Positive Money is a company limited by guarantee registered in England and Wales.

Registered number 07253015.

Registered office: Positive Money c/o New Economics Foundation: 10 Salamanca Place, London SE1 7HB.

T: +44 207 253 0735

info@positivemoney.org.uk

Bank of England on Money and Money Creation in the Modern Economy

Where does money come from? In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood. The principal way in which they are created is through commercial banks making loans: whenever a bank makes a loan, it creates a deposit in the borrower’s bank account, thereby creating new money. This description of how money is created differs from the story found in some economics textbooks.

Believe it or not, this is an extract from the News Release on new Quarterly Bulletin on Bank of England’s website!

We’ve been talking about the way money is created for the last 4 years. We’ve also argued that the textbooks used in universities were inaccurate. At last, there’s an official document and videos that we can send to all those economists, academics, politicians and everyone who still shake their head when we’re explaining this.

Here are the papers and videos:

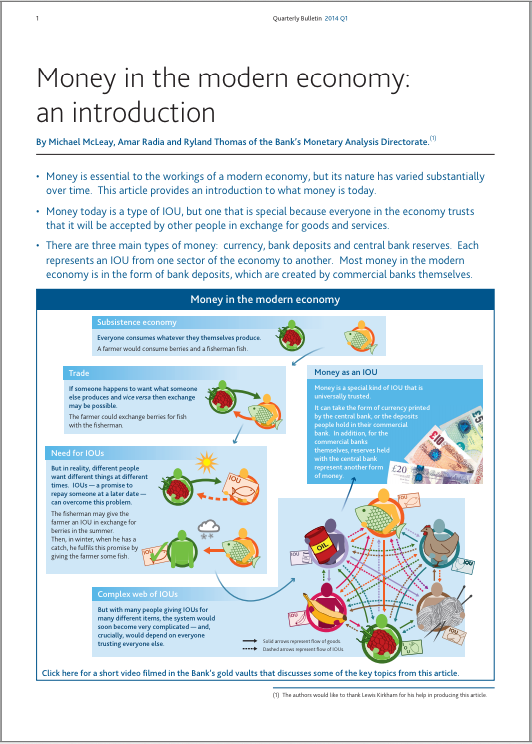

Money in the modern economy: an introduction (531KB)

This bulletin provides an introduction to the role of money in the modern economy. It does not assume any prior knowledge of economics before reading. The article begins by explaining the concept of money and what makes it special. It then sets out what counts as money in a modern economy such as the United Kingdom, where 97% of the money held by the public is in the form of deposits with banks, rather than currency. It describes the different types of money, where they get their value from and how they are created.

The book “Where Does Money Come From?”, co-authored by Positive Money’s Head of Research Andrew Jackson is quoted in the References.

A short video explains some of the key topics covered in this article:

Money creation in the modern economy (111KB)

A companion piece to this Bulletin article, ‘Money creation in the modern economy’, describes the process of money creation in more detail, and discusses the role of monetary policy and the central bank in that process. For expositional purposes this article concentrates on the United Kingdom, but the issues discussed are equally relevant to most economies today.

This article explains how the majority of money in the modern economy is created by commercial banks making loans.

Money creation in practice differs from some popular misconceptions — banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits.

The article dispels a number of misconceptions about how Quantitative Easing works:

Just as in normal times, the reserves created by QE cannot be ‘multiplied up’ into additional loans and deposits.

Nor can reserves be directly lent out, since only commercial banks hold reserves accounts.

“Loans create deposits not the other way round.”