Do Banks Lend Money?

It might seem strange to ask the question “do banks lend money?” (although perhaps not to readers of this blog!) After all, we are reminded every day that they do, with terms such as “bank loan”, headlines like “UK bank lending to shrink in 2012” and government policies to “get the banks lending again” But do they lend?

The Oxford English dictionary defines lending as:

lend: grant to (someone) the use of (something) on the understanding that it will be returned: Stewart asked me to lend him my car; the pictures were lent to each museum in turn

Most people would take this to mean that:

1: The something must actually exist prior to someone lending it (or else how will it be lent?)

2: The act of lending something involves transferring it: from someone, to someone else.

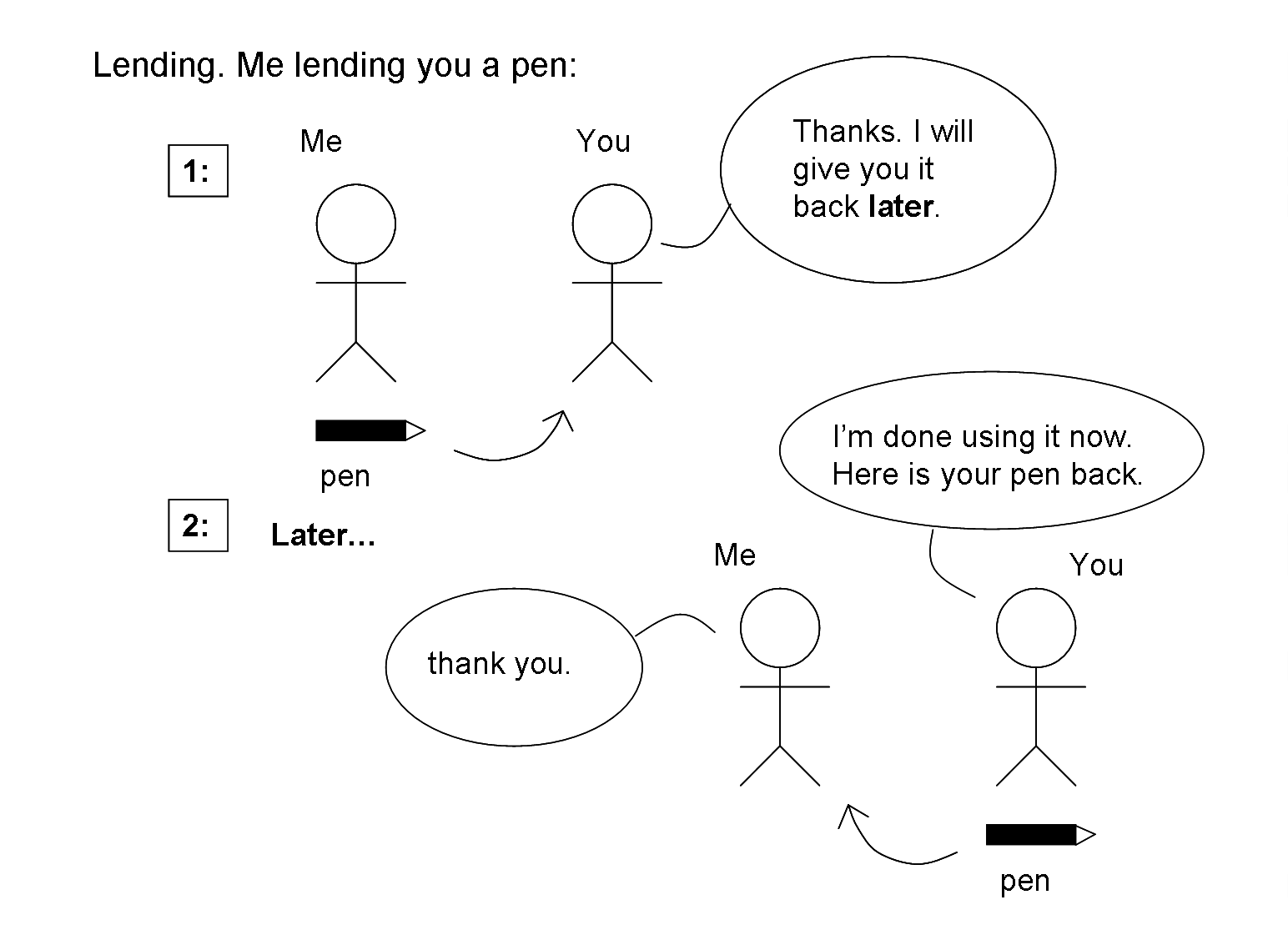

The above seem like reasonable conditions for a procedure to qualify as lending. As we’ll see, bank “loans” satisfy neither of them. First though, an example of an actual loan that does satisfy these two conditions – me lending you a pen:

1 and 2 are satisfied. The pen first exists, and then I transfer it from my possession to yours. Later, you transfer it back. We can therefore say that the loan of a pen is made by me and later honoured by you.

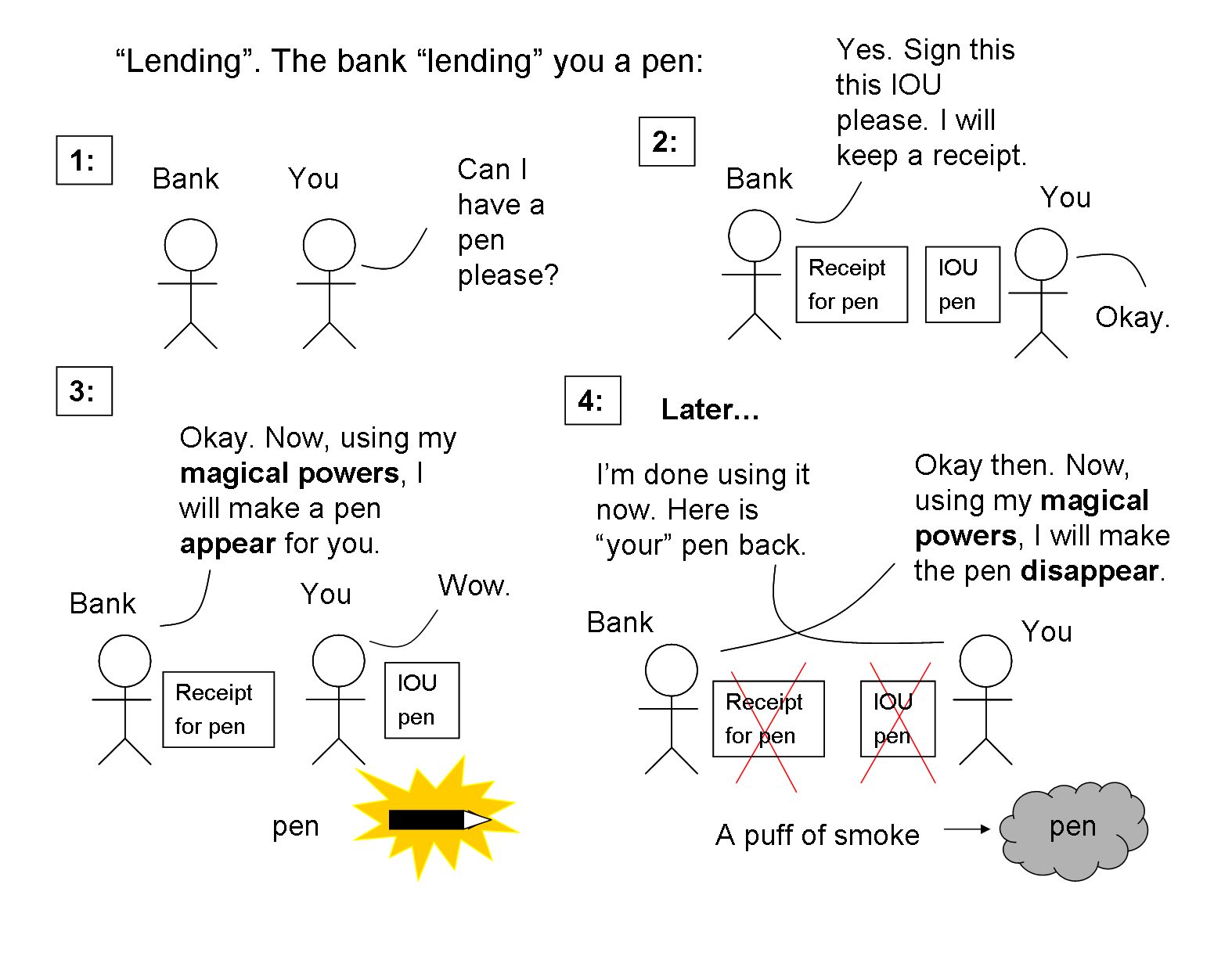

Now let’s consider what banks call lending, but I will call “lending”: the inverted commas denote our suspicion that when the bank “lends” a pen, what it calls lending satifies neither of my two conditions. If things turn out to the contrary, the inverted commas can be dropped. Let’s see then. Here is the bank “lending” you a pen:

The above procedure satisfies neither condition 1 nor 2. The pen didn’t exist prior to being “lent”, so condition 1 is violated. The act of “lending” didn’t involve transferring a currently existing pen from the bank to you. It involved the creation of a new pen, “out of thin air” if you will. So condition 2 is also violated. Our use of inverted commas turns out to be justified, our suspicion is confirmed. The bank does not lend the pen: they “lend” it. Their “lending” a pen has very little to do with the popular use of the phrase “to lend a pen”.

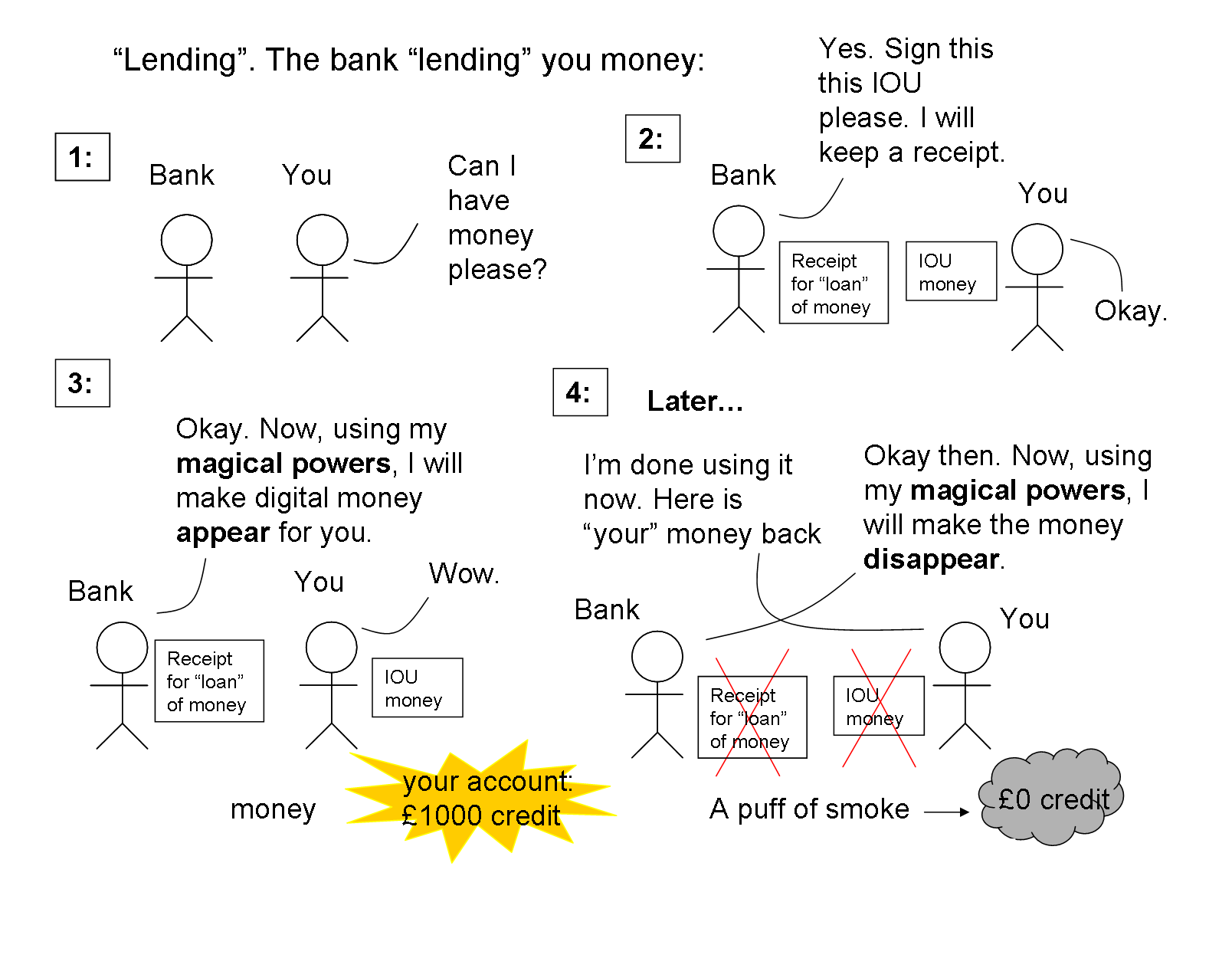

Now the bank does not have the ability to magically create pens. It does however have a similarly awesome power, granted to it by the Financial Services Authority: the ability to create new digital money, in the form of new bank deposits. Here is what this looks like:

Just like with our hypothetical “lending a pen” example, in the case of an actual bank “loan” the bank does not lend you money: they “lend” you it. Their “lending” of money has very little to do with the popular use of the phrase “to lend money”. Using their powers to create new digital money, the bank can and will create as much as it judges to be profitable. Frequently so much new digital money is created that a systemic failure of the financial system occurs. Over 97% of our money supply is created as new digital money, new bank deposits, in a process akin to the above cartoon.

My cartoons represent, hopefully in a more colorful way, what an accountant might see in the bank’s journal (an accountant wouldn’t see inverted commas of course!) :

The above is called double entry book-keeping and keeps track of the creation and destruction of new digital money, amongst other things. So banks do not lend money – they “lend” i.e. create it – according to some strange rules scattered across numerous policy documents and rarely if ever discussed in the media. You may feel that I’m labouring a fairly trivial and unimportant point – banks use “lending” to denote a procedure which doesn’t at all mean what is popularly understood by the verb “to lend”. So what? If banks want to use words in perverse ways, let them.

The trouble is that saying you’re lending when you’re actually “lending” generates enormous amounts of confusion, as people inevitably mix up the two meanings – often including politicians and economists, who make speeches rife with so-called “paradoxes” and/or logical contradictions – even if they know that lending is really “lending” (and most of them don’t know this!) Most of us are not experts in finance and understandably assume that when politicians, economists and newspapers all say that banks are lending, they are in fact lending as is popularly understood – not engaging in some strange alternate practice, for some reason called lending, but not actually having anything much to to do with it.

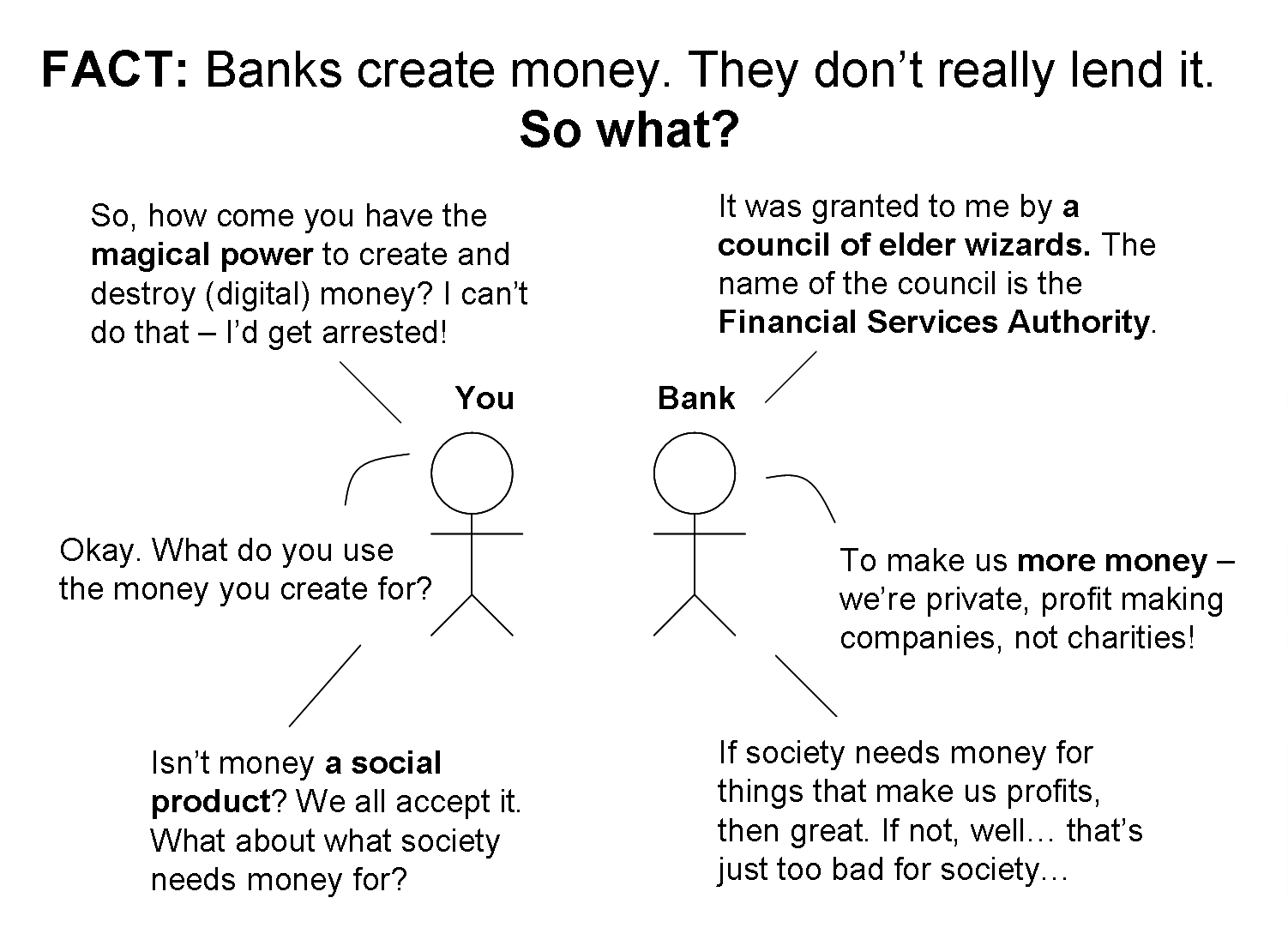

Also, if this is a democracy, how about what we the people think? Should banks be allowed to create our money supply for their private profit, as they currently do? Imagine the following conversation:

Does society need money for schools, hospitals and creating “green” jobs? Does it need money for the arms trade, financial speculation and fracking? Which of these maximise profits for banks? This is what the banks’ new digital money will be created for.

So the financial system impacts upon all of our lives. As James Robertson puts it:

“Money and finance provide the main scoring system for the life of society. Changing the scoring system to get a better game is a priority for people with many different concerns, not just a special interest in money and finance.”

This confusion over what banks really do has got to end – we deserve a financial system we can understand.