UKGlobal

27 January 2026

September 28, 2023

UK banks rake in billions of pounds through harmful oil and gas lending, exacerbating the climate crisis. If you’re looking for a student bank account with a major high street bank, it’s highly likely your money will support funding for environmentally destructive activities. With banks, the Bank of England, and the government all falling short on green policies, switching to a green bank will stop your money from being used as collateral for fossil fuel lending and unethical investments.

In this handy guide we put together with our friends at Switch It Green, we debunk common myths around student bank accounts and break down how switching to a green bank could help save you money and stop banks from investing in harmful projects.

While student accounts are exclusively available to students, opting for a student account is a personal choice and one that you need to make based on what is right for you. Around 55% of individuals in higher education have a student account, while the popularity of digital banks like Starling and Monzo is rising, due to their money management features which can serve as an alternative to the interest-free overdrafts offered with student accounts.

Bottom line: It’s up to you what type of account you choose while in higher education. Have a think about whether a student account is right for you – and, if it is, make sure you know when and how to pay off your overdraft.

The best bank account is one that works for you – that is aligned with your needs, values, and long-term goals. This will vary from person to person, depending on what is important to you. For some, it will be the bank that offers the largest interest-free overdraft, for others, it will be a bank which has committed to never investing in people- or planet- harming activities, such as fossil fuels.

NOT-SO-FUN FACT: Did you know that our high street banks have poured over £4.4 trillion into heavily polluting industries since 2016?

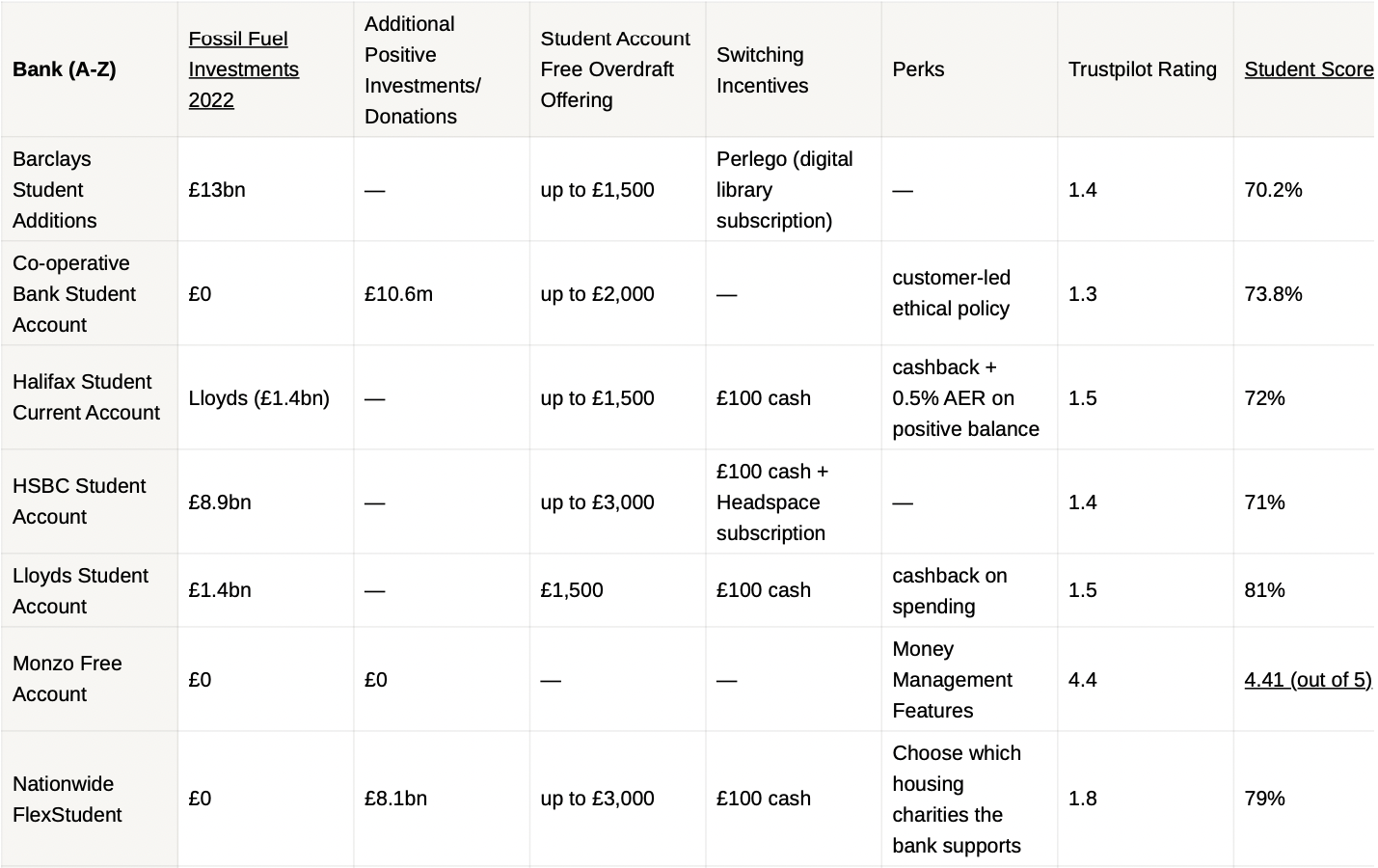

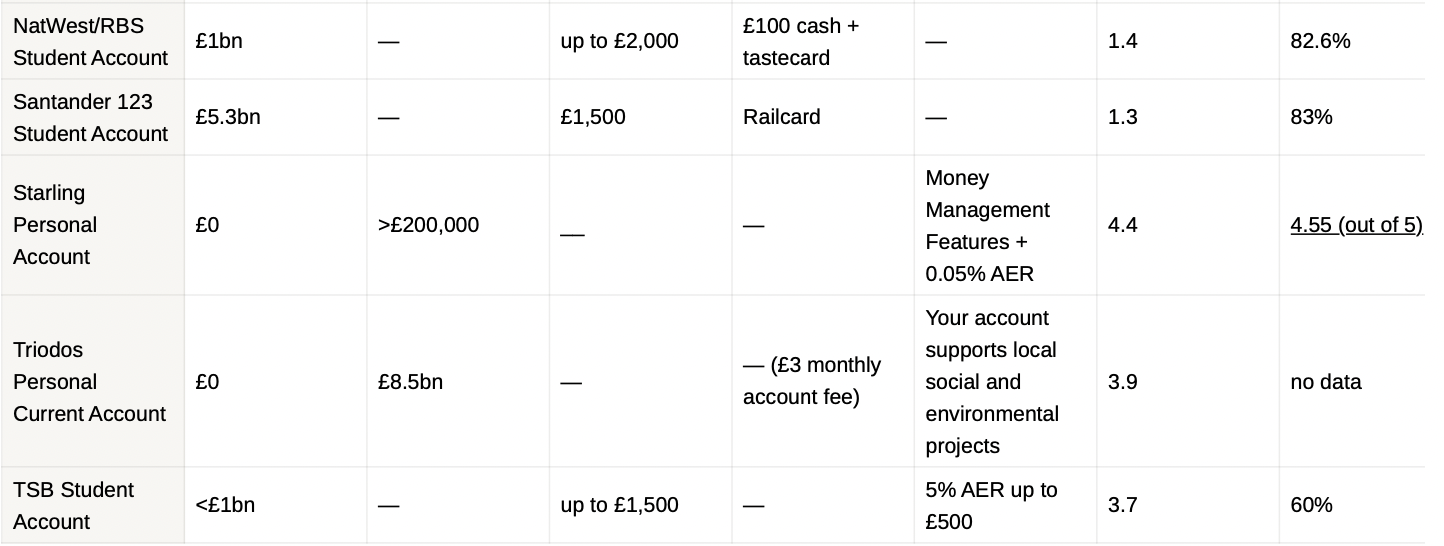

Use the table below to choose the account which ticks your boxes.

Bottom line: There isn’t a one-size-fits-all account. Think about what is most important to you and take it from there.

If you are choosing a fossil-fuel-free bank, your switch can help end fossil fuel financing if you sign up through Switch It Green’s Green Banking Platform.

Switching bank accounts may sound like the kind of life admin that you usually try to put off for as long as possible but, in reality, it takes a matter of minutes – and there are some fantastic services on hand to make things even easier.

The Current Account Switch Service (or CASS) is a guarantee service, which handles all of the more stressful bits – such as moving over your incoming payments, direct debits, payee contacts.

Switch It Green’s Green Banking Platform makes choosing to switch to a green bank as simple and as impactful as possible. You can help stop banks from pouring money into planet-harming activities simply by switching to a green account through the platform.

If you are opting for a student account, you’ll need to wait until you’ve had your place on your chosen course confirmed. If not, you can switch or open an account at any time.

Photo ID (sometimes in two forms e.g., licence and passport)

Proof of address (this can be your UCAS form or student loan confirmation letter)

Proof of student status, if applying for a student account (this can be a letter of acceptance from your university, or UCAS offer letter)

The majority of people don’t realise that most high street banks are giving money to destructive projects – or that they can help put an end to fossil fuel funding by switching to a greener bank. A “green bank” is a type of bank that focuses on eco-friendly and socially responsible practices, supporting things like renewable energy and avoiding investments in harmful activities like fossil fuels. Mass bank account switching – away from the providers funding climate breakdown – will pressure banks to rule out funding for harmful projects, ensuring a safe future for all.

Use this table to compare student bank accounts, student account freebies, and banks’ green credentials. If you are choosing a green bank, head to Switch It Green to make your switch count.

Face it, the biggest banks are lagging behind on their climate commitments. The recent news that Barclays (the biggest climate offender in Europe) is searching for a new climate director appears empty and performative, especially when you consider the bank has poured $190 billion (about £156 billion) into fossil fuels between 2016 – 2022. Yikes. Climate activists, scientists and just about everyone paying attention have been raising the alarm about banks pumping billions of pounds into oil and gas projects, exacerbating the climate crisis that has been destroying local communities and natural ecosystems all over the world.

More and more young people are experiencing ‘eco-anxiety’ (the fear of environmental catastrophe) and this is not surprising. 2023 has seen the hottest day since records began. Over the summer, Storm Daniel wreaked havoc across Europe, eventually landing in Libya, where severe flooding wiped out the coastal city of Derna, over 11,000 people lost their lives and thousands more are still missing. We’re witnessing the climate emergency causing mass devastation around the world, but our government and financial institutions continue to drag their feet when it comes to climate action.

We’re at a crucial turning point where every moment counts. Politicians should be taking radical action to quell UK banks’ polluting and unethical funding activities, but there’s little incentive for banks to divest from fossil finance when the UK government is ignoring net-zero targets themselves. In August, Prime Minister Rishi Sunak approved over 100 new oil and gas licences in the North Sea showing a lackadaisical approach towards the green transition in an attempt to fill the pockets of climate criminals like Shell and BP alongside the biggest banks. And just last week, Sunak rolled back several of the UK’s net zero policies which we strongly pushed back against in an open letter, alongside more than 400 other organisations.

Credit: Bank on our Future

The Bank of England, our central bank, sets the rules that consumer banks (like HSBC or Barclays) must follow. It could be instrumental in forcing the biggest UK banks to stop pouring money into risky fossil fuels and other harmful activities like deforesting the Amazon. The government sets the Bank’s objectives, known as its ‘mandate’. In 2021, we helped win an update to this to include climate change, but it appears climate targets remain secondary to their other objectives, with some ex- Bank of England officials even accusing the Bank of being ‘distracted’ by climate-related goals. This is funny considering the bank’s attitude towards green finance seems to be more of a PR exercise as opposed to setting meaningful rules to green their investment portfolios.

We’ve been calling for central banks to take more leadership on the climate crisis. Since the climate emergency is an existential risk – it’s clearly also a risk to the stability of our entire financial system. We’ve criticised the use of interest rate hikes which hinder green investment and cause misery for ordinary people which we’re seeing right now. 14 rises in a row have meant mega-profits for the four biggest banks, who’ve made almost £30 billion in unearned profits in the first half of 2023 alone, whilst being tightfisted in not passing these rates onto savers. So shopping around for your new green student bank could help protect the planet and put more money in your pocket.

At Positive Money, we’ve long campaigned against our broken banking system that entrenches racial and class inequality, financial exclusion and environmentally destructive activities at the expense of human life and our natural environment. So if you’re looking for a quick and easy way to tell your bank that you’re fed up with them exploiting the earth’s natural resources for profit, the Switch It Green platform allows you to switch to a bank that prioritises the wellbeing of people and planet – and the best part is, your switch will also help end fossil fuel financing by banks.