Rishi Sunak’s sending mixed messages

Today’s announcements from the Bank of England and Rishi Sunak show welcome signs of close cooperation, but sadly the Chancellor is still not seizing every opportunity he could to save us from this crisis and is continuing to pedal falsehoods about government spending.

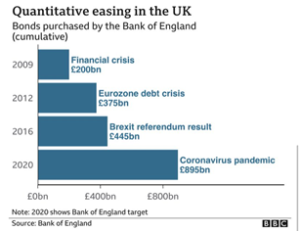

This morning, the Bank of England published their latest Monetary Policy Committee report, and announced the creation of an additional £150 billion in new money via their quantitative easing (QE) programme. QE is where the Bank creates new money and uses it to buy government bonds, therefore indirectly financing government spending. Today’s addition brings the total amount of government bond purchases by the Bank to £875 billion – the highest it’s ever been – and when this latest round of QE is complete, the Bank of England will hold well over a third of the UK’s national debt. Since the government owns the Bank of England, this effectively becomes debt that we owe to ourselves.

These new bond purchases were closely coordinated with Rishi Sunak’s statement this afternoon that both furlough schemes would be extended until March. With the Chancellor saying “As you would expect, the governor and I are in constant communication as the situation evolves. Our responses are carefully designed to complement each other and provide certainty and support to people and businesses across the UK.” This is perhaps the clearest statement of monetary-fiscal policy coordination we’ve seen in the UK in recent years, and this kind of cooperation, which we called for in our report Seeking Legitimacy last year, is welcome. However, it does seem to fly in the face of comments made by Sunak last week, when he spread irresponsible and misleading myths about how our public finances really work.�

Given the scale of the economic crisis we’re facing, our politicians should be using every tool available to them – not publicly deny that the tools exist. Furthermore, the amount of support Sunak announced this afternoon is too little and too late. The Treasury should be taking more advantage of the spending capacity afforded by these Bank of England’s bond purchases to increase funding of public services including the NHS, kickstart our green recovery by example investing in mass home insulation for the coming winter, or reverse their decision on free school meals.

Aside from QE, the Bank of England could also finance government spending more directly by crediting the government’s ‘Ways and Means’ account, which the Bank did extend, but has been left unused this year. Relying solely on QE to help us out of this crisis, will leave us in a loop of inflating asset prices and cause further inequality. The government and the Bank of England must continue to build on their new and improved collaborative relationship to explore every opportunity available to them, and politicians should not hinder this by publicly denying these opportunities exist.