“Property better investment than pensions”, says Bank of England’s chief economist – but what about the housing crisis?

The chief economist of the Bank of England, Andy Haldane, has recently claimed that property is a better investment for retirement than a pension. As long as the Bank of England continues on its current policy path this will most certainly be the case – with even more inequality and higher house prices to boot.

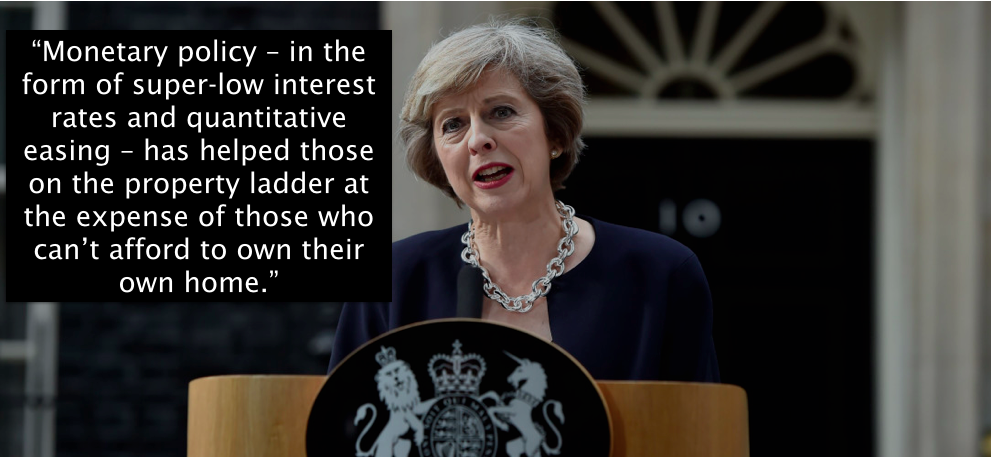

The Bank of England’s policies are concertedly aimed at lowering interest rates. These lower rates mean lower returns on savings and investments in pensions. With much more attractive returns on property, money is being re-directed away from savings and pensions into property. Indeed, this is one of the main reasons why Prime Minister May recently suggested that the Bank of England’s policies increase inequality.

The problem is that as more money is directed towards property, demand for property goes up, which ends up raising house prices. Higher house prices increase the wealth of existing homeowners; whilst making it even more difficult for first-time buyers to get on the property ladder.

In sum, the Bank of England’s policies aren’t only hurting pensioners and savers but also increasing inequality and worsening the current housing crisis. The Bank of England’s policy toolkit needs to be updated – so that it can stimulate the economy in a way that benefits the majority of people, not just the privileged few.

Property better than Pensions

When recently asked whether pensions or property are a better investment for retirement, Chief Economist of the Bank of England, Andy Haldane said:

“It ought to be pension but it’s almost certainly property. As long as we continue not to build anything like as many houses in this country as we need to meet demand, we will see what we’ve had for the better part of a generation, which is house prices relentlessly heading north. I would quite like the day to come when that wasn’t the case…”

Currently, property might be a better investment than a pension. There is also good reason to believe that we are not building enough houses to meet demand, but this fundamentally ignores that the Bank of England is pro-actively helping stoke up demand for property.

Quantitative Easing and Demand for Property

It is well known that by lowering its main monetary policy lever – the overnight interest rate, this will ripple through financial markets and lower interest rates across the board. Lower interest rates mean lower returns for savers and pension funds, making pensions a less attractive place to put your money – hence the desire to invest in property.

However, what is often completely ignored is how the Bank of England’s £445 billion quantitative easing (QE) programme reinforces this process. This is because, through QE, the Bank of England creates new money out of nothing to buy government bonds from financial markets. Government bonds represent the safest investments (also known as safe assets in technical jargon) on the market. Indeed, pension funds tend to invest in government bonds because they are the investments that represent the lowest risk.

By buying billions of pounds worth of government bonds, the Bank of England concertedly reduces the amount of available safe investments. With very few government bonds to invest in and with very low returns, it is natural for people to look elsewhere to put their savings (i.e. property) – as Andy Haldane suggested.

So in effect, the Bank of England’s policies help make pensions and saving an unattractive investment – something Haldane neglected to mention – and, naturally, investment in property is a better alternative. Of course, it was also neglected that with more people wanting to invest in property, demand for property goes up, and house prices increase.

The Evidence

Policymakers at the Bank of England claim that it is the intention of QE to lower returns on safe investments, and get investors to rebalance their portfolios into riskier investments. But even with the likes of Haldane admitting that property is now a better investment than a pension, there is still little recognition that the Bank of England’s QE programme is helping redirect money into property – ultimately inflating the UK’s housing bubble.

Quantitative evidence presented by ratings agency Standard and Poor makes a robust case that QE does increase house prices. Their evidence shows that:

“The share of cash-financed buy-to-let transactions appears to have started outpacing mortgage-financed buy-to-let (BTL) transactions at about the same time when QE was first deployed.

While we do not know the number of cash-financed BTL purchases, we do know that the share of mortgage-financed BTL purchases has fallen since 2007, while the share of rental properties has increased.

This means that an increasing number of new additions to the rental market must have been financed by means other than mortgages, which we consider a good proxy for cash purchases.

We think this points to the portfolio-rebalancing effect of QE, when investors liquidate lower-yielding positions in their portfolio where yields have come under downward pressure due to QE (such as yields on government debt), in order to acquire higher-yielding assets from the proceeds.”

The report is essentially saying that exactly when QE started and the Bank of England began flooding financial markets with cash – whilst simultaneously reducing the availability and profitability of safe investments – the amount of properties purchased with cash increased. In effect, QE redirected investors’ money away from traditional safe investments, into property.

New Demand and House Prices & Inequality

By forcing people to invest in property rather than pensions, the Bank of England is indirectly creating more demand for property. It is basic economics that if the Bank of England is creating extra demand for property (especially with an extremely rigid supply of housing), this extra demand will force prices upwards.

By inflating the price of existing real estate, the wealth of existing property owners increases, whilst making it more difficult for first-time buyers to buy a house. In effect, this increases inequality, as Standard and Poor notes:

“(QE) is now also one of the drivers behind the widening wealth and income gap between younger and older generations and between those on the housing ladder and those not on it… Younger low- and middle-income households (would-be first-time buyers) are the ones affected most. As buying a home becomes ever more expensive, they are increasingly forced to spend a large share of their income on rent and are unable to save in order to buy a home or otherwise accumulate wealth.”

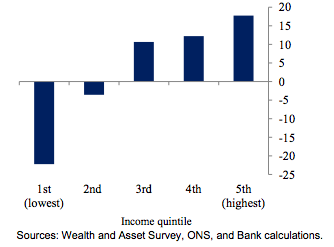

Since QE began, wealth inequality has dramatically increased. Those in the bottom 40% of the income distribution have seen virtually no increase in their wealth (in fact their wealth has fallen), while those in the top 20% have seen their wealth increase by nearly 20%. While a Bank of England report showed that because QE kept asset prices high, and 40% of asset wealth is held by the richest 5% of households, QE has made those households better off by an average of £128k each.

Change in Inequality Since QE Began

The Alternative: Create Money for People

The Bank of England clearly needs its policy toolkit to be updated. Instead of exacerbating inequality, blowing up house prices, hurting pensioners and disincentivizing saving, the Bank of England needs policies that can help stimulate the economy in a way that benefits the majority of people, not just the privileged few. This is one of the many reasons why Positive Money is launching a petition to get Chancellor Phillip Hammond to abandon the current QE programme (please sign here), in favour of alternatives which don’t have the same negative side-effects.