Wealth ‘halved in a decade’ for people in their 30s: What’s money got to do with it?

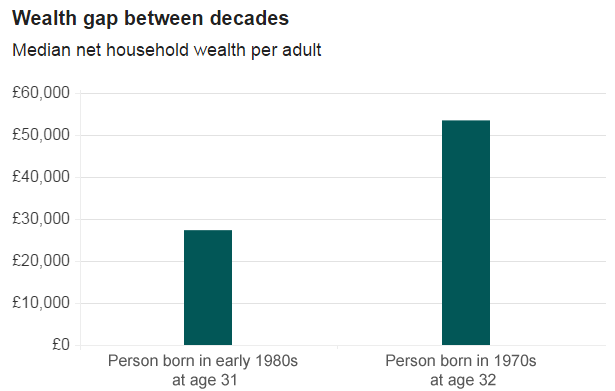

A new report by the Institute for Fiscal Studies (IFS) shows that people in their early 30s are half as wealthy as people of the same age ten years ago.

This has been correctly attributed to a number of factors, but one which is gaining increasing attention is the role of money creation in the modern economy. In a nutshell:

Money creation by the private banking sector has stoked up property prices – making housing less affordable for younger generations

The Bank of England’s policies have also helped price out younger generations from the housing market, whilst hurting their pensions

Wealth halved for people in their 30s

The report by the IFS shows that people born in the 1980s generation has an average wealth of about £27,000 each, whilst the 1970s generation had an average of £53,000 at the same age. Average 30-year-olds should be £26,000 wealthier than they are now.

According to the IFS, this is because younger generations are being priced out of the property market and are not receiving the same pension packages as their older relatives. But why are property prices so high? And why are pension packages not as rewarding as they used to be?

(Source: IFS & BBC)

What’s money got to do with It?

There are numerous explanations for this growing trend. On the one hand, real incomes of the younger generation have been stagnating for some time – for the first time since WWII, people in their 30s have lower incomes than the preceding generation. This makes it harder for people to save and thus increase their wealth.

Another reason is that house prices are increasing so fast that younger generations are finding it impossible to get on the property ladder (which would increase their wealth). This is traditionally explained by the fact that we simply are not building enough new houses. The supply of housing is not able to respond to growing demand, so house prices are going up.

These are valid explanations – but without considering the role of money, they paint an incomplete picture of the problem. More specifically, how money is created – and how money creation influences house prices and pensions.

To understand how money creation influences house prices we first need to look at the supply and demand for housing, which in effect helps determine house prices.

House prices – supply and demand

Prices are determined by factors that influence both supply and demand. It is impossible to discuss the impact of supply on prices without knowing a bit about demand, and vice versa.

An increase in the supply of housing will only impact prices in so far as demand has been satisfied. If the supply of housing increases faster than growth in demand, then house prices should fall. However, if the rate of construction doubled but the level of demand still outpaced supply, then the increased supply of housing would not result in lower house prices.

So we can increase the supply of housing all we want, but if demand grows faster, house prices will continue to increase.

There are a number of factors that influence demand for housing, but at the core sits the process of money creation. There are two primary processes through which money creation currently influences demand for property; 1) private bank money creation, 2) and the Bank of England’s quantitative easing programme.

House prices, bank lending and money creation

When private banks lend money, new money is created and new purchasing power is added to the economy. This new spending power can increase demand for goods and services. Given that over 50% of new money creation goes into the housing sector, demand is being created for housing.

As the supply in the property sector is known to respond very slowly to demand – supply is virtually fixed in the short-term – the primary effect of new money creation is to push up house prices.

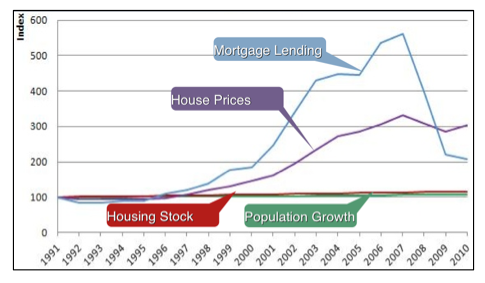

For some time now, Positive Money has demonstrated the positive relationship between bank lending and house prices. In the ten years up to the start of the financial crisis, house prices tripled. Many people think this is because there were not enough houses around, but that is only part of the picture. During the period in question, the amount of money banks created through mortgage lending more than quadrupled! This lending was a major driver of the massive increase in house prices.

House Prices and Bank Lending: Housing stock increased faster than population

(Source: Positive Money)

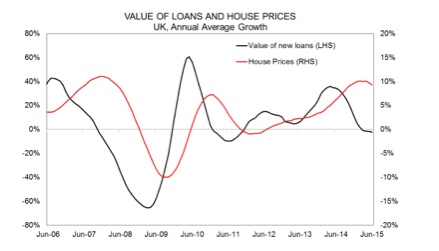

A piece of research by Shelter also demonstrates that changes in the total amount of lending for home purchase influence average house prices. As the amount of lending begins to increase, a corresponding increase in house prices shortly follows. Conversely, a decrease in the amount of lending is following by a drop in house prices.

(Source: Shelter)

House prices and Quantitative Easing

More recently, the Bank of England’s £445 billion quantitative easing (QE) programme has also helped increase property prices. Through QE the Bank of England creates new money out of nothing to buy government debt (in the form of bonds) from financial markets. Government bonds represent the safest investments (also known as safe assets in technical jargon) on the market.

By purchasing billions of pounds worth of government bonds, the Bank of England concertedly reduces the amount of available safe investments. With a lower availability of safe investments, money (and demand) is re-directed into the property market – leading to an increase in house prices (click here for a more in-depth analysis).

Quantitative Easing, pensions, and retirement plans

The Bank of England also significantly hurts pensions and retirement plans. By creating so much new money to buy government bonds, the Bank of England artificially creates new demand for them. With more demand, there is more competition for government bonds, which ultimately lowers the returns on government bonds.

Logically, retirement packages and pension funds are composed of government bonds because they represent the safest investment available. So by reducing the returns on government bonds, the Bank of England is pro-actively hurting pension and retirement packages. This helps explain why younger generations are not receiving the same kind of pension packages as preceding generations.

Let’s create money for people

Money creation has clearly played a fundamental role in making it harder for younger generations to increase their wealth. In fact, there are numerous other problems with private bank money creation and the Bank of England’s quantitative easing programme.

This is why Positive Money is campaigning to change our monetary system. We believe – and have demonstrated – that there are much more effective ways of creating money, that would benefit the majority of people, and would certainly help increase the wealth of the younger generations. So we have launched a petition to get Chancellor Phillip Hammond to abandon the current QE programme in favour of more effective alternatives, which don’t have the same negative side-effects. Please sign our petition here.