We can’t sustain infinite economic growth on a finite planet. Governments’ attempts to do so are having devastating social and environmental consequences. It’s been obvious for decades that our addiction to growth is unsustainable, so why aren’t governments getting the message?

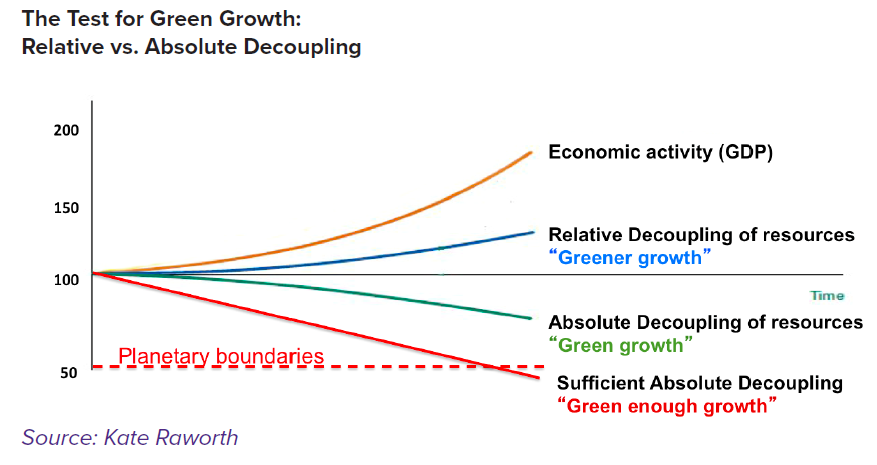

Short of a technological miracle, infinite growth in GDP will destroy the planet through climate change and environmental degradation. Greenhouse gas emissions have risen with the level of economic activity. To avoid catastrophic damage while still growing, we need ‘sufficient absolute decoupling’ – where emissions keep within planetary limits even as we become more prosperous, as shown below. Currently, they’re not falling anywhere near fast enough to avoid disaster.

Several factors drive governments to think that growth is both beneficial and essential. One crucial reason is the huge amount of debt, owed by private households, companies, and governments themselves, generated by our flawed money and banking system.

The main source of money used by citizens is created by banks. Over 97% of money in the economy exists in the form of bank deposits. Though even most MPs aren’t aware of this, banks create new money when they make loans. Through this process, money is created as an IOU – a debt.

In the UK, private debt stands at over 220% of GDP. Government debt accounts for another 87% of GDP. Currently, it is in the government’s interest to foster growth in GDP that erodes these debts – or risk a crisis when the debt burden becomes so vast people start defaulting on their debts.

However, the Bank of England can create money without increasing public or private sector debt. So rather than using it to continue to create hundreds of billions of pounds to pour into financial markets (as it has done since 2009 through quantitative easing), a smaller amount could be created and put straight into the real economy, via investment in green infrastructure or a citizens’ dividend intended to wipe out unsustainable debts. This ‘green’ or ‘people’s’ QE would have huge ecological benefits.

But with some scientists forecasting that catastrophic climate change could be unleashed in a matter of years rather than decades, we need to be bold enough to think about more systemic measures. Rewiring money and finance for sustainability will mean introducing new and diverse models of banking, and limiting commercial banks’ ability to create new money. Our proposal for a Sovereign Money System is one reform to make this happen.