Money Creation & Interest: Is there enough money to pay off all the interest? (Part 1)

There is a lot of confusion about the role interest plays in the current monetary system. It is often suggested that the fundamental problem is not the banking sector’s ability to create money, but the idea that “banks create the money to make the loans, but don’t create the money to pay the interest on those loans”.

This argument states that since banks only create the loan principal (the amount actually lent), but don’t create any extra money to pay the interest, then there will never be enough money to pay back the interest. If this were the case, then logically people would have to take out new loans in order to get new money to pay the interest on existing debts. This would imply that the amount of money created by banks would have to constantly grow in order for interest to be paid and loans to be serviced.

While the simple logic of this argument is intuitively appealing, it misses out some crucial details of what banks do. Therefore, over the course of a two-part blog series, we will show that the conclusion drawn from the argument is incorrect, as it does not apply to real world banking.

In this post, we first further explain the logic behind the argument that “there’s not enough money to pay the interest”. Subsequently, we provide a basic explanation as to how this logic is flawed and doesn’t apply to real world scenarios. In our next post, we go into more technical detail – and explain what happens to interest in real-world scenarios.

While there are a number of flaws with the contemporary monetary system, it is mistaken to claim that interest payments, in of themselves, necessitate an ever-growing stock of money.

The source of the fallacy: The Banker on a Desert Island

You may have heard the story that starts with a banker and an entrepreneur who find themselves the only residents of a desert island:

Bob the banker has a chest of gold coins. Alice the entrepreneur asks to borrow 100 gold coins. Bob the banker agrees but demands 10% interest.

The total money stock in the economy is therefore 100 gold coins.

The ‘principal’ of the loan is 100 gold coins, which needs to be paid back in a year’s time plus 10% interest.

Thus, in 12 months’ time, Alice has a debt to the Bob the banker of 110 gold coins.

But there are only 100 gold coins in the economy, and Alice owes the bank 110 gold coins, how can she ever pay back the full amount?

It is argued from a mathematical standpoint, it is impossible for Alice the entrepreneur to pay off Bob the banker because there simply isn’t enough money in existence. Alice will be able to pay off the principal, but not the interest. The only way for the Alice to pay off the interest on the pre-existing loan is to take out a new loan of at least 10 gold coins, in order to pay the interest on the first loan.

But now Alice has another problem. In 12 months time she will owe the 10 gold coins to Bob the banker, plus a further 10% interest; a total of 11 gold coins. But there are only 10 gold coins in the economy at this point. So in order to pay the interest on the second loan (which was only taken out to pay the first loan) Alice must take out a third loan of at least 1 gold coin.

It seems that Alice the entrepreneur is trapped in a vicious debt cycle, and will constantly have to keep borrowing from Bob the banker to merely to pay off the interest owed to the bank.

Now let’s expand this thought experiment to the whole economy. Imagine that the bank:

can create new money to lend (as real world banks do)

always tries to re-lend the initial £100 loan when it is repaid

always lends to anyone deemed creditworthy enough to take out a loan, even if it’s just so they can get money to pay the interest on previous loans.

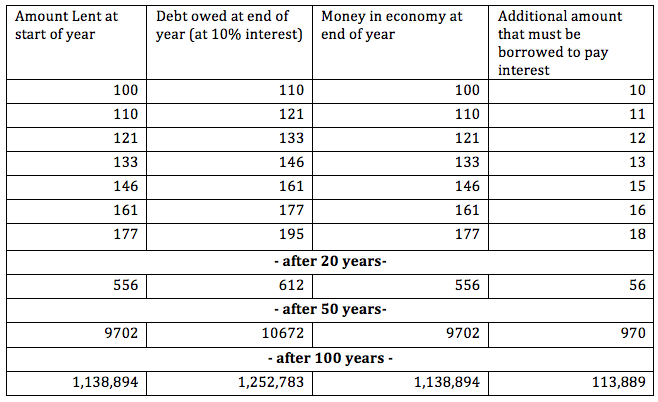

At the scale of the economy, the mathematics of the story become alarming:

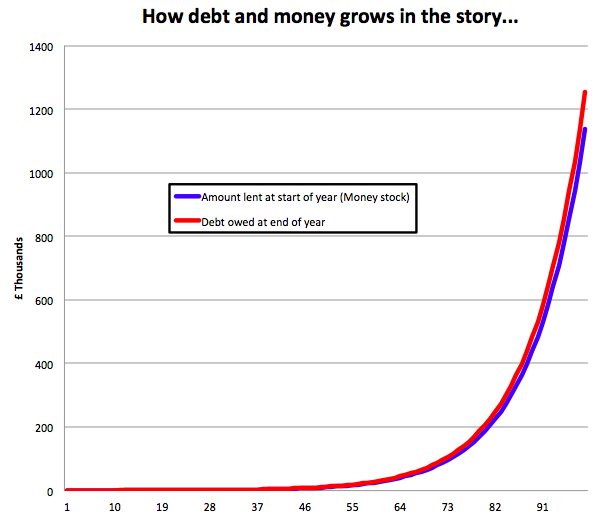

In chart form, this growth of money and debt looks like this:

For understandable reasons, a number of writers apply this simplistic story to the modern day economy. They, therefore, argue that the majority of the general public are trapped in a similar debt cycle and that new loans will constantly have to be taken out merely to service the interest on pre-existing ones. Interest payments can therefore only be made it if there is an ever-growing stock of money.

Real World Banking Scenarios

Let’s begin by revisiting the desert island example, and try applying some more realistic conditions to see if it holds. In the real world, money isn’t borrowed to be held until it’s time to pay it back with interest. It’s borrowed to buy things that other people have produced. So we need other entrepreneurial people on the desert island producing things that Alice wants to buy. Let’s call them the Cooks.

It’s also worth considering why Bob would want to be paid interest unless he wanted to be able to buy things also. What use would money be to him otherwise?

Let’s say Alice agreed to Bob the banker’s terms and will repay the loan in full after 12 months plus 10 gold coins of interest. So Alice now has 100 gold coins to buy things from the Cooks. They only want the money so they can buy things from each other, and Alice needs to sell them goods she produces to earn the money back so she can repay the loan to Bob the Banker.

Alice starts the year by spending her 100 gold coins on goods produced by the Cooks. During the course of the year the 100 gold coins circulate amongst the Cooks and between the Cooks and Alice, as they buy and sell to each other, but Alice makes sure that by the time the 12 months is up, she’s sold sufficient goods to the Cooks that she now has the full 100 gold coins back in her possession. Now it’s time to pay Bob the Banker.

At the start of the last day of the 12 months, Alice pays Bob the 10 gold coins due in interest. This is not strictly due until the end of the day, but she makes the payment slightly in advance.

Bob the banker, needing food, goes to the Cooks and makes his purchases, spending the 10 gold coins. Soon after, Alice manages to sell another 10 gold coins worth of goods to the Cooks, bringing Alice’s money back up to 100 gold coins.

At the end of the day, she repays the loan by handing the 100 gold coins over to Bob the Banker. Since she’s already paid the interest in full, the debt is cleared and there’s no more to pay.

Conclusive Remarks

Bob the banker spent the money acquired through ‘interest’, back into circulation – eventually making it available for Alice to repay her loan. There are a number of potential scenarios where Bob may not spend the money back into circulation, for one reason or another. However, the primary purpose of this blog was merely to show that it is mathematically (and therefore logically) possible for Alice to repay both the principal and interest of the loan from Bob.

Well, what if Bob didn’t spend the money back into circulation? One would have to ask why would Bob make the loan at interest if he didn’t want to use the proceeds from charging interest for spending. Moreover, the same question could be asked of the Cooks – if the Cooks didn’t spend the 10 gold coins they received from Bob the Banker, then Alice would also not have been able to repay her loan. Its also worth asking why Alice would take out a loan in the first place (or at least a second or third loan etc.), if she was not confident that Bob would eventually re-circulate the money and make it possible to fully pay the loan off.

Now, this is rather contrived, but the sole point of the original desert island myth was to demonstrate the logical impossibility of paying interest without going further into debt. Contrived or not, the counter example demonstrates that it is not inevitable that interest is unpayable without further debt. All that is needed is to include the fact that money is used to buy things, which the myth overlooks.

In part 2 of this analysis, we will further explain how the real world is a little more complicated than the desert island myth suggests. We will also explain in more technical detail what happens to the interest after banks’ loans have been repaid.

*Correction

(It has been pointed out to us that we have made a mistake in our description of the situation where Alice borrows the missing interest. Since this new loan will be used in full to pay off arrears of interest there will be no money left in the economy to pay off either the principal or the interest on the new loan. Alice’s debt would then actually grow as shown in the right-hand column of the table. Also, the table shows the growth in debt according to the myth if the banker re-lends all repayment receipts, including interest payments.)