'Fiat money' or Gold Standard?

Many people, upon first learning about ‘Fractional Reserve’ Banking, are drawn to the idea of the Gold Standard. They find out that ‘Fractional Reserve’ Banking leads to an inflating money supply, moreover one plagued by cycles of boom and bust due to its elasticity. They dislike this – they want money to work as a safe store of value by fixing its total supply. The Gold Standard is one way of doing this.

Before we embark on a discussion of the pros and cons of a Gold Standard, I’d like to dispatch two monetary misconceptions commonly encountered on the internet:

1: I have put the words ‘fractional reserve’ in inverted commas because, like so many terms used in banking, it is a misnomer. Banks do not require reserves to issue ‘loans’! (to see why I put ‘loans’ in inverted commas, read this!). The ‘money multiplier effect’ is a myth of modern banking.

2: The Gold Standard is fiat money! One often finds (especially on the internet!) paper money described pejoratively as ‘fiat money’. ‘Fiat’ is used as a scare-word to silence critical thought (like the way ‘socialism’ is used in the U.S. as in “Policy X is socialism!”). But ‘fiat’ currency – ‘fiat’ is Latin for ‘let it be done’ – simply means a currency declared by law as legal tender. “Money exists not by nature, but by law” as Aristotle put it. A nation adopts gold as the basis for its currency by fiat – by government decree.

With that out of the way, let’s proceed! The idea of the Gold Standard is to fix the quantity of money by pegging its issue to a scarce resource – gold. Money has been pegged this way in the past, as coins made of precious metals, or as receipts exchangeable for a fixed measure of the metal. For example, the name “dollar” comes from the silver coins called talers, originally minted in the Czech Republic. The U.S. dollar began its life as a silver coin – according to Wikipedia:

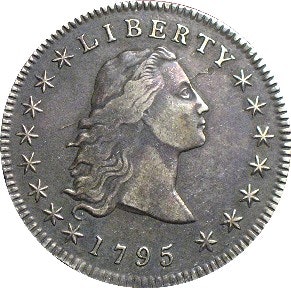

“The first United States dollar was minted in 1794. Known as the Flowing Hair Dollar, it contained 416 grains of “standard silver” (89.25% silver and 10.75% copper), as specified by Section 13 [33] of the Coinage Act of 1792. It was designated by Section 9 of that Act as having “the value of a Spanish milled dollar“.

A 'flowing hair dollar' minted in 1795

Why do supporters of the Gold Standard – sometimes referred to as ‘gold-bugs’ for short – want this kind of money? Let’s ask what money is for in general. Economists identify three main economic functions served by money:

1 – As a means of exchange / deference of payment

2 – As a store of value

3 – As a unit of account

‘Gold-bugs’ argue that since ‘paper money’ can be increased at will by government and banks it is inflationary and so will not perform the second function of money properly. In today’s banking system, the term ‘paper money’ can be taken to mean all notes, coins and digital bank deposits which are not backed by any commodity. Most ‘paper’ money is in fact numbers in a computer and not paper at all. ‘Gold-bugs’ are quite right that this modern ‘paper’ money supply is inflationary – in creating our national money supply digitally, as interest-bearing debt in the form of bank deposits, commercial banks (aided and abetted by our government) cause a great deal of inflation. They are also right that it is excessively elastic. When commercial banks make a lot of new ‘loans’ the money supply expands, When a lot of old ‘loans’ are repaid the money supply contracts. This leads to boom and bust.

Let’s imagine we lived instead in a ‘Gold-bug Utopia’ where the Gold Standard is used. Say everyone were exchanging a fixed supply of gold coins, which are initially distributed equitably amongst the citizenry. If the supply of goods and services these citizens provide increases, then the supply of money they exchange cannot increase in tandem -it is fixed by the supply of gold in existence. This naturally leads to deflation.

Deflation means that the same amount of money buys more goods and services than before, since these have increased whereas money (gold) is fixed. This sounds like a fine thing – it’s as if society were investing in its own productive company and the increased goods money can buy us via deflation were a deserved return on our “investment” – the hard work we put in to run our economy. Gold Standard money seems to perform admirably as a store of value. A recent defense of the Gold Standard from the Mises institute makes these points in its favour.

There is a problem within today’s economy however – with all of us up to our eyeballs in debt due to the mess left by ‘Fractional Reserve’ banking, deflation would be a disaster. Companies and governments would need to exchange ever more goods and services for the money to pay down their fixed debts – meaning if the Gold Standard were implemented wholesale tomorrow, it would probably cause a gigantic debt deflationary crash! So just as with the Positive Money system, anyone advocating the Gold Standard should have a gradual, stable transition to a largely debt-free economy in mind.

Assuming we have a sensible plan to get there, is there a more fundamental problem with the ‘gold-bug utopia’ I have just described? I think there is and this problem leads me to discount the Gold Standard as a good idea. The problem is one pointed out in detail by Silvio Gesell in his book “The Natural Economic Order” – that there is a potential conflict between using money as both a store of value and a means of exchange.

To make money function as a good store of value, ‘gold-bugs’ would have us tie it to the fixed supply of a scarce commodity which does not degrade over time – gold does not rust. The problem is that money then enjoys privileges that no mere commodity can. Gesell argues persuasively that by making money – that which is exchanged for goods – immune to the devaluation those goods are subject to (bread molds, cloth wears, pots and pans rust etc) we are favouring the user of goods and discriminating against the producer of them. Drawing inspiration from the ideas of French anarchist Pierre-Joseph Proudhon, Gesell lays out his solution of “freigeld” – free money – in the book’s introduction:

“Must money always remain what it is at present ? Must money, as a commodity, be superior to the commodities which, as medium of exchange, it is meant to serve ? In case of fire, flood, crisis, war, changes of fashion and so forth, is money alone to be immune from damage ? Why must money be superior to the goods which it is to serve ? And is not the superiority of money to goods the privilege which we found to be the cause of surplus-value, the privilege which Proudhon endeavoured to abolish?

Let us, then, make an end of the privileges of money. Nobody, not even savers, speculators, or capitalists, must find money, as a commodity, preferable to the contents of the markets, shops, and warehouses. If money is not to hold sway over goods, it must deteriorate, as they do. Let it be attacked by moth and rust, let it sicken, let it run away; and when it comes to die let its possessor pay to have the carcass flayed and buried. Then, and not till then, shall we be able to say that money and goods are on an equal footing and perfect equivalents – as Proudhon aimed at making them.”

When money does not rust, those with money have a store of value immune to deterioration, while those holding goods do not. Hence those with money will have superior bargaining power to those with goods. They can wield this advantage in every market exchange, exploiting it to accumulate more and more money for themselves. Over time then, the “gold-bug utopia” goes bad – almost all the gold coins end up in the possession of a few people (the 1% you might call them!), who can then exploit their gold monopoly to trap everyone else into peonage. Producers still require a temporary means of exchange, but this has been monopolized by the holders of gold to serve as their incorruptible store of ever accumulating value. So gold must be borrowed at almost any rate of interest demanded by its lenders. Ironically enough, the Gold Standard advocated by Austrian economist Friedrich Hayek can itself be “the road to serfdom”!

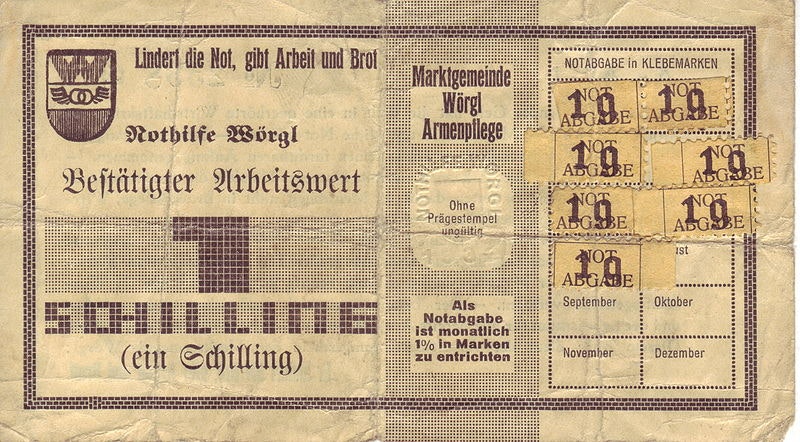

Gesell’s solution to this problem was to issue money as a paper note legislated to devalue over time, thus putting money on par with the goods and services it was to serve in exchanges. The note would have to be stamped each month to remain valid for exchanges, with each stamp incurring a fee to represent the gradual devaluation of the note. This system is known as demurrage and is the basis for many local currencies today. The system was famously implemented successfully to revitalise the town of Worgl during the Great Depression. Here is a Worgl note – you can see on the right twelve boxes for the monthly stamps:

Paper money, such as the note above, is sometimes criticized by ‘commodity money’ theorists on the grounds that it has no intrinsic value. But is there really such thing as ‘intrinsic value’? I would say that people will value goods and services differently, depending upon each person’s character and circumstances. Gold may in fact be quite value-less to the producer of goods, a point Gesell makes in his book:

“But must the medium of exchange be made of gold? Does a peasant who has grown cabbages and wishes to sell them to pay a dentist, need gold ? Is it not, on the contrary, a matter of complete indifference to him, for the short time during which, as a rule, he retains the money, of what substance the money consists ? Has he, as a rule, even time to look at the money ? And can one not use this circumstance to make money out of paper ? Would not the necessity of offering the products of the division of labour, namely the wares, in exchange for money still exist, if we substituted cellulose for gold in the manufacture of money ? Would such a transition cause the abandonment of the division of labour, would the population prefer to starve rather than recognise cellulose-money as the instrument of exchange?”

Value is always subjective, never ‘intrinsic’. When people make market exchanges, each gives the other something they value less at the time in exchange for something they value more. Gesell argues it is solely its utility in the act of exchange that should give money its value and that attempting instead to give money an ‘intrinsic value’ is attempting to conjure a phantom.

In “Where Does Money Come from?” (chapter 2) the role of money is described as that of recording “a social relationship between creditor and debtor”. In Gesell’s example quoted above, the creditor was the peasant seller of cabbages, the debtor the cabbage buyer who gives a deferred payment (i.e. money, whether gold or paper) in exchange. Later, the peasant becomes a debtor to the dentist, by exchanging this money for the credit of dental treatment. And society, embodied in the dentist, has just honoured the original debt from the sold cabbage. Money represents a social relationship then – a social agreement to accept deferral of payments over direct barter – not a store of value. I say we should think of value being stored in the people we care for, the communities we live in and the beauty of the natural world – not in bars of gold.

Two famous economists of the day – Irving Fisher and John Maynard Keynes – were impressed by the ideas of the ‘amateur economist’ Gesell. Fisher commented that:

“Free money may turn out to be the best regulator of the velocity of circulation of money, which is the most confusing element in the stabilization of the price level. Applied correctly it could in fact haul us out of the crisis in a few weeks … I am a humble servant of the merchant Gesell.”

and Keynes that:

“Gesell’s chiefwork is written in cool and scientific terms, although it is run through by a more passionate and charged devotion to social justice than many think fit for a scholar. I believe that the future will learn more from Gesell’s than from Marx’s spirit.”

In his highly influential book “The General Theory of Employment, Interest and Money” Keynes identifies a second privilege money enjoys over goods and services, one he regarded as even more important and termed “liquidity preference”. He also disagreed with Gesell’s solution of demurrage and proposed instead using steady inflation as a means to make money “rust”, thus placing it on par with the goods and services it is exchanged for. The choice between Gesell’s or Keynes’ proposed solution can be up for debate. Perhaps various money systems can operate at different scales (community, county, nation state etc) with different choices (demurrage or inflation) being appropriate in different cases?

___________________________________

I wrote this piece for everyone who thinks that the current banking system is socially harmful, because I think it is important that of the many alternatives available we choose the best one. I don’t think the Gold Standard is a good idea because it tends to increase even further the privileges of those with money, allowing them to accumulate for themselves even more excessive wealth. Inequality has already reached staggering levels – moving to the Gold Standard, a system likely to further exacerbate inequality, could tear society apart.

I urge those who are critics of “Fractional Reserve” Banking and advocates of the Gold Standard to consider instead Positive Money’s proposals. These would also stabilise the money supply, but allow the use of demurrage or inflation as desired, to check increasing inequality and help the producers of what we really value – the goods and services desired by society. The power of money would be placed more in the hands of people and communities – “the best shots” – rather than governments and banks – “the big battalions”.

While I sympathise with ‘gold-bugs’ fears that ‘paper money’ is vulnerable to manipulation and therefore too risky, I think that with proper checks and balances in place the benefits of ‘paper money’ over gold outweigh the risks. The U.S. constitution, for instance, separates the legislative, executive and judicial branches of government. Add a monetary branch explicitly – as Positive Money advocates via the Monetary Policy Committee – and I think manipulation of currency and conflicts of interest can be held in check. As Ben Dyson argues in this podcast:

“…there is this magic box out there and anybody who has this magic box can just pull money out of it. Over the centuries kings and private banks fought for control over this “Magic box”. Now it is in the hands of private banks. But, if we would give it to the hands of governments, they probably would abuse it for their own benefit as well.

“So, the best solution is to put this box in the centre of the society, so that everybody knows where it is and how exactly it is being used.

“In practical terms it means giving the power to create money to an accountable and transparent body, such as the Monetary Policy Committee at the Bank of England …and make sure that we know exactly what they are doing, how much money they have created in any moment and where that money is going…”

In conclusion then, ‘fiat’ money can accomplish the aims of the Gold Standard (stabilising the money supply) without its drawbacks, providing it is made accountable to the public. ‘Gold-bugs’ everywhere should consider a change of heart: I think that the system Positive Money advocates would deliver us a more stable, equitable, accountable and sustainable economy.