Bank of England: UK banks to lose their status as ‘gatekeepers’ to the payment system

In a significant breakthrough, the Bank of England (BoE) has just announced it will be adopting a policy change that Positive Money has been arguing for over the last 2 years. The BoE will finally allow non-bank ‘payment service providers’ (PSPs) to hold accounts at the BoE, so that they can compete with existing banks to provide current (checking) accounts. This will break the stranglehold that large UK banks have over the provision of payment accounts – and represents a step towards further changes that would limit the ability of banks to create money.

Here’s the official Bank of England statement:

“The Governor of the Bank of England announced on 17 June that the Bank intends, over time, to extend direct access to RTGS [the computer system that holds and manages the accounts at the Bank of England] to non-bank Payment Service Providers (firms granted the status of E-Money Institutions or Payment Institutions in the UK), collectively known as PSPs. The Chancellor [the UK’s finance minister] has committed to make the necessary legislative changes to ensure that these new entrants can access RTGS safely and efficiently.” [Our additions in square brackets.]

This might sound like a minor technical change, but it could lead to a profound shift in the financial system. The ability of banks to create money comes from the fact that they combine the business of (1) providing payment accounts and a payment system, with (2) the business of making loans. When they issue a loan, they do so by creating new money in the current account of the borrower (see footnote [1] for a fuller explanation). So one way of reducing the power of banks to create money is to separate out these two functions into separate businesses (or separate functions within the same business).

The Benefits of Breaking Apart the Banking Business Model

In fact, in his recent speech Bank of England Governor Mark Carney claims this separation of functions could be key:

Bank of England Governor, Mark Carney. (Source)

“FinTech has the potential to deliver more resilient financial infrastructure, more effective trade and settlement, and new ways to encode, share and analyse data. …. For consumers, [these changes] could mean more choice; better-targeted services; and keener pricing. For everyone, FinTech may deliver a more inclusive financial system, domestically and globally; with people better connected, more informed and increasingly empowered.These benefits spring from FinTech’s potential to deliver a great unbundling of banking into its core functions of settling payments, performing maturity transformation, sharing risk and allocating capital. This would mean revolution, fundamentally re-shaping the financial system.”

Carney seems to be aware that this could lead to significant changes for the monetary system:

“[Fintech] will change the nature of money, [especially the balance between inside money (created by commercial banks) and outside money (created by central banks)], shake the foundations of central banking and deliver nothing less than a democratic revolution for all who use financial services.” [Footnote 1 added inline into text above].”

Our proposals for a sovereign money system are along those lines. The proposals completely prohibit banks from creating money by functionally separating out the payments function from the lending side of a bank’s business. But even before those proposals are implemented, we can start making steps in that direction by encouraging the creation of businesses that only do one of these two functions.

So we want to see (1) more non-bank lenders who don’t provide payments (such as peer-to-peer lenders) and (2) more non-bank payment providers who don’t issue loans. The first type is already growing rapidly, with peer-to-peer lending taking on an increasing proportion of the lending that would normally be done by banks.

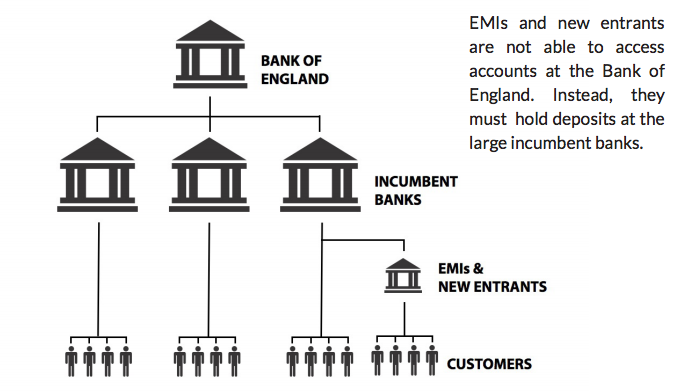

Banks as gatekeepers to the payment system

However, the second type of payments-only service provider is much more limited due to the fact that banks are currently the ‘gatekeepers’ to the payment system, making it almost impossible for non-bank competitors to provide current accounts that can compete with those offered by the banks.

We wrote about this problem back in August 2014 when we published a briefing (here). As we put it then:

[PM] “UK banks earn over £8 billion each year from providing personal current accounts (PCAs) and a further £2 billion each year from business current accounts (BCA). But the government’s Competition & Markets Authority has declared that that the sector “lacks effective competition and does not meet the needs of personal consumers or small and medium sized enterprises”.

The current [checking] account sector should be ripe for competition. Payments and current accounts are fundamentally a technology business, and so we should expect to see the same levels of competition as happens in the mobile phone or broadband industry.

However, there are huge and unnecessary barriers to entry to this market, which means that the UK’s large incumbent banks are protected from competition from potentially more nimble and innovative [fin]tech firms. This works to the detriment to consumers, but to the advantage of incumbent banks.”

Our discussions with policymakers

In late 2014 we met and discussed these ideas with the government’s Competition and Markets Authority, which was investigating the lack of competition in the current account industry. We then made submissions on the same topic to the newly established Payment Services Regulator, a division of the Financial Conduct Authority (one of the UK’s financial services regulators). Finally when the Bank of England announced a full review of who would have access to central bank accounts in January 2016, we met with the team leading that review.

Of course, we weren’t the only ones, and plenty of financial technology (‘fintech’) firms have been calling for similar changes. This pressure on the authorities seems to have paid off in the recent decision to open up access to settlement accounts for non-bank payment providers.

The Bank of England’s reasons for opening up access to settlement accounts

Interestingly, many of the reasons that Carney gave for widening access to accounts at the Bank of England echoes the reasons we gave in our paper Increasing Competition in Payment Systems. We wrote that:

Currently all non-banks must go through 4 large banks if they want to provide payment services to the public.

[PM] “The Bank of England provides certain ‘settlement accounts’ to banks and building societies. Ultimately, the entire UK payment system settles across these Bank of England accounts…But accounts at the Bank of England are only available to central government and banks and building societies (specifically, firms that are “authorised credit institutions”). [Non-bank payment institutions] do not qualify for settlement accounts at the Bank of England, even though they hold money and make payments on behalf of customers. Consequently, the incumbent banks … can set the costs faced by any new entrants, who are their potential competitors. The fees can be many times higher than the actual cost to the bank.”

Carney describes the same situation:

“48 institutions currently have settlement accounts in RTGS [the computer system that maintains accounts at the Bank of England]. All other users of the systems that settle across RTGS access settlement via one of four agent banks. These users include over 1000 non-bank PSPs serving customers’ increasingly demanding standards, and many rely on major UK payment schemes, particularly Faster Payments (FPS).” [Our addition in square brackets.]

In a revealing footnote he acknowledges that “for now banks continue to act as gatekeepers to payment and settlement in central bank money.”

Similarly, Carney acknowledges that the need of non-bank ‘Payment Services Providers’ (PSPs) to work through just four large ‘agent’ banks is a barrier to competition:

“As they grow, some PSPs want to reduce their reliance on the systems, service levels, risk appetite and goodwill of the very banks with whom they are competing. Re-selling services ultimately provided by banks limits these firms’ growth, potential to innovate, and competitive impact.”

In our briefing and our meetings we were clear in our recommendations:

“Our core recommendation is that the Bank of England should be required to provide settlement accounts to all providers of payments services.”

Carney’s statement is perfectly in line with this recommendation:

“…I am announcing this evening that the Bank intends to extend direct access to RTGS [the settlement account computer system] beyond the current set of firms, allowing a range of non-bank PSPs to compete on a level playing field with banks.

By increasing the proportion of settlement in central bank money, diversifying the number of settlement firms, and driving greater innovation in risk-reducing payments technologies, expanding access should bring financial stability benefits. It should also enable more efficient, effective and inclusive payments, including in ways that we cannot fully anticipate.” [Our addition in square brackets.]

In the briefing we explained the Bank of England didn’t need to give Payment Service Providers the same access to borrowing facilities and liquidity support that conventional banks benefit from:

[PM] “In the current scheme, access to settlement accounts also gives the bank or building society certain other advantages, such as access to borrowing facilities and liquidity support. The Bank of England is unlikely to allow new entrants access to such schemes, and there is no reason for them to do so. Payment-only providers and EMIs do not need access to these facilities. All they need is a way to store funds at the Bank of England, and pay these funds to banks and building societies through the payment schemes’ settlement processes.”

The BoE has taken exactly this approach:

“[Footnote 8] We do not intend, however, to extend facilities to PSPs for which they have no need. Non-bank PSPs will not therefore be eligible for membership of the Sterling Monetary Framework – and in particular the Bank’s credit facilities. That is because PSPs are not part of the monetary policy transmission mechanism or exposed to inherent overnight liquidity risk.”

A Big Step in the Right Direction

All in all, this is a very positive breakthrough by the Bank of England that will reduce the power of banks and expose them to competition in payment services. We’re hopeful that fintech firms can show that payments accounts can be provided cost-effectively without the power to create money. They can also show that payment accounts can be provided without the need to expose customers’ funds to risk, and without significant safety nets and guarantees provided at taxpayer expense. In other words, non-bank payment providers may show that there’s a better way of running the payments system than the current model of banking.

Footnote

[1] Almost all of us use current accounts at banks to make our (electronic) payments. This means that when we see our account balance go up, we see that as ‘payment’ for goods (if you’re a business owner) or services (if you sell your labour for a salary). Since it’s the banks that maintain those accounts, they can lend by increasing the balance of your account, in effect creating new money. Non-banks such as peer-to-peer lenders can’t do this; rather than lending by creating money they must borrow existing money from savers, and then transfer that money to borrowers.