The Future of Money Conference in Frankfurt

On November 24th, Positive Money had the pleasure to attend The Future of Money conference that took place at the Frankfurt School Blockchain Center, initiated by Monetative, the International Movement for Money Reform, and the Blockchain Center.

The main topics discussed were the current monetary system, Sovereign Money/Vollgeld, Central Bank Digital Currencies and Cryptocurrencies. The conference covered a number of subtopics, presented by speakers prominent in their respective fields. This blog will relate some of the highlights. However, the reader is encouraged to explore the agenda and material presented here, as doing justice to the presenters and their work could fill the pages of an entire book.

The programme began by setting the background of the situation we face today. Michael Kumhof presented a model which tries to correct the fact that representations of banks in the models currently used to inform policy are at best misleading. They ignore the fact that banks are creators of money, instead presenting them as intermediators of funds. This short-sightedness, recently discussed in one of our blogs, has pernicious implications for policy.

Steve Keen explained how the current debt- based monetary system is inherently unstable, as demand and income are determined by the turnover of existing money and the creation of new debt. He proposed an ‘intelligent process of debt jubilees’ as a solution. He also highlighted that one of the most difficult things in capitalism is to channel money into innovation, which could be overcome by government creating new money to be allocated by the private sector.

William White of the OECD painted a bleak picture for the future. He pointed to several structural factors, including the fact that the main tool used to combat the 2007/8 crisis – ultra-loose monetary policy – seems to have simply postponed the problem. The current global debt ratio is 40% higher than before the crisis and asset prices are at unsustainably high levels. This has led us into a debt trap, where we need to start monetary tightening to avoid exacerbating the problem but doing so will most probably trigger a crisis. We are ill-prepared to combat such a crisis, given the state of the armoury in place to confront it. Interest rates are at or close to the lower bound, quantitative easing has turned out to be part of the problem – inflating prices while increasing inequality – and fiscal policy remains trapped by a contractionary, contradictory, and counter-effective austerity narrative.

Nonetheless, it was not all so bleak. In fact, the emphasis placed throughout the conference on central bank digital currencies (CBDCs) was both exciting and encouraging. Michael Kumhof argued that the introduction of CBDCs and provision of universal access to the central bank’s balance sheet, both based on sound design principles, could have significant benefits. These might include lower steady-state interest rates, higher seigniorage, a reduction of financial stability risks, and a second monetary policy instrument which would improve the ‘ability to stabilise inflation and the business cycle’.

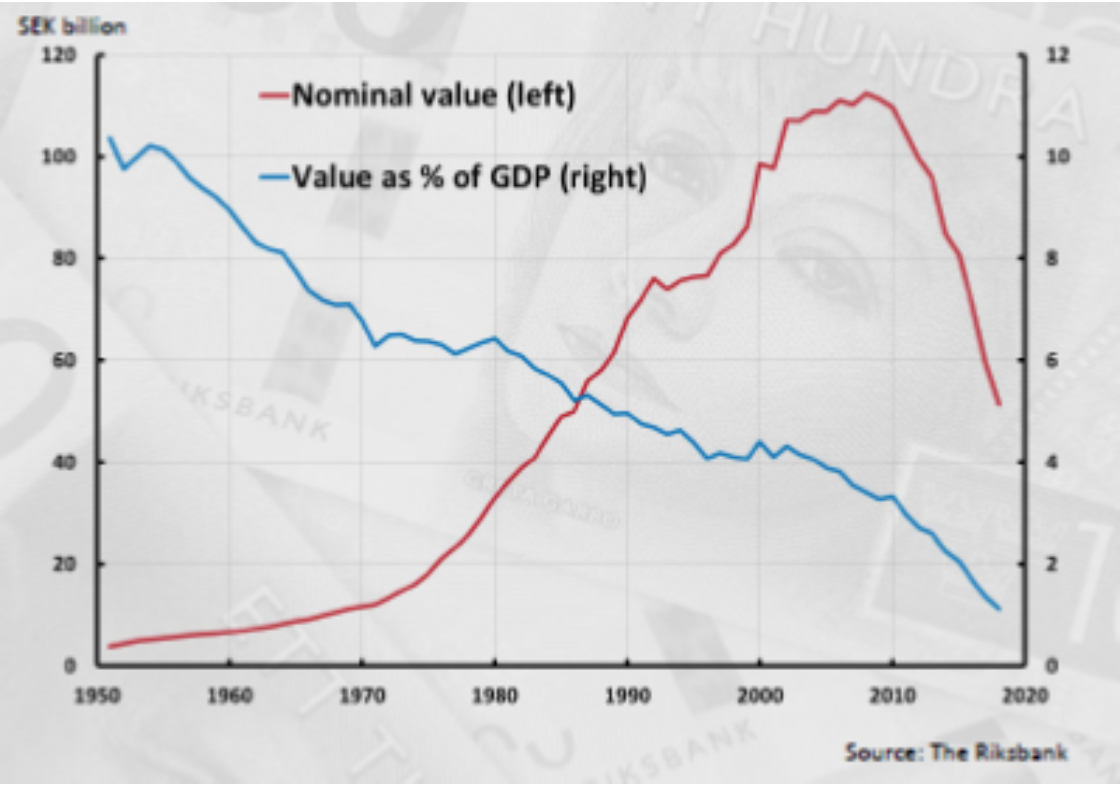

Sweden is closest to implementing a CBDC given the rapid decline in its use of cash, as seen in the graph below (presented by Carl Claussen), and the Riksbank’s effort to prevent the country’s payment system from going fully private.

Sweden’s use of physical cash is declining rapidly. (Source: Carl Claussen, Riksbank)

Positive results there could instigate other central banks to adopt CBDCs and will certainly increase the pressure for them to do so.

Miguel A. F. Ordonez, Governor of the Bank of Spain from 2006-12, made a vital contribution, drawing on his perspective as a former central banker. He highlighted that under the current system, money and banking are inseparable, which makes money fragile and requires heavy regulation. On the other hand, with the issuance of a CBDC, money would be separated from banking activities, making it safe and allowing for the liberalisation of the sector.

Ordonez noted that over recent decades, other sectors have undergone structural reforms and become more liberalised, while banking continues to enjoy a number of ‘privileges, protections, subsidies and entry barriers’. Competition and antitrust laws are not enforced and public institutions act as “‘de facto’ guardians of [the] profitability of banks”.

Introducing CBDCs would make money safe and increase stability by improving monetary policy, reducing debt bubbles, ending the worst kind of financial crises and making recoveries more attainable. The banking sector would face an increase in competition and market discipline, creating a more efficient monetary system and leading to higher growth, lower prices, and innovation. Social objectives could then be ‘achieved with better and targeted instruments’.

Issuance of a CBDC would create the foreground for a Sovereign Money System. This point was carefully noted by Joseph Huber, who added that a CBDC would lead to an increase in seigniorage, and that the cost of handling would be equal to that of bank money.

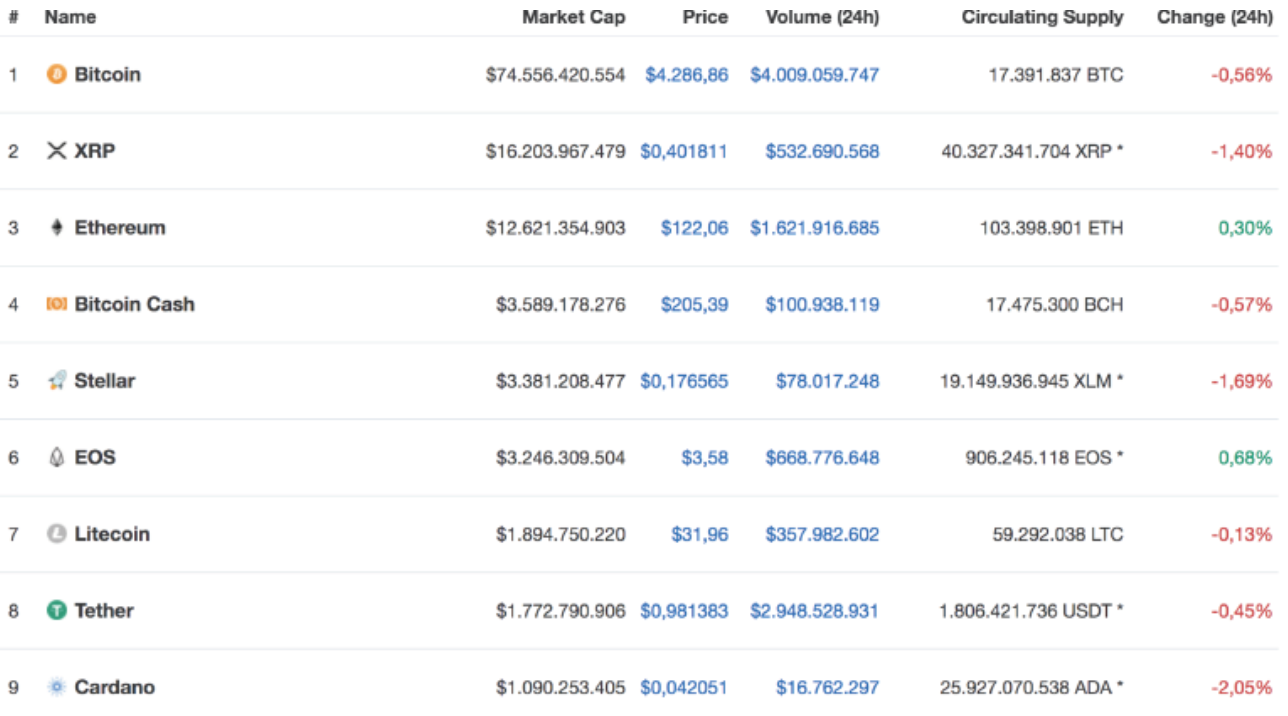

When it came to cryptocurrencies, sentiment was mixed. The idea has been revolutionary, and they have attracted significant investment, as seen by their market capitalisation in the ranking of cryptos below (presented by Dr Philipp Sandner):

There are many popular cryptocurrencies, and their value fluctuates greatly. (Source: Dr Philipp Sandner)

However, their effectiveness as a medium of exchange, unit of account and store of value is hampered by several factors. Their volatility and their consumption of vast amounts of energy are just two among these. A bitcoin transaction requires the same energy used by a household over one week, and the network as a whole currently consumes as much electricity as the Netherlands. Nevertheless, blockchain technology and its payment system are promising innovations. Their development can help shape a better future.

Positive Money has been a pioneer in the discussion surrounding digital cash (i.e. a CBDC) since the release of our 2016 report Digital Cash: Why Central Banks Should Start Issuing Electronic Money, followed by The Future of Cash: Protecting Access to Payments in the Digital Age in 2018. The topic has now entered the mainstream, with the director of the IMF recently making the case for their issuance. Central banks around the world have been producing reports and investigating their potential implementation.

The possibility of monetary reform is now closer than ever. How CBDCs are designed and implemented will determine the degree to which the reformed monetary system will be a Sovereign one. Change is happening. All we need to do is to campaign for it and ensure it takes the right shape.