Come on Mario. I only need a few thousand euros.

The main Dutch financial newspaper FD published recently an excellent article on People’s QE written by Marcel de Boer. Here’s a translation in English:

Alright, I am preaching to the choir. In about a month and a half I am refurbishing my house, but I don’t really have enough money. To get everything exactly as I want it, I need an extra few thousand euros. I can pay for it but it will impact my reserves, for which I care deeply. Hence, I thought of Mario Draghi, the man who can create unlimited amounts of money, which he is currently busy doing. The President of the European Central Bank (ECB) is only doing it the wrong way around. It appears to me that he must reassess his QE policy and adopt ‘QE for the people’. Instead of pumping liquidity into the financial system, he should write cheques directly to all the citizens of the Eurozone. The indirect cheques he sends now, are not landing where they should. In any case, my bank refuses to pass the low market interest rate the ECB staged on to me.

Helicopter money

Now you are asking yourself if I am sane, but this proposal is not so crazy. More relevant I think it is a truly missed opportunity that the monetary policymakers did not choose for ‘helicopter money’ when they decided in January to turn on the money presses. If they had studied better examples from the US, UK and Japan, they would have known that the buyout program is not effective at all.

[sws_grey_box box_size=”630″]Helicopter money

The former Fed chairman Ben Bernanke received the nickname ‘Helicopter Ben’ after he declared that it was a real option to literally strew money if the economy was spiralling into deflation. Bernanke referenced the economist Milton Friedman who had created such a plan in the sixties. Inflation originates if too much money is looking for a finite amount of products. With deflation there is insufficient money supply in the system. To prevent a downward spiral, central banks have to therefore create money. With QE that also happens, but if the money keeps floating into the financial system, and does not end up with families and companies, the demand to real products will not increase. [/sws_grey_box]

The idea behind QE is that the market interest rates decrease as a result of buying up bonds. The lower interest rates make borrowing more attractive. If consumption and investments increase as a result, the economy will grow and inflation return to its target level ECB’s primary monetary policy objective.

That’s the theory. Neither the US, the UK nor Japan, has seen credit provision has seen a noteworthy increase in credit provision in the last five years. While the balance sheet of the FED has five folded since 2009, the money supply has increased 57%, but credit grants only increased 15%, as reported by the investment bank Nomura. In the UK, credit grants in the same period decreased by 18%.

Room for growth

At the same time in the US, the lower interest rates have made it easier to repay their debts. That means that in future there will be more room for growth. But in the Eurozone the market interest rates were already significantly lower than when the Federal Reserve started with QE – Quantitative Easing. There was not that much room for a further decline in interest rates. On top, the problem is that the credit grants in the Eurozone are primarily between banks and not directly to the markets, as is the case in the US. If the European Banks do not pass on the low interest rates, the growth-impulse will not arrive. Additionally, in the US it is far more common for people to have an equity portfolio, invest for their old age pension. Since the buyout program will spike stock rates, it will cause a welfare effect and lead to extra consumption. This effect is likely much bigger in the US than in Europe.

More inequality

QE is especially favourable for people owning equity, i.e. the wealthy. If these people become much richer, they are unlikely to spend their additional wealth. It is the poor who spend their money – if they have it.

In other words, QE increased income inequality in society. That is not what a central bank was set up for. These extremely low interest rates may be fun for debtors, but these interest rates also take care consumers and business do not think before they put their money to work. QE therefore ensures a misallocation of resources. Also, it prevents the process of creative destruction. Non-viable companies are protected from bankruptcy, and they continue to demand resources that could be put to use elsewhere. Lastly, all this central bank money creates bubbles in the financial markets. We all know bubbles have one central characteristic: they will burst eventually.

‘QE infinity paradox’

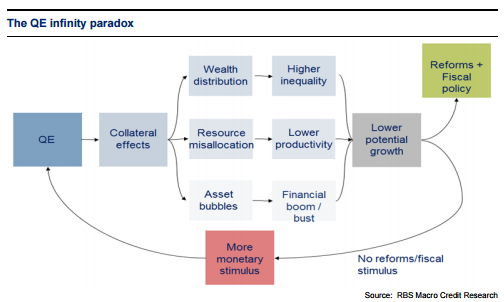

Albert Gallo, head of credits at RBS, summarised the side effects of QE in an infographic. They all lead to a lower potential of economic growth. If government intervention in the form of extra surplus impulses or structural reforms stay away – and this is unfortunately the case – it will force the central bank to continuously issue new rounds of stimulus. Gallo call this the ‘QE infinity paradox’.

No wonder that lately, more analysts have been saying that the emperor is not wearing any clothes. The central banks have become powerless, with no possibility to bring inflation levels back to intended 2%. It has to be said that the (Western) economies are momentarily doing reasonably well, but again not as well as, Fed, which can finally can start policy curtailment.

But what happens if China and other upcoming countries collapse and we are flooded with deflation? Are we immune to it? Probably not. The central banker’s nightmare can quickly become a reality: a downward spiral caused by lack of demand, continual cost savings and wage cuts.

Solution

Without any real structural reform there only remains one way to really come out of this: helicopter money. This can happen in two ways. The central bank can finance government expenses or credit a sum of money to each citizen’s account. The first route effectively already happens in the Eurozone, be it modestly. ECB buys the loans the European Investment Bank (EIB) has set in the market to mainly finance infrastructural investments. The ECB does not admit it explicitly, but it really prints money to enable a budget surplus. On a much larger scale, this is the route the new Labour-leader, Jeremy Corbyn, has suggested with his policy Quantitative Easing for the People.

The other route is by offering a cheque to citizens: ‘pay every citizen monthly €250’ wrote Carsten Brzeski, economist with ING DiBa, earlier this year. The Eurozone has approximately 330 million inhabitants, so after a year the ECB would increase its balance sheet by €1000 billion. This would be close to the ECB’s QE target of €1140 billion. Or consider the proposals by Francesco Giavazzi and Guido Tabellini, professors at the Italian Bocconi University, who proposed a tax reduction of around 5% of GDP in every European country, financed by placing government bonds with the ECB.

No side effects

Initially citizens might use the provided expenditure for debt reduction, but as the cheques keep coming, at some stage the money will be spent. I cannot think of a better way to alight inflation. And it happens without side effects mentioned by Albert Gallo. The economist John Muellbauer, Professor at the Oxford University, had made the case for the long-term use of helicopter money and gave a presentation once for the ‘governing council’ of the ECB. The reaction was that they found it a fascinating thought-experiment, and nothing more. In particular, they had legal and practical drawbacks. The ECB is permitted to intervene to its own liking on the financial markets – buyout operations are a part of Frankfurt’s toolkit – but it is forbidden to exercise monetary financing. Sending cheques would immediately lead to procedures in Karlsruhe or Luxembourg. Central bankers ask, how can you organise it all,who exactly sends these cheques?

So scatter away!

I would argue that if the EIB can be financed, then Draghi can send cheques as well. And if that is practically tricky, he can let it be executed by Brussels, or by the national governments.

For the purpose of clarity. The ECB’s current QE programme has been underway only seven months and still has a full year to go during which it will purchase bonds for €60 billion a month. During this period market disturbances will continue. If Mario really intends it to be about price stability, so to ensure inflation of ‘close but under 2%’, than it is time to commence with scattering money rather than giving it to bankers. If we divide the €720 billion the ECB still has to spend over, to the 330 million Eurozone inhabitants, then I should be able to expect a mere €2000 from Frankfurt. Exactly the amount I need for my house extension – my contractors would rub their hands in joy.