New report: Where are the conditions for the Bank of England’s broken bailout scheme?

The government and the Bank of England are using a new scheme – the Covid Corporate Financing Facility (CCFF) – to bail out the UK’s largest corporations with no strings attached. As of 24th June, a select list of 63 companies, including some of the country’s biggest polluters, held a total of £18 billion in cheap CCFF loans. Positive Money’s new report published today outlines exactly what the CCFF is, why it’s a problem, and most importantly – how it can be improved.

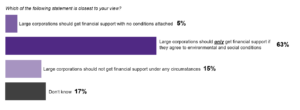

Our new report “The Covid Corporate Financing Facility: Where are the conditions for the billion £ bailouts”, which digs into the details of the Bank of England’s bailout scheme, is making headlines in the media. Alongside our YouGov poll revealing 63% of British adults think large corporations should only be given financial support if they agree to certain environmental and social conditions, our report has so far received coverage in City A.M., DeSmog UK, and The Ecologist.

The CCFF is a highly exclusive and privileged scheme which gives Britain’s biggest corporations access to newly-created public money from the Bank of England at interest rates between 0.3 – 0.7%, far lower than the rates charged to the rest of the country’s businesses.

The scheme is intended to help companies pay wages and suppliers, but in practice there are no meaningful restrictions on how they use the money. The only step the Treasury and the Bank have taken to improve the behaviour of recipient companies came months after the scheme had already launched, in the form of a single condition requesting long-term borrowers show restraint on senior pay and the payment of dividends to shareholders. However, this condition is insufficient and poorly designed, as demonstrated by chemicals company BASF which went ahead with a £3 billion dividend payout to its shareholders, after having drawn £1 billion of public money from the CCFF.

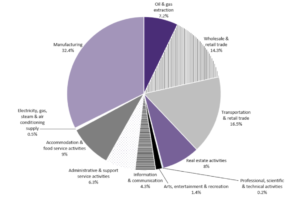

Despite Prime Minister Boris Johnson and Bank of England Governor Andrew Bailey’s public commitments to a fair and green recovery, the CCFF in its current form lacks any conditions designed to protect workers or the environment. As of 24th June, 56% of funds allocated have gone to high-carbon sectors, including airlines, oil and gas, transportation, and manufacturing. Analysis from ESG consultancy AG suggests that at least 6.9 billion trees would need to be planted to sequester all of the carbon emitted by CCFF companies in the 2018/19 reporting year – a feat which would require covering an area three times the size of the UK with trees capable of carbon storage.

Shares (%) of outstanding CCFF commercial paper by sector as of 25th June 2020:

Due to the scheme’s lack of conditions, we’ve seen some of the world’s biggest polluters receive millions of pounds while simultaneously laying off thousands of workers. British Airways received £300 million and went on to lay off over 12,000 workers – and they’ve threatened to cut an additional 19,000 jobs unless workers accept worse pay and working conditions. Airlines overall have drawn £1.8 billion from the scheme while collectively announcing up to 21,000 layoffs. According to analysis from AG, approximately 39% of CCFF participants have large scale redundancies planned, totalling over 34,000 UK-based jobs, while only 19% have disclosed accurate statistics for carbon emissions, energy, water and waste. Our polling reveals only 5% of the population back the current design of the CCFF, where companies receive financial support with no conditions attached. For detailed case studies revealing the poor environmental, social and governance record of many of the companies participating in, and eligible for, the CCFF read our full report here.

The CCFF has also been a deeply secretive scheme. Initially the Bank of England tried to keep the names of recipients hidden by asking companies to sign confidentiality agreements. It was only following a Positive Money campaign, that the Bank and the Treasury took an important first step and began publishing a list of companies participating in the CCFF, but serious transparency issues still remain. Key aspects of the scheme, such as total drawings prior to the publication of the list of participating companies, as well as how decisions on loan amounts are being agreed upon, remain veiled from public view. In failing to maximise the transparency of the scheme, the CCFF is exacerbating a lack of democratic accountability and legitimacy which has sat at the heart of the Bank of England for far too long.

To truly align the CCFF with the government’s commitment to ‘build back better’ and match the public’s overwhelming desire for conditions to be attached to financial support, there are five steps the Bank and the Treasury must take to reform the scheme:

Implement new restrictions on senior pay and a one year ban on dividend payments.

Require participating companies to guarantee: (i) no lay-offs while the Coronavirus Job Retention Scheme (CJRS) is in place; (ii) immediately make room for workers on company boards; and (iii) include trade unions in any future restructuring of the workforce when the CJRS comes to an end.

Require each company to outline credible net-zero carbon plans in line with the Paris Agreement, and commit to disclosing their climate risks.

Outline clear consequences for failure to comply with the conditions of the CCFF, such as fines or less favourable terms and conditions in future bailout schemes.

And finally, enhance the transparency of the CCFF by publishing: (i) total amounts borrowed by each company since the start of the scheme; (ii) detailed explanations of how loan amounts are agreed upon; and (iii) all communication with companies explaining how conditions are being met.

By offering Britain’s biggest corporations exclusive access to cheap funding with no strings attached, the Bank of England and the Treasury are going against the public’s wishes and undermining their commitments to a fair and green recovery. It is completely unacceptable that large companies, including some of the world’s biggest polluters, are benefiting from public funds while paying out dividends, laying off workers, and failing to make credible zero-carbon commitments. The Bank and the Treasury must act fast and apply enforceable social and environmental conditions to the CCFF, to secure greater protection for workers and strong commitments to Paris-aligned climate-friendly business models.

Transparency is a crucial pillar of a functioning democracy – and is especially important wherever the use of public funds is involved. To avoid deepening the already vast democratic deficit at the Bank of England, the CCFF must be made as transparent as possible.

The CCFF is in urgent need of improvement. A first step would be halting these no-strings-attached bailouts, which you can demand too by signing our petition and sharing the video below. But if the government and the Bank really want to listen to the public’s wishes, and are seriously committed to building back better with a green and fair recovery, they must go further and urgently implement all our recommendations, before it’s too late.