Britain 2018: We’ve never had it so bad

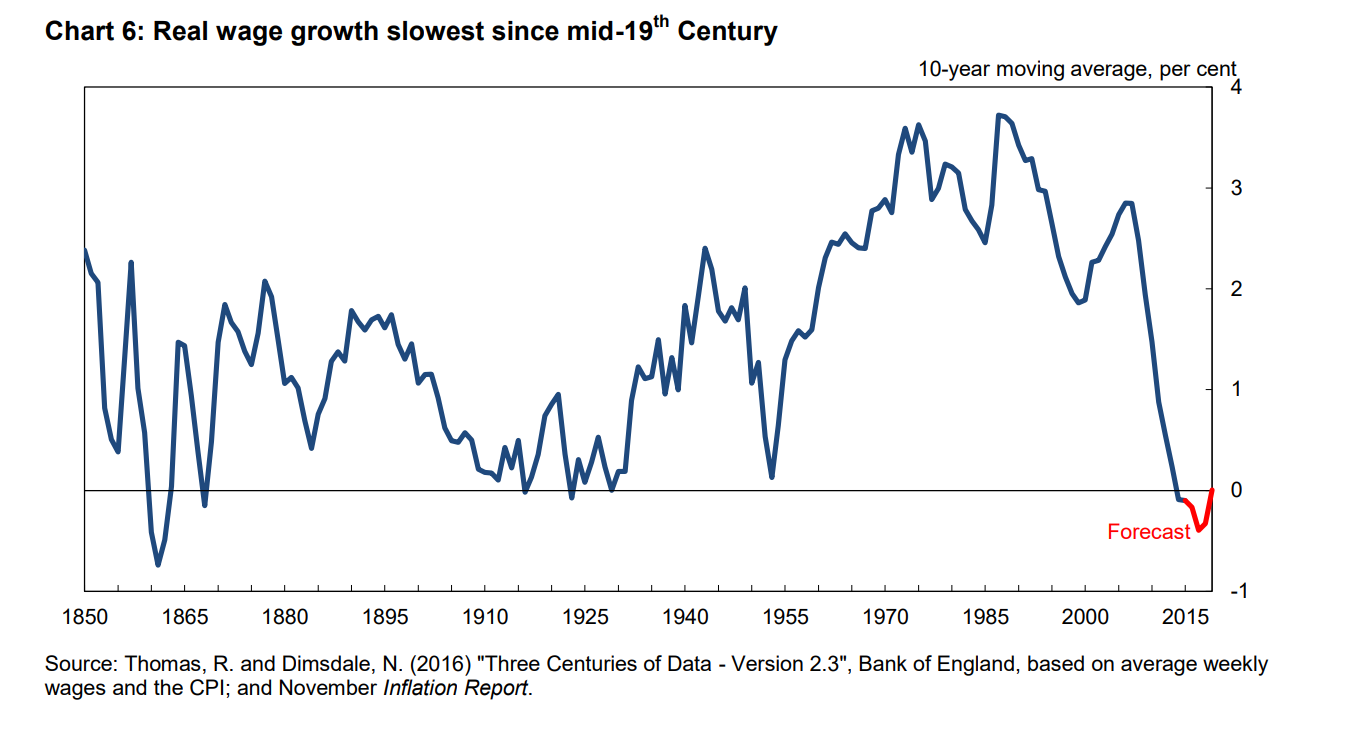

Last December, in a Bank of England (BoE) speech entitled the ‘Spectre of Monetarism’(1), its governor Mark Carney said that ‘over the past decade real earnings have grown at the slowest rate since the mid-19th Century’. To evidence this statement, the BoE published the chart below:

Unfortunately, since this speech, things have deteriorated. Today’s ONS July inflation data puts annualised CPI inflation at 2.6% (2). This compares with the CIPD’s outlook for wage growth slowing to just 1.5% (3). Therefore in real terms, workers are likely to experience an annual 1.1% pay cut.

While inflation may fall as the effect of the weaker pound ‘washes’ through, it’s also possible that wages may come under further pressure, as demand slows. This real wage trend, therefore, seems unlikely to improve dramatically anytime soon.

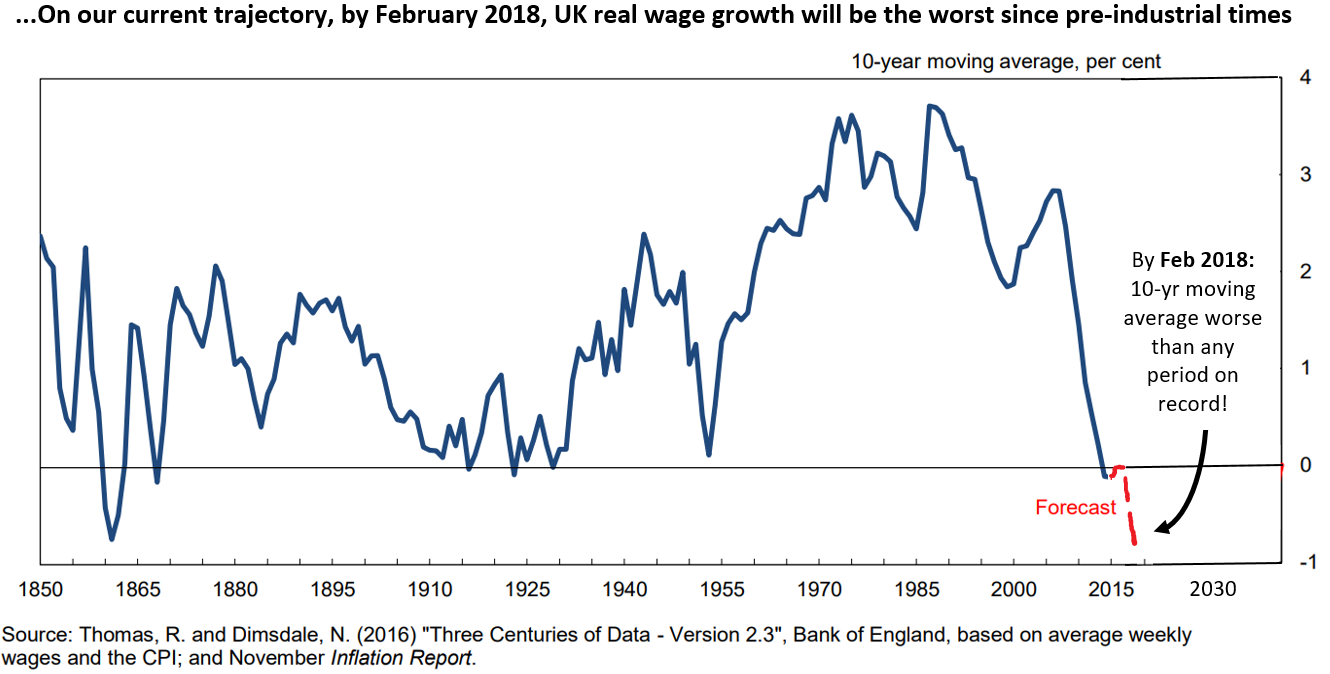

Using the ONS data on real average total weekly pay, we can see exactly how long this trend would need to continue before the rolling 10-year average real wage growth becomes even worse than during the 1860s (>-0.8% pa over a decade). Into this date, the UK’s decade-long real wage performance would become worse than over any period since pre-industrial times!

If we continue as we are, we’ll hit this grim milestone in just six months – in February 2018. By this date, it may literally be said that Britons will ‘have never had it so bad’:

Mr Carney concluded this same speech: ‘There isn’t a parallel universe of higher interest rates, higher growth and equity prices, and lower pension deficits. That is, there isn’t, without real structural reform’.

But we at Positive Money believe there is one reform that can deliver all such outcomes – and achieve lower inequality, lower debt and a better environment too. This reform is ‘QE for people’ (4).

Unlike the QE programme deployed since 2009 – in which the BoE simply bought up financial and corporate assets – this policy would enable the government to spend more on the things we need, like education, health-care, affordable housing and green infrastructure, without burdening future generations of taxpayers. Implemented with credible constraints, this is the only policy that can end our reliance on ever rising financial asset prices to keep our economy growing.

———-

(1) http://www.bankofengland.co.uk/publications/Documents/speeches/2016/speech946.pdf

(3) https://www.cipd.co.uk/knowledge/work/trends/labour-market-outlook

(4) Referred to as ‘Overt Monetary Financing’ (OMF) by key supportive economists such as Adair Turner and Martin Wolf.