Global population does not want commercial banks to stay responsible for creating most of the money

More than 23,000 people in 20 countries were asked about who they think actually creates 95% of the money in circulation and who they think should create most of the money.

These questions were part of the Glocalities survey of Motivaction International and the Sustainable Finance Lab that was held in December 2013 and January 2014.

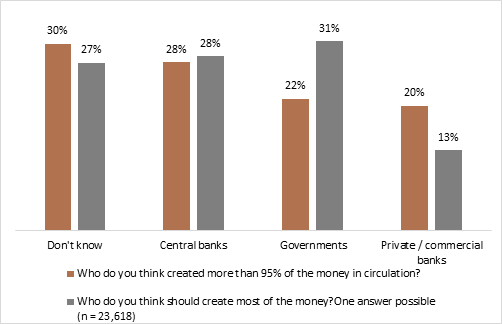

Here are the main results:

Low knowledge in population of who creates money: Only a minority of 20% is aware that private/commercial banks create most money

Even among financial sector workers there is a lot of misunderstanding about who creates money

Only 13% of people want private/commercial banks to create more than 95% of the money in circulation, as is currently the case

59% want to assign the responsibility for creating most of the money to a public body (government/central bank)

The following graph shows the main results. See Appendix 1 and 2 for the scores of all countries surveyed:

Source: Glocalities survey Motivaction

“A necessary condition for informed debate on the future of our monetary system is that the public understands how it works. This research demonstrates that only a small proportion does so. It also demonstrates that, when they are taught the reality, most people do not like what they learn.”

Martin Wolf, Chief economics commentator, Financial Times

A minority of 20% is aware that private/commercial banks create most money

A significant proportion of people across the globe (80%) have no idea who creates most of the money in circulation. Half the people think it is a public institution (either a central bank or the government) that creates most of the money in the financial system. Only 1 in 5 respondents gave the right answer, that it is private/commercial banks that create more than 95% of the money. ‘’In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money. Bank deposits make up the vast majority (97%) of the amount of money in circulation’’. Source: Bank of England paper on Money creation.

“Money affects every aspect of our lives, but as this survey shows, not enough of us really understand how it works. After the banking crises of the last few years, it’s time to ask whether banks should still be allowed to create our money.”

Fran Boait, Executive Director, Positive Money

The majority of people want a public institution for creating most of the money and not commercial banks

When people are asked who they think should create most money worldwide only 13% prefers private/commercial banks to fulfil this responsibility (as is currently the case), against 59% who wish for a public institution (either government or central bank) to be the main creator of money. Among the minority of people who correctly state that private/commercial banks create most money in circulation, only 27% believe that this should continue to be the case, whereas 63% of them want to see this responsibility transferred to governments or central banks.

‘’It is instructive to learn that the majority of people internationally think that most money is created by public bodies and not by private/commercial banks, while in fact the opposite is true. Even among financial sector workers the majority is not aware of the key role that commercial banks play in creating money and only a minority of them would naturally assign this task to commercial banks. Now the world is facing numerous challenges that can only be tackled by smart investment policies it is time to rethink how the responsibility for creating money should be assigned and monitored.‘’

Martijn Lampert, Research Director Glocalities at Motivaction

Most people in the financial sector do not know that private/commercial banks create money

The awareness in the financial sector about who actually creates most of the money is only moderately higher than in the general population. The answers of people who work in the financial sector in Western economies (Europe, USA, Australia, Canada) reveal that only 26% know that private/commercial banks create most of the money in circulation. When asked who should create most of the money the majority (61%) of financial sector workers also choose a public body and only 16% choose to assign this responsibility to private/commercial banks.

“The current financial system is still prone to crisis. Giving public bodies a larger role in money creation can help to stabilize the system and give governments the much needed funds to invest in sustainability”. Instead of embarking on an unprecedented and uncertain transition it might be wise to start with experiments.”

Rens van Tilburg, Director Sustainable Finance Lab