Nothing normal about the “new normal”

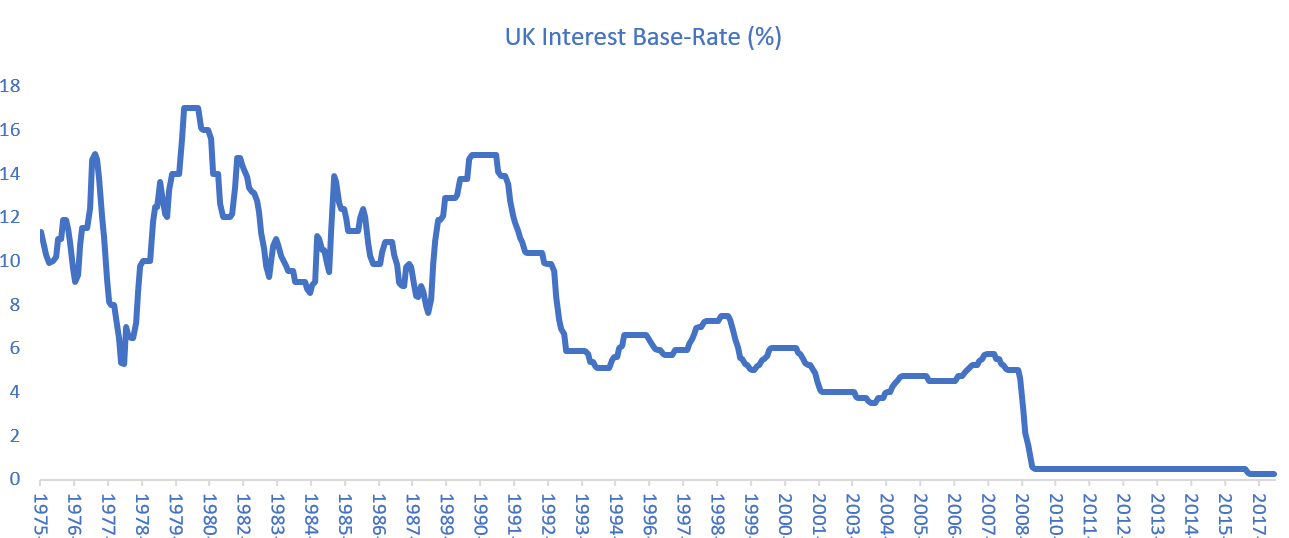

The Bank’s decision to keep interest rates at 0.25% last week may seem like business as usual. But there’s nothing normal about the way that monetary policy is operating at the moment. The longer the rates remain as low as they are, the more obvious it becomes that they’re no longer an effective monetary policy tool.

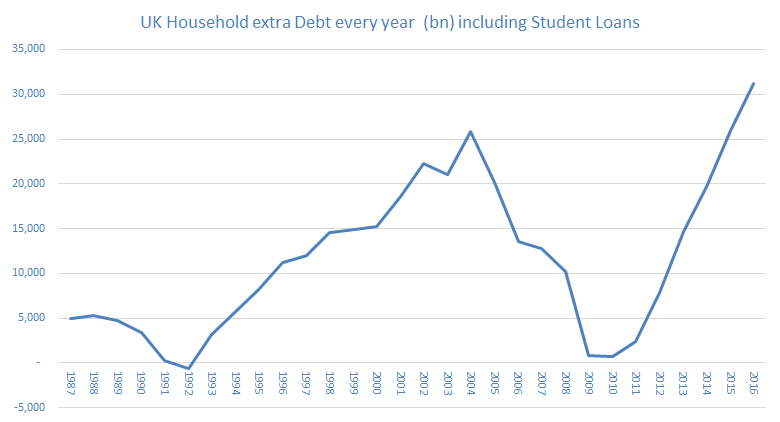

Falling real wages have led to a surge in borrowing, with consumer credit rising to record levels, and yet the Bank has voted to keep rates barely above zero. Taking student loans into account, the UK’s household debt burden has surpassed its pre-crisis peak. The governor, Mark Carney, has issued warnings about ballooning private debt, but with economic conditions so fragile, the Bank of England is powerless to constrain it:

The latest inflation report downgrades the Bank’s growth forecast, as the squeeze on households’ real incomes suppresses consumption. Inflation is predicted to rise to 3%, meaning that real wages are now falling. This follows a decade in which real wage growth was lower than any time since the mid-19th century (see chart below). As many households struggle to keep up with rising living costs and growing debt, the economy faces considerable downward pressures, and another recession could be just around the corner.

But the Bank is totally unprepared. With interest rates already at 0.25%, it has no room to cut them any further. Mark Carney has justifiably ruled out cutting rates below zero. Whereas after the EU referendum the Bank expanded its quantitative easing programme and began purchasing corporate bonds, a further attempt to do so would be met with huge political resistance. Last year, the Prime Minister pointed out that QE has had “bad side effects”, and boosted the wealth of homeowners at the expense of those not yet on the property ladder.

The Bank has no capacity to respond to a future crisis, and that puts us in an extremely dangerous position. In previous crises, the Bank has had the option of a significant cut in interest rates to boost demand. But since the governor has justifiably ruled out cutting rates below zero, a further rate cut is off the table.

It’s time we started talking about new options capable of reviving the economy, like monetary financing or QE for People. This means the Bank of England working with the Treasury to inject new money directly into the real economy, without a corresponding increase in debt. Instead of pumping money into financial markets as with QE, it could go towards infrastructure or house building. And instead of inflating the value of financial assets, it could deliver a direct boost to jobs, wages and household finances. You can read more about our QE for People campaign here.