Financial Crisis & Recessions

[vc_row][vc_column][vc_column_text]

The financial crisis happened because banks were able to create too much money, too quickly, and used it to push up house prices and speculate on financial markets.

1. Banks created too much money…

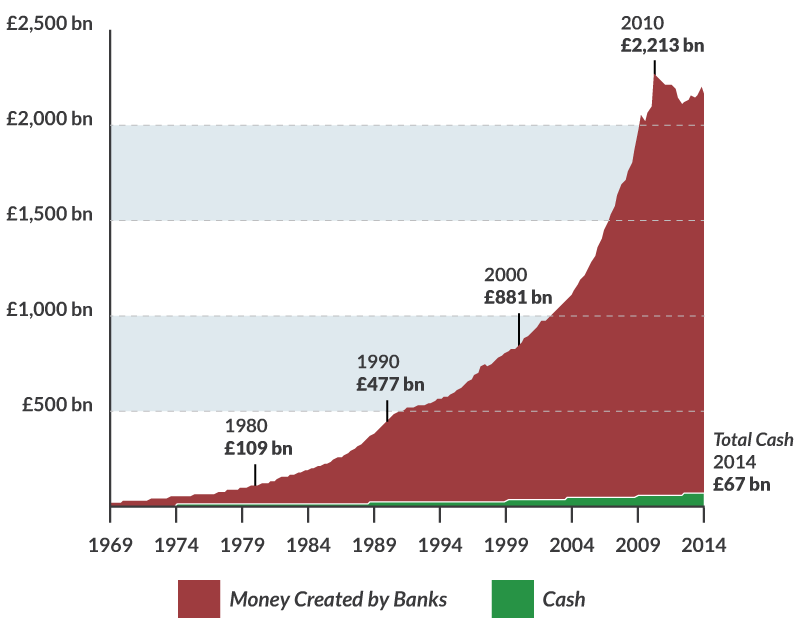

Every time a bank makes a loan, new money is created. In the run up to the financial crisis, banks created huge sums of new money by making loans. In just 7 years, they doubled the amount of money and debt in the economy.

2. …and used this money to push up house prices and speculate on financial markets

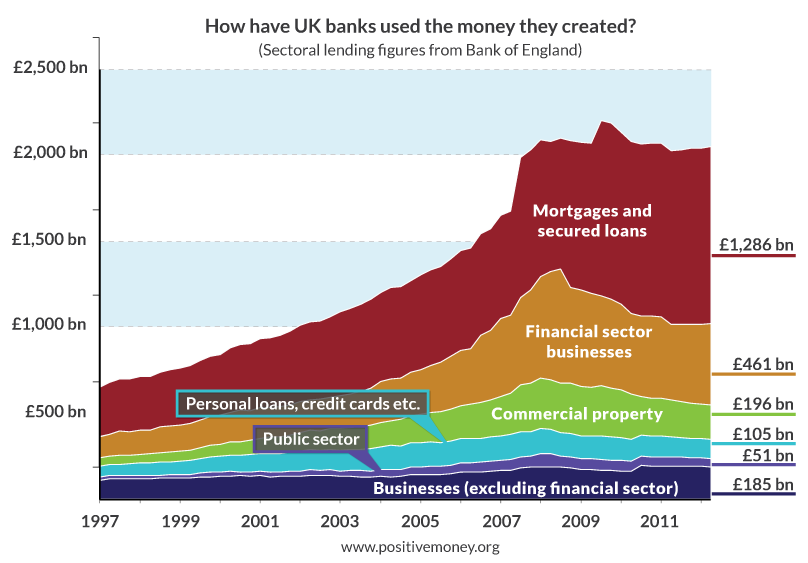

Very little of the trillion pounds that banks created between 2000-2007 went to businesses outside of the financial sector:

Around 31% went to residential property, which pushed up house prices faster than wages.

A further 20% went into commercial real estate (office buildings and other business property)

Around 32% went to the financial sector, and the same financial markets that eventually imploded during the financial crisis.

But just 8% of all the money that banks created in this time went to businesses outside the financial sector.

A further 8% went into credit cards and personal loans.

3. Eventually the debts became unpayable

Lending large sums of money into the property market pushes up the price of houses along with the level of personal debt. Interest has to be paid on all the loans that banks make, and with the debt rising quicker than incomes, eventually some people become unable to keep up with repayments. At this point, they stop repaying their loans, and banks find themselves in danger of going bankrupt.

4. This caused a financial crisis

As the former chairman of the UK’s Financial Services Authority, Lord (Adair) Turner stated in February 2013:

“The financial crisis of 2007 to 2008 occurred because we failed to constrain the

financial system’s creation of private credit and money.”Lord Adair Turner, speaking as chair of the Financial Services Authority, 6th February, 2013

This process caused the financial crisis. Straight after the crisis, banks limited their new lending to businesses and households. The slowdown in lending caused prices in these markets to drop, and this means those that have borrowed too much to speculate on rising prices had to sell their assets in order to repay their loans. House prices dropped and the bubble burst. As a result, banks panicked and cut lending even further. A downward spiral thus begins and the economy tips into recession.

5. After the crisis, banks refuse to lend, and the economy shrinks

Banks lend when they’re confident that they will be repaid. So when the economy is doing badly, banks prefer to limit their lending. However, although they reduce the amount of new loans they make, the public still have to keep up repayments on the debts they already have.

The problem is that when money is used to repay loans, that money is ‘destroyed’ and disappears from the economy. As the Bank of England describes:

“Just as taking out a new loan creates money, the repayment of bank loans destroys money… Banks making loans and consumers repaying them are the most significant ways in which bank deposits are created and destroyed in the modern economy.” (Money Creation in the Modern Economy, Bank of England p3-4)

So when people repay loans faster than banks are making new loans, it’s like draining the oil from the engine of a car: the economy slows down and prices decrease. As a result the economy risks slipping into a ‘debt-deflation’ spiral, where wages and prices fall but people’s debts do not change in value, leading to debts becoming relatively more expensive in ‘real’ terms. Even those businesses and people that weren’t involved in creating the bubble suffer, causing a recession.[/vc_column_text][vc_tta_accordion active_section=”2″ collapsible_all=”true”][vc_tta_section title=”Further reading” tab_id=”1507142518426-c73618ad-c567″][vc_column_text]

Fisher, I. (1933). The Debt Deflation Theory of Great Depressions. Econometrica 1: 337-57

Keen, S. (2012). Instability in Financial Markets: Sources and Remedies. INET Conference, Berlin

Minsky, H. P. (1992). The financial instability hypothesis.

Minsky, H. P. (2008). Stabilizing an unstable economy (Vol. 1). New York: McGraw-Hill.

Turner,A . (2013). Macroeconomic Policy and Economic Stability. Keynote Speech at INET Hong Kong

Whalen, C. J. (2007). The US credit crunch of 2007: A Minsky moment (No. 92). Public policy brief/Jerome Levy Economics Institute of Bard College. [/vc_column_text][/vc_tta_section][/vc_tta_accordion][/vc_column][/vc_row]