Is the Next Global Financial Crisis Upon US?

Financial markets are currently in a frenzy – and a global market crash could be just minutes away. Earlier last week, China allowed its currency to fall in value, prompting its highest one-day decline in over two decades. Today, data shows that China’s factories have contracted at their fastest pace since the most recent financial crisis. Market panic is quickly gaining pace as China’s economy shows clear signs of further deterioration.

The US stock market has experienced its largest decline in 18 months, European shares have experienced their biggest weekly fall this year, and the FTSE fell to its lowest point this year. John Ficenec of the Telegraph believes things are only going to get worse, and he gives us 8 convincing reasons why.

China Slowdown

When the financial crisis struck in 2008, it was central banks that essentially stepped in and provided the finance to keep the world’s major economies afloat. Indeed, a significant stimulus package was put together for China.

(Here at Positive Money we have previously noted that China has progressively lowered its benchmark interest rates since 2011 and has lowered reserve ratios a number of times in the past years. Accordingly, Chinese private sector debt has quadrupled in the last 7 years, and we noted that soaring Chinese debt levels are one of three of the biggest threats to global financial stability.)

The Chinese stimulus prompted a housing and infrastructure bubble, absorbing many of the World’s commodities. Ficenec, therefore begins his article by suggesting that:

“China was the great saviour of the world economy in 2008. The launching of an unprecedented stimulus package sparked an infrastructure investment boom. The voracious demand for commodities to fuel its construction boom dragged along oil- and resource-rich emerging markets.”

However, Chinese demand has begun to slow:

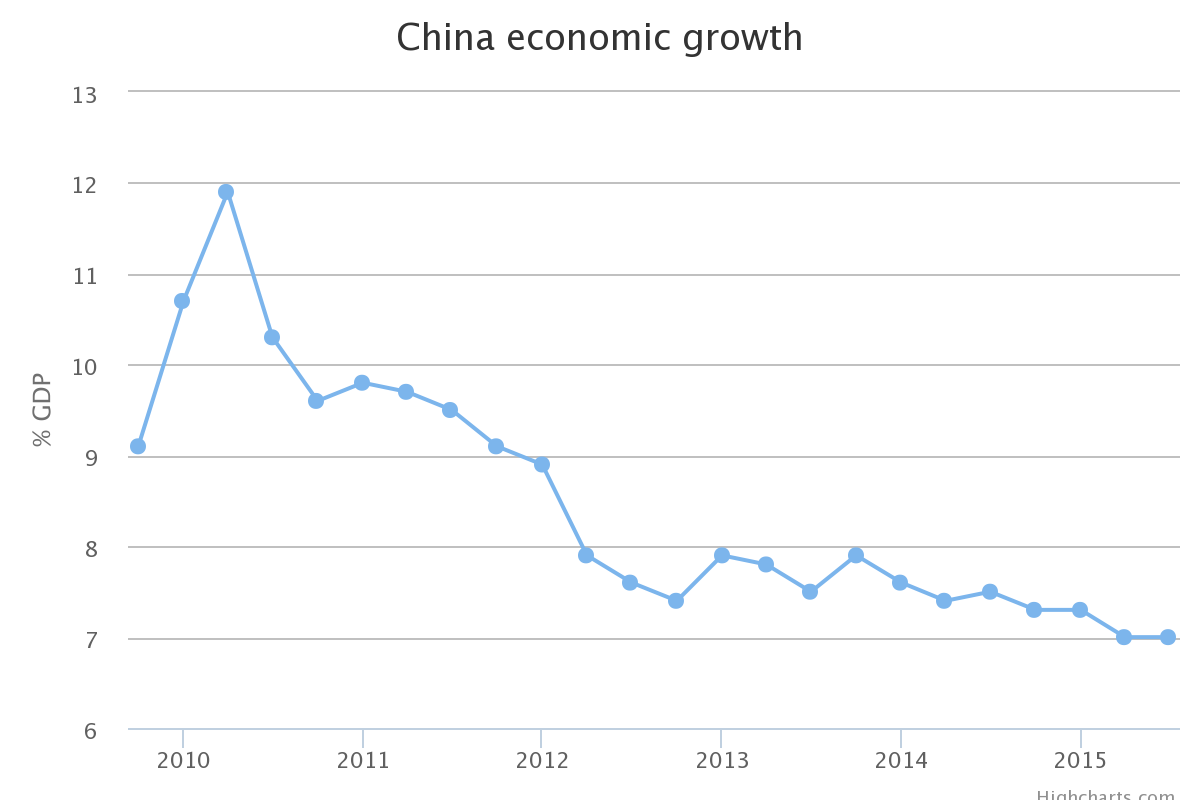

“Economic growth has dipped below 7pc for the first time in a quarter of a century, according to official data. That probably means the real economy is far weaker… Data for exports showed an 8.9pc slump in July from the same period a year before. Analysts expected exports to fall only 0.3pc, so this was a huge miss. The Chinese housing market is also in a perilous state. House prices have fallen sharply after decades of steady growth. For the millions who stored their wealth in property, it makes for unsettling times.”

Commodity Collapse

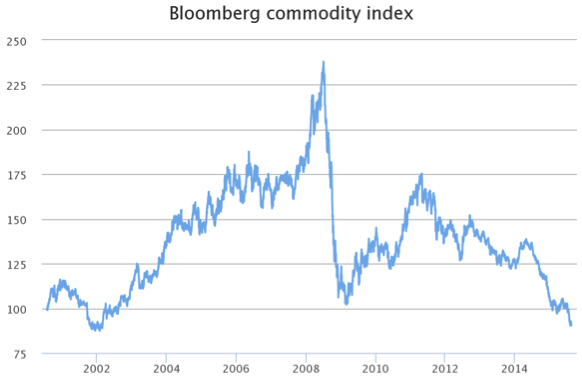

Prices of commodities are very good indicators of global economic activity. Thus, when demand for important raw materials (i.e. copper, iron ore, aluminium, zinc, nickel, lumber etc.) plummets and prices drop, we are given a good idea of what to expect from our economies.

It is thus no surprise, that Ficenec suggests as China’s economy activity continues to decline, demand for commodities will similarly continue to fall. Indeed, the massive slowdown in China’s economy has almost single handily prompted a collapse in the commodity markets:

“The Bloomberg Global Commodity index, which tracks the prices of 22 commodity prices, fell to levels last seen at the beginning of this century.”

Resource Sector Credit Crisis

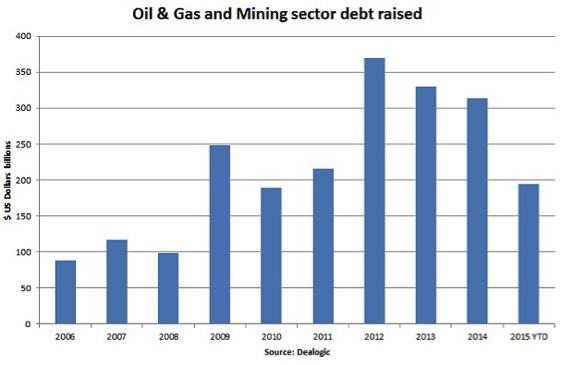

Numerous loans worth billions of dollars were used to finance exploration and excavation of raw materials and oil. Thus, with the continued collapse in prices for these goods:

“Many of these projects are now loss-making. The loans raised to back the projects are now under water and investors may never see any returns… As more debt needs refinancing in future years, there is a risk the contagion will spread rapidly.”

Dominos Begin to Fall

Many of the emerging economies, with export-oriented economies are dependent on the returns from high commodity prices. Accordingly, they use the profits from their exports to purchase imports from Western economies. Thus, there is a clear domino effect from China, to emerging economies, to the West.

“The great props to the world economy are now beginning to fall. China is going into reverse. And the emerging markets that consumed so many of our products are crippled by currency devaluation. The famed Brics of Brazil, Russia, India, China and South Africa, to whom the West was supposed to pass on the torch of economic growth, are in varying states of disarray.”

According to Ficenec, there are three primary knock-on effects that this will have for the West. 1) The profits that many Western companies have been dependent on for the last 6-7 years will no longer be available. 2) The prices of the shares of these companies are presently over-valued based on their current earnings. 3) Thus, as the profits of these companies decline, their share price will decline even more abruptly.

The author consequently suggests that:

“The central banks are rapidly losing control. The Chinese stock market has already crashed and disaster was only averted by the government buying billions of shares. Stock markets in Greece are in turmoil as the economy grinds to a halt and the country flirts with ejection from the eurozone.

Earlier this year, investors flocked to the safe-haven currency of the Swiss franc but as a €1.1 trillion quantitative easing programme devalued the euro, the Swiss central bank was forced to abandon its four-year peg to the euro.”

Credit Markets Roll Over

Next, Ficenec suggests that:

“As central banks run out of silver bullets then, credit markets are desperately seeking to reprice risk. The London Interbank Offered Rate (Libor), a guide to how worried UK banks are about lending to each other, has been steadily rising during the past 12 months.”

The author makes a good point that this is actually quite a natural process and may in fact be a ‘healthy return to normal pricing’ after a number of years of unprecedented monetary stimulus by a various central banks. But more importantly, Ficenec points out that:

“As the essential transmission systems of lending between banks begin to take the strain, it is quite possible that six years of reliance on central banks for funds has left the credit system unable to cope.”

Interest Rate Shock

Another reason to believe that things are going to worse from here is the potential for an interest rate shock.

“Interest rates have been held at emergency lows in the UK and US for around six years. The US is expected to move first, with rates starting to rise from today’s 0pc-0.25pc around the end of the year. Investors have already starting buying dollars in anticipation of a strengthening US currency. UK rate rises are expected to follow shortly after”.

This will be particularly problematic for many emerging economies which have in recent years taken out massive loans in U.S. dollars and U.K. sterling. As the dollar and pound begin to strengthen in value (appreciate), many of the emerging economies who depend on a devalued currency in order export more, will struggle to pay back their loans – as paying back those loans will require a lot more of their respective domestic currencies than originally intended.

Bull Market Third Longest on Record

Ficenec then puts forward something that Positive Money has been stating for a long time, prices on the UK stock market have been increasing primarily due to Quantitative Easing programmes.

“The UK stock market is in its 77th month of a bull market, which began in March 2009. On only two other occasions in history has the market risen for longer. One is in the lead-up to the Great Crash in 1929 and the other before the bursting of the dotcom bubble in the early 2000s… UK markets have been a beneficiary of the huge balance-sheet expansion in the US. US monetary base, a measure of notes and coins in circulation plus reserves held at the central bank, has more than quadrupled from around $800m to more than $4 trillion since 2008. The stock market has been a direct beneficiary of this money and will struggle now that QE3 has ended.”

Overvalued US Market

Low interest rates and Quantitative Easing programmes have most likely had the same effect on the US stock Market. Ficenic thus suggests:

“In the US, Professor Robert Shiller’s cyclically adjusted price earnings ratio – or Shiller CAPE – for the S&P 500 stands at 27.2, some 64pc above its historic average of 16.6. On only three occasions since 1882 has it been higher – in 1929, 2000 and 2007.”