Poll shows 85% of MPs don’t know where money comes from

The results of a new poll of MPs reveal a worrying lack of understanding of the UK’s money and banking system across the House of Commons. The poll finds that only 15% of MPs are aware of how most money is created in the modern economy.

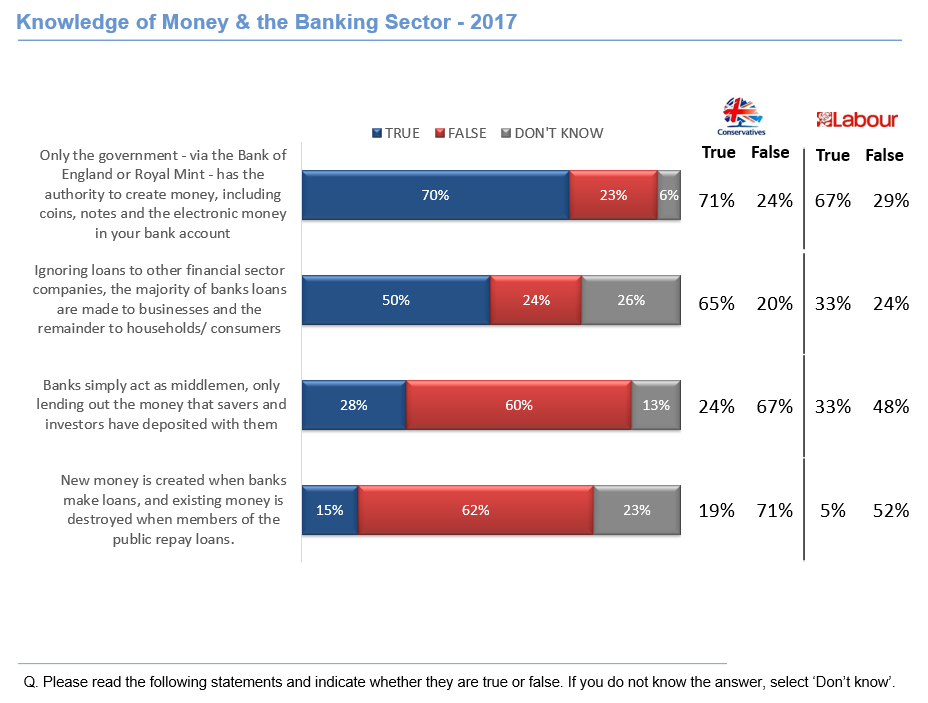

We commissioned polling company, Dods, to give a cross-section of MPs four statements about the UK’s money and banking system and to ask whether they’re true or false.

Only 15% of MPs were aware that new money is created when banks make loans, and existing money is destroyed when members of the public repay loans. 62% thought this was false, while 23% responded ‘don’t know’. Tory MPs seemed to have a slightly better idea, with 19% answering correctly, compared to only 5% of Labour MPs.

As explained in the ‘Money creation in the modern economy’ report published by the Bank of England in 2014, most money takes the form of bank deposits, which are mostly created through commercial banks making loans: “Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” The most recent figures suggest that 97% of money exists as bank deposits, with only 3% created by the Bank of England and Royal Mint as cash.

70% of MPs incorrectly believed that only the government has the authority to create all new money – including the electronic money in personal bank accounts – with only 23% knowing this to be false, and 6% answering ‘don’t know’. Labour performed slightly better on this question, with 29% of Labour MPs answering correctly, compared to 25% of Tory MPs.

Despite their confidence in telling the public that there is ‘no magic money tree’ to pay for vital services, politicians themselves are worryingly ignorant of where money actually comes from.

There is, in fact, a ‘magic money tree’, but it’s in the hands of commercial banks, such as Barclays, HSBC and RBS, who create money whenever they make loans. Unfortunately, this privilege is used in ways which don’t benefit most of the society. Over 80% of new bank lending in our economy is directed towards property and financial markets, which is making housing unaffordable, increasing inequality and resulting in more and more people drowning in debt.

In order to address the problems of rising inequality, the housing crisis and record personal debt, MPs need to grasp the basics of how our economy works, now more than ever.

You can see the full breakdown of the poll results here. And please like and share our video to share this news with your friends and family!

——

Figure 1: Full breakdown of the data