BBC admitted their video “How do Banks Work?” was misleading

The BBC produced a Video entitled “How do Banks Work?” which sought to explain the principles of banking and the role played by banking in relation to the global financial crisis. The video gave a misleading impression of the way banks work by failing to note their role as creators of money, and this role in leading up to the crisis.

One of our supporters, Conrad Jones, decided to take action and complained. The process was tedious (as you can read below) and it took perseverance and a lot of patience…

…but at last it resulted in BBC admitting that the video “left a misleading impression of how banks in fact work, and of the impact of the working of banks on the economy at large.” and the video was removed from the website.

There’s so much misleading information in the media at the moment. We hope this report will inspire you to take similar action…

Here is a report by Conrad Jones:

The BBC made a Video titled “How do Banks Work?” which stated that Banks act as Intermediaries, taking in depositor money and then lending this out.

The short three minute video was narrated by Robert Peston (BBC’s Business Editor) and was partly aimed at 14-18 year old students, but also appeared on a BBC3 Program and was on the BBC3 website.

The Video also said how vulnerable Banks were to lenders who “fell on hard times” or just didn’t pay the money back that the Bank had lent them.

I found the Video very annoying. It was not the style of the video that annoyed me – using a quirky “Pesto Bank” example with a Magician pulling money out of a Hat by using depositors Cash (Notes & Coins) to lend to borrowers.

It was the content, which made no mention of the fact that Private Banks create money when they lend without needing any additional cash. Banks do not just record how much Government created Money passes into their vaults – as implied by the BBC Video, they create it when they lend and destroy it when it is repaid to them, keeping the Interest Payments registered as profits on their ledger. Bank Deposits (created by Private Banks) are accepted in payment for Taxes – just like Notes and Coins are – which are created by the Government.

I didn’t think there was much point in complaining as I would either be ignored or have a barrage of technical jargon thrown at me as to why I was wrong and Robert Peston was right. I haven’t studied economics at University – Robert Peston is the expert, right?

On May 17th, 2012, I decided to send an email to the Bank of England about this video as the BoE was sure to set me straight on whether this BBC video was accurate or not. All I was really interested in was finding out the truth, not having a go at the BBC or Robert Peston. They replied:

Dear Conrad,Thank you for your e-mail of 17 May, requesting information on bank deposits and the increase in the money supply.Banks operate under a system of fractional reserve banking, whereby banks are obliged to retain a level of ‘cash reserves’ as set by the banking regulator, the Financial Services Authority, and this will depend upon the type of loans a bank makes. Let us assume that banks must retain 10% of their deposits in ‘cash reserves’ then in brief if a bank takes a deposit of £1000, if it is obliged to keep 10% or £100 as reserves, it is then free to lend on £900 to a business. The business then spends this money which finds its way back into the banking system through the bank account of the business’s supplier and this bank is then obliged to retain 10%, £90, and can lend out £810 and so on and so on. I hope that you can see from the above that banks do not create new money themselves; they merely act as financial intermediaries. It is simply the same money being used several times.Through such loans banks create what is called “broad money, the loan is an asset of the bank and has to be matched by creating a liability: the value of the loan is credited as a deposit to the customer’s account. That deposit is the commercial bank’s liability and it is those deposits that we count, amongst other things, as “broad money”.

The commercial bank’s value in this transaction is not the face value of the loan. It is in the interest differential between what it pays on its liabilities and what it receives on its assets. It cannot simply create the face value for itself through lending, as one does with issuing a banknote. There is always a match between their assets and liabilities, and at the end of the loan the borrower has to repay the bank thereby extinguishing the asset and corresponding liability.

This is – in simple terms – the basis on which commercial banks create money. By contrast, the Bank of England has a monopoly supply over “Central Bank Money”, comprising banknotes and commercial bank reserves held at the Bank of England. Central Bank Money is the ultimate settlement asset for commercial banks – so although in value terms it is relatively small compared to the amounts of commercial bank money created, commercial banks do not circumvent the Bank of England. Quite the reverse in fact: they ultimately need to settle their payments in Bank of England money.

Thank you once again for writing to the Bank. I hope that the above goes some way towards explaining the rather complex relationship between the commercial banks and the money supply.

…

Public Information & Enquiries Group

Bank of England |Threadneedle Street|London|EC2R 8AH|+44 20 7601 4878

This still didn’t seem to tally with reality as there is no Reserve Requirement enforced by the UK Government on Private Banks. In 1968 the reserve requirement was 20.5%, but over the years, this has gradually reduced down to zero. Note how the £900 (90% of £1000) isn’t lent into the Mortgage, Speculative or Cluster Bombs Manufacturing markets, all 90% is lent to the Productive Business Sector – to create employment!

I remember quoting examples like the one described by this BoE email a couple of years ago on various blogs, and being shot down in flames due to the fact that it was wrong and not how Banks currently operate.

No mention that if a Private Bank asked for Central Bank Reserves and the BoE refused, the stability of the currency supply would reduce, and the BoE is obliged to maintain the stability of the currency. For that reason, it is unlikely that the BoE would refuse to lend a Private Bank Central Bank Money, which means that Private Banks decide to increase or decrease the money supply based on their lending decisions.

No mention of the almost exponential growth in the amount of M4 money – data on M4 Lending (Credit Money) is available from the Bank of England’s own Interactive Database. No mention of the falling level of investment by Banks into SMEs, clearly stated in Bank of England Reports.

I then sent an email to the BBC asking them about this video and received the following reply:

Received: Tue 22/05/2012 09:45

“Reference CAS-1455977-74XQYC

Thank for your sending us your complaint about the BBC Learning Zone.

The BBC has a system for dealing with complaints from our audiences, whereby all complaints about the BBC, its programmes and its services should be sent via the BBC Complaints website at http://www.bbc.co.uk/complaints

We have forwarded your e-mail on to the relevant department and someone will contact you regarding your complaint shortly.”

So I made an official complaint on the BBC Complaints website.

I received the following reply on 12th June 2012:

Dear Mr Jones

Thanks for contacting the BBC. This is an automated email confirming we received the complaint submitted in this name via www.bbc.co.complaints. Please do not reply since this email is automatically generated from an account which is not monitored. If you have received this in error please contact us using our webform at www.bbc.co.uk/complaints.

We attach the text of the complaint for your records. We will log this shortly and then normally include it in our overnight reports to BBC staff of all audience reaction. These will be made available for staff to read tomorrow (with your personal details removed) to ensure that your points reach the right people.

To make sure that we use the licence fee efficiently we may not investigate and respond to every complaint in detail but we aim normally to reply within 10 working days (around 2 weeks). For full details of the complaints procedure and how we consider the issues raised in complaints please see our information at www.bbc.co.uk/complaints/handle-complaint/

———-

YOUR COMPLAINT:

Complaint Summary: Inaccurate description of How Banks work.

Full Complaint: Robert Peston’s video does not represent how Banks operate becasue it misleads the viewer into believing that a Bank purely acts as an Intermediary. Banks do not lend depositors money, they create Commercial Bank Money whenever they lend, either through Mortgage, credit Card or Car Loan. A Bank is not restricted on the amount it can lend by the Bank of England, or any other Regulatory Authority. Banks keep a small capital reserve back, held in their Central Bank Account at the Bank of England. If Robert Peston is correct, can he explain why M4 Money (Lending – Credit Money created by Banks) is not zero? Banks are not intermediaries, they create a loan by adding a liability and and asset to their ledger which requires no actual money – they effectively create money. Robert Peston avoids this issue. I draw your attention to the following video: http://www.youtube.com/watch?v=l7L3ZtCSKKs I also refer you to Section 44 of the BBC Charter 2006 “44. Accuracy and impartiality” http://www.bbc.co.uk/bbctrust/assets/files/pdf/about/how_we_govern/agreement.pdf Section 89 (2) “(2) In particular, the Trust must establish and maintain procedures for the handling and resolution of complaints about standards in the content of the BBC’s services, including complaints concerning the subject-matter of clauses 43 to 46 (BBC guidelines designed to secure appropriate standards; accuracy and impartiality; Ofcom’s Fairness Code; and Relevant Programme Code Standards).”

———-

Thank you again for contacting us.

BBC Complaints

I sent them a letter on 10 July 2012) to

BBC Complaints

PO Box 1922

Darlington

DL3 0UR

Highlighting what my understanding was:

…

My complaint is not with the style of the video but purely with the content which misses out key aspects of Banking:

The video fails to say that:

Banks do NOT act as intermediaries,

their key function is creating the Nation’s money supply in the form of ‘Commercial Bank Money’ known as Credit,

A bank does not take in deposits and then use those deposits by lending them to borrowers,

A form of Fractional Reserve Banking is used but a Bank creates a loan based on the collateral provided by the lender and the ability of the borrower to pay the loan back, it is not based on how much reserves a Bank has.

Banks hold Reserve Accounts at the Bank of England which is used for transferring and receiving central Bank Money between other Commercial Banks.

Although Banks do hold Reserves, they are not sufficient to guarantee depositors money (credit money held in digital form) which is insured by the Government paid for by Tax Payers.

The financial crisis was not caused by a few defaulters experiencing hard times, it was caused by a massive build up excessive leveraging and the packaging up of sub-prime mortgage debt into Mortgage Backed Securities which were sold on to Investment Companies.

Another contributing factor to the Financial Crisis was the merging of Investment Banks with Deposit Account Banks – a move implemented with the repeal of Acts such as the Glass-Steagall Act.

A depositor effectively “Lends” money to a Bank, which gives the Bank the Legal right to do what it likes with that money.

…

After various emails to the Bank of England, I received a reply from them too:

Dear Mr Jones

Thank you for your further e-mail of 18 June concerning the BBC video on how banks work. Your e-mail has been passed to me to reply.

Having viewed the film it seems clear that it is a fairly simple film aiming to describe nothing more than the basics of banking. If you are not happy with the content of the film and feel that it may in some way be misleading, you may wish to contact the BBC directly with your views.

Thank you once again for writing to the Bank. I am sorry that we cannot be of assistance to you on this occasion.

Yours sincerely

….

Public Information & Enquiries Group |PCID | HO-M C-D

Bank of England | Threadneedle Street | London EC2R 8AH | +44 20 7601 4878

Certainly a very polite and diplomatic response.

After making my complaint to the BBC in June, they responded in August:

Dear Mr Jones

Reference CAS-1503391-BTT8V1

Thanks for contacting us regarding the BBC website article on how banks work.

Please accept our apologies for the delay in replying. We know our correspondents appreciate a quick response and are sorry you’ve had to wait on this occasion.

We passed your complaint to the production team responsible for managing this content but unfortunately it took some time to locate the correct team.

They’ve in turn raised their comments with Robert Peston who clarifies that the clip in question is about the basic structure of banks and why they are so vulnerable, not about how they create money.

I hope this information is helpful and thanks again for taking the time to contact us.

Kind Regards

…

BBC Complaints

NB This is sent from an outgoing account only which is not monitored. You cannot reply to this email address but if necessary please contact us via our webform quoting any case number we provided.

So Banks ARE intermediaries then?

Still not happy with this vagueness, I thought a letter to the Director General of the BBC might help clarify things. He is – after all; responsible for the Editorial Content of the BBC – related to Accuracy and Impartiality of its programs, whether on TV, Radio or Internet.

F.A.O Mr George Entwistle – Director General of the BBC

15 September 2012

Dear Sir,

RE: BBC Learning Zone Online Video “How do Banks work” Case number CAS-1503391-BTT8V1

I am writing to inform you that I believe that Clauses 44 and 46 of;

“The Agreement Between Her Majesty’s Secretary of State for Culture, Media and Sport and the British Broadcasting Corporation” have been contravened.

I made a complaint on the BBC website on the 12th June 2012, and received the following reply from …… (BBC Complaints):

“Thanks for contacting us regarding the BBC website article on how banks work.

Please accept our apologies for the delay in replying. We know our correspondents appreciate a quick response and are sorry you’ve had to wait on this occasion.

We passed your complaint to the production team responsible for managing this content but unfortunately it took some time to locate the correct team.

They’ve in turn raised their comments with Robert Peston who clarifies that the clip in question is about the basic structure of banks and why they are so vulnerable, not about how they create money.

I hope this information is helpful and thanks again for taking the time to contact us.”

My complaint is that a Video that proports to explain how banks work, does not mention that they create most of the money in our economy, so is not describing how banks work at all.

(please refer to the attached quotes and printouts referencing money creation and a brief description of how banks actually work.)

I have four main accuracy issues with your video “How do Banks Work”:

Banks do not act as intermediaries between Savers and Lenders,

There is no mention in your video that Banks create over 97% of the money supply,

The financial crisis was not caused by a few individuals who were unable to pay back their loans – it was caused by massive credit expansion over a number of years (creation of broad money by banks) through Mortgage and other Lending, which were packaged up as Mortgage Backed Securities (MBS) and sold to investment Banks. Encouraged by de-regulation, bank lending and a bonus culture based on commissions paid on each mortgage sold, massively increased Mortgage lending to over 630% between 1995 and 2007 (The Independent – Tuesday, 28 August 2012 at 10:00 am),

Banks are not vulnerable because they are backed by Government Subsidies. The rest of the Economy is vulnerable because Banks are allowed to create excessive debt bubbles causing assets – such as Housing; to escalate in price. When Banks reduce lending, the money supply shrinks. If banks were only intermediaries, this wouldn’t happen.

The viewer would be mislead into thinking that Banks only lend existing money (implying that the Government creates this money first), when in fact, Banks produce digital account entries which we all use to pay for goods, services and which are accepted as taxes.

If the BBC is serious about compliance with Clauses 44 & 46 of the July 2006 Agreement, then I believe it should either:

a) remove this video,

b) modify it or

c) remake it to include details of how Banks actually work.

To clarify: my complaint is regarding inaccurate explanation of how a Bank works. To excuse this inaccuracy by saying that it is just a “basic structure of how banks” does not explain why the key role of Banks – which is to create Commercial Bank Money, was left out.

I do not believe that the BBC is incapable of portraying an accurate representation of how a Bank works without missing out one of it’s key functions. The Banking Sector is referred to by the Bank of England as the “Money Creating Sector”.

“Broadly speaking, at present, the money-creating sector covers UK banks and building societies, whereas the money-holding sector consists of UK households and private companies.”

Bank of England, Proposals to modify the measurement of broad money in the United Kingdom p.402

Quarterly Bulletin

2007 Q3 | Volume 47 No. 3

I find it implausible that the BBC would find it more difficult than an individual, such as myself, to find out the true facts concerning a subject, these facts now being freely available – perhaps they weren’t at the time of making the video?

The outcome that I would be most in favour of is that Mr Peston should be given the opportunity – and full resources; to remake the video “How do Banks work” and allowed the time to fully research the subject matter. I was able to and I am not a trained Economist, so I cannot see why he cannot, unless the BBC is putting unnecessary constraints on its editorial staff. This video was funded with public funds – through license fee collection; it is therefore not acceptable that misleading information should be paid for in this way.

I look forward to your reply.

Thank you.

Yours faithfully,

Conrad W Jones

Unfortunately, George Entwistle resigned shortly after taking his new Job as Director General of the BBC, so I did not get a reply from him.

I did get further replies from the Complaints department though:

One I received on 28 September 2012 which apologised for the late reply and said that the reply time sometimes depends on the nature of the complaint, the number of other complaints they had to investigate and whether the production team is available or away on location.

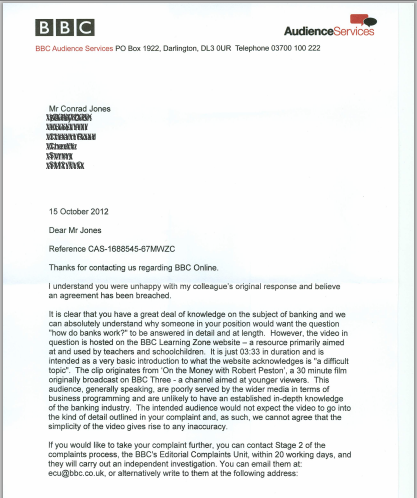

Another was sent on the 15 October 2012:

(click on the image to enlarge)

“A resource primarily aimed at Teachers and School children” – I wouldn’t have thought it was that difficult to explain to school children that Private Banks create digital I.O.U.s that act as money and make up 97% of the money supply. I would have thought it would have made it a lot easier – given that knowledge; to explain to Children (and their parents) why the Government have had to bailout the Banks given the fact that if they collapse – the money supply collapses.

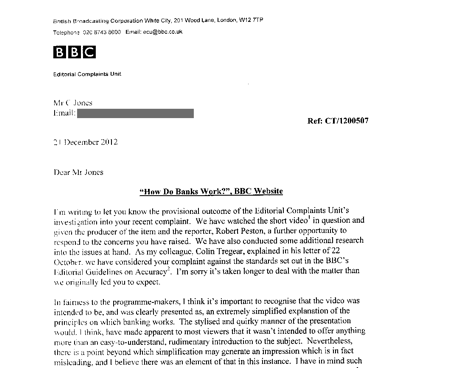

This letter was sent on 21 December 2012 by the BBC:

(click on the image to read the whole letter)

My response to this was the following:

Dear Mr ……,

Thank you for your reply (copy attached).

In support of my comments regarding the Video “How do Banks Work”, I have today purchased the book “Where does Money come from” written by the New Economics Foundation (NEF) and members of the PositiveMoney team, and given your name and address at the BBC as the Delivery Address.

It is my intention that you have a look at this book and then pass this on to Mr Robert Peston.

The purchase of this Book is a gift to the BBC and you may keep it as long as you wish.

There is also additional material available from the PositiveMoney website giving a clear and simple explanation of How the Banking System Works – in Video Format.

http://bsd.wpengine.com/how-banks-create-money/banking-101-video-course/

Parts 1,2 & 3.

Please feel free to extend your deadline of the 11th January. I would not object if you decide you need more time to make a decision.

The key point is that Banks do not simply take in depositors money and then lend that to someone else, they extend credit and are able to expand the credit or money supply (This type of money is known as M4).

It’s been a long time since I was an A-Level student, but I could imagine a present day A-Level Student arguing with someone who raises the issue of how Banks Create Money and being brow beaten by several of his student colleagues based on the inaccurate Video produced by the BBC aimed at 14+ to A-Level students, and that one solitary voice being told that he is wrong because a Senior Editor at the BBC stated in his Educational Video that Banks only lend Depositor Money – with no mention of the Credit Expansion Ability they have at their disposal.

Although “Extremely Simplistic” – your words, the BBC Video “How do Banks Work” was placed on the Learning Zone of the BBC (one of the most highly respected sources of information on the Planet), and aimed squarely at vulnerable and impressionable adolescents, who will write down anything and try and remember it in order to pass an Exam, partly because they trust the information being given to them, even if it is wrong.

I could send Excel Spreadsheets of M0 and M4, showing how M4 has rapidly expanded well beyond the normal money multiplier models currently being taught in Economics Courses – sourced from the Bank of England, and also documents easily accessible from the Bank of England showing that there is no longer a Reserve Requirement for Banks, but I’m sure that the Senior Business Editor and Economics Editors can locate this for themselves.

An interesting spreadsheet produced by the Bank of England is threecenturiesofdata.xls (search for “threecenturiesofdata” in Google and a Bank of England link will be displayed for the file to be download). Selecting “Money, Interest and Prices gives data for M0 and M3/M4 from 2009 back to 1870”. This gives the raw data for some interesting Analysis of the Trend of M0 in relation to M4. This Data can be used to show that from 1971 (after the Gold Standard ended), M4 expanded rapidly, and M4 is not created by Government’s, only M0 (Notes & Coins).

I do not wish ignorance to influence people in making bad decisions regarding our Banking Industry and I do not write this to attack the BBC. My motivation is for a better understanding of Banks and a focus on a better understanding of the Banking System, as it affects all our lives, whether we study Economics or not.

The BBC Video was a brave first attempt, and I hope that I have provided some ideas of how to improve upon it.

Thank you.

Yours Sincerely,

Conrad Jones.

Their response was [Sent 04 January 2013]:

Dear Mr Jones

It’s generous of you to have arranged for a copy of “Where Does Money Come From” sent to me, and I look forward to reading it. As far as the people responsible for “How do Banks Work?” are concerned, however, I think it may be a case of pushing at an open door. Your account of the role of banks in the creation of money has never been in dispute, and nor (I believe) would Mr Peston dispute it. The only issue has been whether the item in question simplified matters to the point where the result was actually misleading on what you describe below as the “key point” – and, as I hope I’ve made clear, I believe it was. As we are in agreement on this, we can now regard my finding as finalised. A summary of the matter will be published on the complaints pages of bbc.co.uk, together with a note of the action taken by the BBC as a result of the finding, and I shall let you know when this happens.

Yours sincerely

………..

At this point, Steve Baker MP – who I had copied emails to regarding this; helped by sending an email to the BBC [Sent 04 January 2013]:

Dear …..,

Mr Jones is correct in all the essentials. In the 13 years I have been studying monetary theory and working with economists, banks and bank regulators, I have been constantly disappointed at the extent of ignorance about the money creation process and the incentives surrounding it amongst those who we take to be experts.

I do not share the ideological perspective of the NEF as expressed in “Where does money come from?” but I have verified with a professional monetary theorist that it is correct in the technical detail. Mr Peston would be doing the country a service if he read it.

More here:

www.stevebaker.info/campaigns/the-financial-system/

Yours sincerely,

Steve Baker MP

The BBC replied with:

Dear Mr Baker

Thank you for your message. I hope it will reassure you to know that the account of the role of banks in the creation of money which Mr Jones gave in his complaint was never in dispute. The issue wasn’t whether Mr Peston correctly understood that role (which I believe he does), but whether he had simplified matters to the point where a misleading impression was given. As Mr Jones and I are in agreement that a misleading impression was indeed given, I have written to notify him that my finding is now finalised (and to thank him for arranging to send me a copy of “Where Does Money Come From?”, which I look forward to reading).

Yours sincerely

……….

Head of Editorial Complaints

“…a misleading impression was indeed given.” – At last!

And finally:

Dear Mr Jones,The summary of our finding on your complaint has now been published on bbc.co.uk, and can be seen at http://www.bbc.co.uk/complaints/comp-reports/ecu/howdobankswork. Meanwhile, thank you again for “Where Does Money Come From?”, which I have read with interest.Yours sincerely……..

CONCLUSION:

The BBC Video “How do Banks Work?” was removed. As yet; there are no plans (by the BBC) to remake a similar Video which actually describes how Banks really work.

One of the best websites to go to find this out remains PositiveMoney.org – in my opinion.