New powers for the Bank of England to support banks – but who will benefit?

The winds of change are blowing for the Bank of England. Hot on the heels of a report for the Labour Party arguing for reform of the Bank’s mandate came a move by the Government to alter the ‘capital and income framework’. Altering the relationship between the Treasury and the Bank, the changes have one critical implication: Threadneedle Street has new powers to extend money to the banking sector. Unfortunately, the changes fail to revise monetary policy in a way that addresses the major problems with bank lending, and won’t necessarily see money reach the productive economy.

The decision reflects several pressures at work in the UK’s political economy, including Brexit and the attendant fear of a fresh financial crisis. It moves the Bank one step closer to becoming an active, regular originator of credit, rather than just a rate-setting and regulatory body. The new framework seems to offer the central bank greater autonomy to channel money into financial markets in an attempt to raise the volume of lending and shape its makeup. Sadly, the mechanism for doing so would rely on schemes similar to those employed since the 2007-08 crisis, and so may well lead to the Bank repeating the same mistakes. Moreover, the idea that the central bank needs a capital base to create stimulus is unnecessarily restrictive and a needless step away from a productive policy of public money creation.

New lending, but no money creation

The new reforms were announced as part of the Chancellor’s annual Mansion House speech, given in the presence of financial leaders. They revamp the way the Treasury and the Bank share income and profits and, more importantly, what the Bank’s balance sheet looks like. The Treasury will provide a £1.2 billion capital injection to the Bank’s balance sheet, bolstering its base capital to £3.5 billion and allowing the Bank to finance more of its operations like a normal commercial bank. In part, this simply reflects the fact that the Bank does more now than before the crisis, including a range of regulatory and supervisory tasks.

A central bank does not need to finance stimulus like a normal commercial bank. It can create reserves – new money – and do what it likes with them. However, the debt purchased with money created under QE (quantitative easing) since the crisis has been insured by the Treasury. The reason given is to safeguard and preserve a balance between the credibility of the government and the central bank. This is an understandable outcome in such times of experimentation.

On the other hand, the argument has by now moved on: we know central banks could provide monetary finance to governments to provide a highly effective means of stimulus, and that they don’t need their own equity to do so. By providing the Bank of England with a capital base, Mr Hammond is chipping away further still at the notion that public money creation could and should be used for productive purposes.

This shift can be read most visibly in the fate of the Term Funding Scheme (TFS), until now officially a component of the Bank’s quantitative easing programme, will move onto its balance sheet. The TFS is designed to provide commercial banks with access to low-cost funding, to ensure that they continue to lend to the rest of the economy. Since it was launched at the end of summer 2016, it has swelled to £127 billion.

Switching from where it is currently housed at the Bank of England Asset Purchase Facility Fund Limited (BEAPFF – a body created to manage the Bank’s QE programme) to the balance sheet of the Bank itself paints the TFS as essentially a regular lending portfolio, like that of a commercial bank. In that respect it joins the Funding for Lending Scheme (FLS), which was launched in 2012 and is part of the Bank’s ‘market operations’.

Henceforth, the Bank could launch large-scale programmes like this without the Treasury insuring it against any losses. So the new changes do provide new expansionary capacity, even though they run against the logic of public money creation. Given current political attitudes, the Bank is now able to create a new funding scheme with less hassle and horse-trading with the government, in the event that the economy runs into difficulty again – clearly, Mr Hammond has in mind uncertainty for business and consumers surrounding Brexit. If the financial sector runs into trouble, low-cost funding for banks could contribute to the same function as bailouts and QE since 2008.

No fix for distortions in lending

Mr Hammond’s proposals contain a reminder of another concern: the need to shape the cross-section of lending in the UK to be more socially valuable. In the eyes of Labour and the Scottish Government, this issue gives grounds for a national investment bank to target lending at the real economy. The new changes are a stretch from that sort of policy, but contain a shadow of the same idea. The Bank’s extension of the FLS after a year of operation came with strings attached, with greater funding made available to banks that lend more to SMEs.

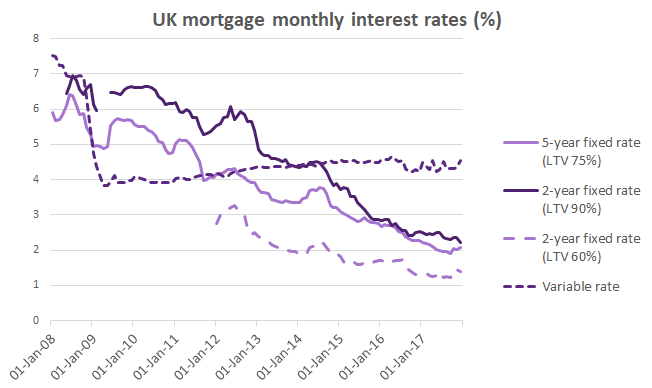

However, the TFS and FLS have done little to address the skew in lending in the UK economy, merely reproducing the same slant towards mortgages and away from productive SMEs. According to results from the Bank’s Credit Conditions survey, lending became much cheaper for large companies through 2014-15, but moved less for medium firms and hardly moved at all for small firms. Since the TFS was introduced, companies have seen few of the benefits, while rates on mortgages continued to fall.

Source: Bank of England Database

If the Chancellor recognises this at all, it is disappointing that instead of creating new tools for the Bank to use in a downturn (that would target the real economy directly) he has chosen to double down on the same expansionary tactics as those seen since the last crisis. A sceptical observer (like Richard Murphy here) might conclude that what Mr Hammond is really interested in is moving capacity for financial support to banks after a rocky Brexit off of the Government’s books, to protect his fiscal credentials.

Nevertheless, in the current context, it is a serious moment when the Government chooses to amend the Bank of England’s framework. All the more frustrating, therefore, to see the most sorely needed changes left for another day.