it doesn’t represent the whole story. It is often argued that low interest rates at the Bank of England have also helped make loans more affordable, as the chief economist of Nationwide Robert Gardiner suggests:

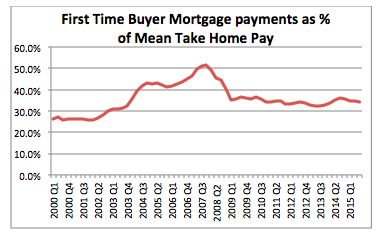

“Historically low interest rates have helped to offset the negative impact of rising house prices on affordability. Indeed, even though house prices are at an all-time high, the cost of servicing a typical mortgage is still close to the long term average as a share of take home pay.”

This argument suggests that a reduction in the Bank of England’s benchmark interest payments and the ostensible increase in wages has helped ease the proportion of income dedicated to servicing mortgage loans. While house prices are increasing, the proportion of disposable earnings used to service mortgage payments for first time buyers dramatically reduced from 50% in 2007, to around 32% in 2015.

Source: Halifax

Indeed, interest payments are now less than half of what they were as a proportion of pre-tax income before the 2008 crisis. One estimate suggests that the reduction in interest rates means that mortgage holders have to pay £2,500 less a year.

Lower Debt Servicing Cost – Just for a Longer Amount of Time

While monthly debt-servicing costs are low, this is not merely because of lower interest rates and a recent 2% increase in wages. What is often almost completely ignored is that the lifetime of mortgages is increasing rapidly. The average lifetime of a mortgage used to be 20-25 years, but now it is 30-35 years.

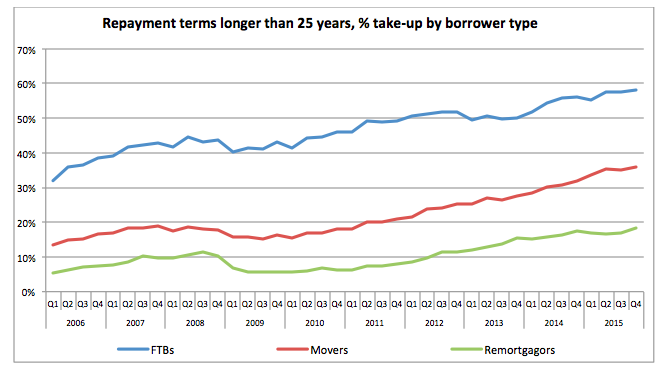

For example, figures from the Council for Mortgage Lending (CML) show that 60% of first-time buyers are now taking out a mortgage with a maturity that exceeds 25 years – nearly double the proportion of 10 years ago. The trend is similar for those already on the property ladder. The proportion of remortgagers and movers taking out a loan longer than 25 years, has also nearly doubled over the same time period.

Source: CML

Statistics from Halifax show that taking out a mortgage for longer than 35 years has increased from 15% to 26% from 2007 to 2015. Meanwhile, over the same period, the proportion of first-time buyers who had a mortgage term between 20 and 25 years has decreased from 48% to 30%. (Note: Figures were not available for mortgages with a term between 25 and 30 years; 30 and 35 years).

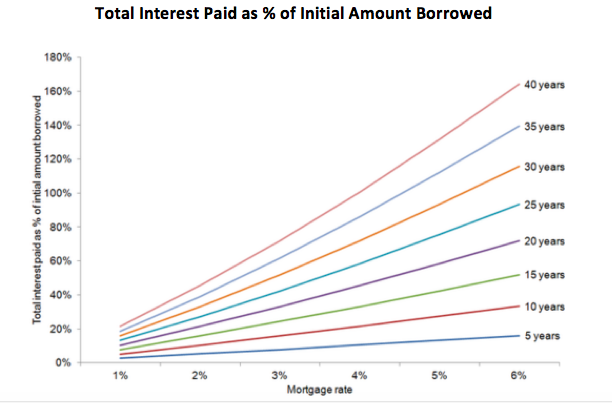

By extending the lifetime of mortgages, the average monthly debt servicing cost is reduced. A longer mortgage term entails cheaper repayments as they are spread out over a longer period of time. However, longer-mortgage terms also mean you pay interest for longer, meaning that the total cost of the loan actually ends up being more.

The graph below demonstrates this point, whilst Mark Shoffman in This is Money, provides a modern day example:

“Over 25-years, a £150,000 mortgage would cost £574.87 a month and £173,934 over the lifetime of the loan. In comparison, extending the term to 35 years reduces repayments to £433 and gives a total cost over the lifetime of loan of £183,455. You technically end up paying £9,521 more over the life of the product by taking it out for ten years longer.”

Source: Savills

The point here is that monthly debt servicing costs are low not just because of reduced interest rates, but also (if not more likely) because borrowers are taking out mortgages with much longer terms. On the face of it, monthly debt servicing cost might be more affordable, but over the long run borrowers end up spending a greater portion of their lives servicing debt (less time saving); and end up paying more in interest too.

Concluding Remarks

Interestingly, many economists are pointing to the fact that low interest rates have lowered monthly debt servicing costs – making housing ‘affordable’. Yet, very little attention is given to the fact that lower interest rates can lead to more bank lending, which in turn leads to higher house prices – ultimately making housing less affordable!

On the same note, suggestions are increasingly being made that we should not be worried about the threat to financial stability of a growing house price bubble. The reason being that monthly debt servicing costs are so low, that households should be able to cope with a sudden shock to the housing market.

There is some truth to this argument. However, as Andrew Bailey, deputy governor of the Bank of England said in 2014, if mortgages extend into retirement when incomes fall, then “we will have a long-term problem”.

But also, regulators and policy makers should be aware of the fact that the extended period of loans gives borrowers less wiggle room should they come into arrears and risk defaulting. Usually when borrowers begin to show signs that they are unable to cope with the burden of servicing their mortgage, lenders can extend the term of their loan. With longer-term loans this buffer is being eroded.

[1] New regulations, designed to reduce risk of default, mean that 85% of bank loans cannot be more than 4.5 times the income of the borrower.