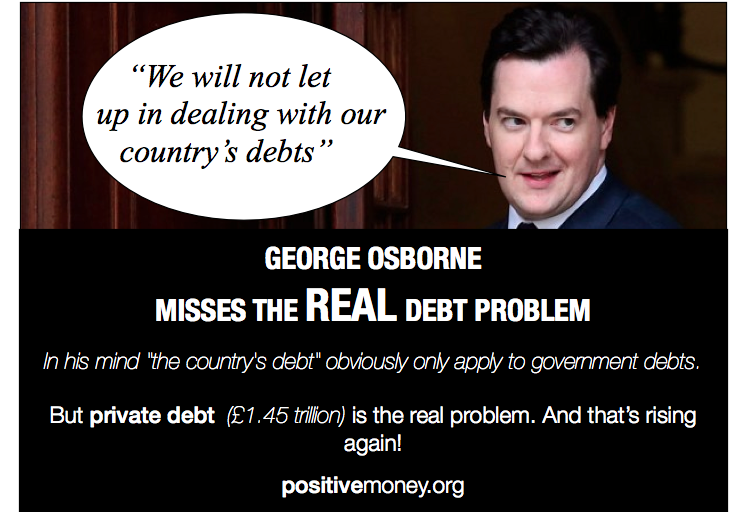

George Osborne misses the real debt problem

The autumn statement given this morning by the UK’s chancellor (finance minister) had the standard focus on the government’s debts whilst completely missing the much bigger problem: private debt.

Osborne made statements such as:

“We will not let up in dealing with our country’s debts”

“Using surpluses in good years to keep debt falling [… will] fix the roof when the sun is shining”

In Osborne’s mind “the country’s debt” obviously only apply to government debts. But private debt – the debt of families and households, in the form of mortgages, credit cards and overdrafts – is what we should really be worrying about right now.

At £1.45 trillion, household debt is higher than the government’s debt (around £1.2 trillion, depending on which figures you take). And the interest paid on the national debt is lower than the rate of interest paid on household debt.

Whilst government policy is focussed on reducing the government’s debts, it’s simultaneously focussed on increasing household debt. Policies such as lowering interest rates to their lowest level in history, Funding for Lending and Help to Buy are all designed to encourage people to borrow more so that banks can create more money by making loans. As this new money gets into the economy, it boosts spending and fuels the ‘growth’ that we’re hearing so much about now.

But if the last financial crisis was caused because household debt was too high, and that debt hasn’t fallen significant since then, then pushing that debt up even further is likely to be a dangerous strategy. Even former FSA-chief Adair Turner has argued that this may lay the foundation for the next financial crisis.

So Osborne can’t claim to be “dealing with our country’s debts” until he finds policies that will allow the level of household debt to start falling. The only way to do that on any significant scale is to have money created by the Bank of England, free of debt, and spent directly into the real economy. That new money would boost the real economy and allow households and families to start paying down some of their own debts.

Our paper Sovereign Money: Paving the Way for a Sustainable Recovery (Free download) explains how this policy works. If Osborne really wants to deal with this country’s debts, whilst also boosting the real economy (instead of financial markets and property bubbles) then this is the policy he should have announced today.

Further reading:

Nine million in ‘serious’ debt across the UK

Soaring UK personal debt wreaking havoc with mental health, report warns (The Guardian)