Sovereign Money Creation vs Modernising Money

We’ve just released our new report, Sovereign Money: Paving the Way for a Sustainable Recovery, which explains why the current debt-fuelled recovery is not sustainable, and how using the state’s power of money creation can make it sustainable.

The problem with how our money is created

There are currently two sources of money into the UK economy:

Money created by banks, when they make loans. This currently makes up the majority of money in the economy.

Money created by the Bank of England on behalf of the government. Currently this makes up a tiny percentage of the money in the economy.

The problem we currently have is that the government isn’t willing to use its power to create money in the public interest. Instead, it relies on the same banks that caused the financial crisis to create money. But most of the money created by banks goes into house price bubbles (40% of all new money created in the 10 years running up to the financial crisis) and financial markets (37%), whereas only a minority (13%) ends up in the real economy.

So right now, we see banks still reducing their lending to businesses, whilst increasing their lending for mortgages and business. If household debt is rising, but businesses aren’t able to increase salaries, then sooner or later, some of the debt becomes unpayable and people will default. The government’s strategy for getting the economy growing again could actually lead us back into another financial crisis.

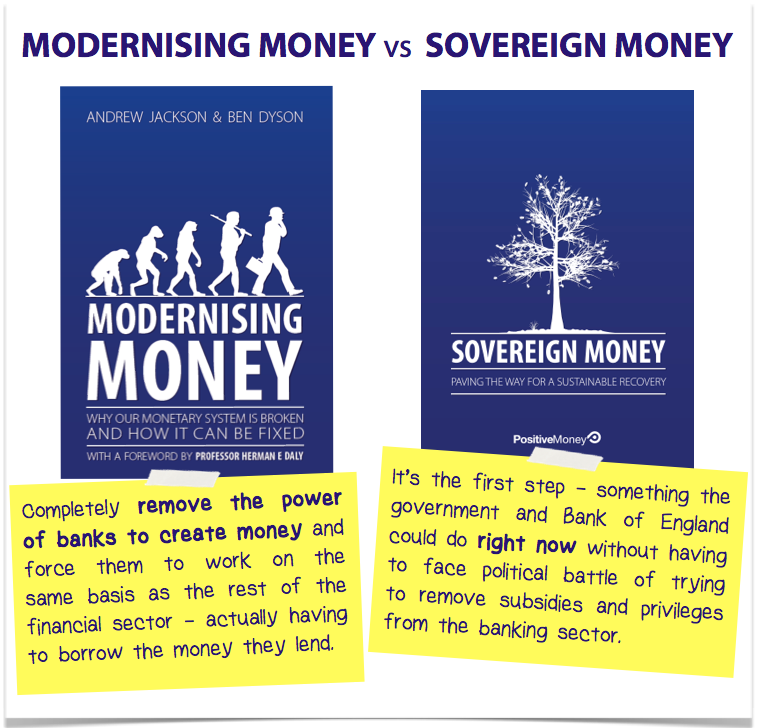

The differences between Sovereign Money Creation and Modernising Money (the book)

In our book Modernising Money, we argue that we should completely remove the power of banks to create money and force them to work on the same basis as the rest of the financial sector – actually having to borrow the money they lend, rather than being able to create it in the process of lending. The changes required to do this would make it possible for banks to be allowed to fail, and would mean that all the benefits of creating money would go to the taxpayer rather than the banking sector.

In Sovereign Money: Paving the Way for a Sustainable Recovery, we don’t go quite so far. Instead, we’ve outlined the reasons why the government is making a dangerous mistake by relying on further bank lending to boost spending and help the economy grow. We explain how a process called Sovereign Money Creation (SMC), which involves allowing the Bank of England to create money, which would be granted to the government and spent into the real (non-financial) economy would boost spending and employment but without requiring households to borrow even more. Rather than increasing the total amount of debt in the economy, SMC actually lowers it. It would make the current ‘recovery’ into a sustainable one, rather than one fuelled by credit cards and mortgage lending.

Importantly, the creation of sovereign money through SMC can be done without having to stop banks creating money, so it’s something the government and Bank of England could do right now without having to face the counter-lobbying and political battle of trying to remove subsidies and privileges from the banking sector.

Ultimately, we still believe that the economy would be more stable and society better off if we completely remove the power that banks have to create money. That’s still what we’re campaigning for in the long-term. But it’s unrealistic to think that a government would be willing to make the overnight switch from allowing banks to create almost all of the money in the economy, to allowing them to create none. The approach of SMC allows the government to put the first toe in the water, and see the benefits of having money created in the public interest and spent into the real economy.

The use of sovereign money would also break the dependence we currently have on the banks to create money, and mean that lobbyists for the banks could no longer claim that any type of regulation or limits on what they can do will ‘restrict credit and harm the economy’. If banks aren’t willing to create money for the real economy, then the Bank of England can do so instead.

The Sovereign Money report shows that there are better ways to create money than relying on the same banks that fuelled the crisis. We can then move to a discussion of which is better for the economy and society:

Money created by banks when people go into debt, and pumped into the housing or financial markets, in the hope that some of it ‘trickles down’ into the real economy, or

Money created by the state and spent directly into the real economy, without requiring anyone to go further into debt.

You can guess how we’d answer this question, but believe it or not, most economists and politicians haven’t given it much thought, so it’s time to create a public debate.

PDF Download:

[div class=’box-download’]Download Here (Free, PDF, 60 pages)[/div]