End fractional reserve banking and fix the economy

When you ask the man in the street how money works, they will suggest that it’s a system of tokens that circulate forever. That system is called full reserve banking. Money could work like that. Money should work like that… but money doesn’t work like that.

To be more accurate, a tiny slither (3%) of our total money supply is indeed made up of tokens that circulate forever, but the vast majority (97%) is made up of a completely different kind (technically known as broad money) which is a kind of temporary money, continuously being created and destroyed. It gets created when banks make loans and destroyed when those loans are repaid.

The result of this strange arrangement is that the total amount of money that exists in the economy is always fluctuating. At any one time, thousands of people may be creating new money by taking out loans while at the same time thousand may be destroying money by repaying existing loans.

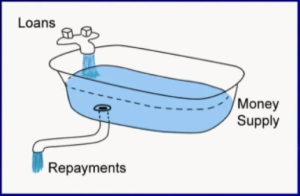

The total amount of money in the economy is therefore rather analogous to the amount of water in a bath when the plug has been removed, letting water pour out, and there is a tap running with water flowing in. The water flowing out corresponds to money destruction as existing loans are repaid, and the running tap corresponds to new loans being made. If these two rates are exactly the same then the total amount of money we had would remain constant, but that’s rather tricky to arrange.

The problem comes when there are large changes in the rates of borrowing… Imagine for a moment a period in which there was great enthusiasm for borrowing, say for example in the years running up to a housing bubble. The tap has been gushing, pouring water in the bath. People are borrowing like crazy because they think that house prices can only ever go up.

Then the bubble bursts, people are sceptical that house prices can go any higher and suddenly the enthusiasm for new borrowing reduces dramatically. This is like turning the tap off or at least, turning it down dramatically. But the water carries on pouring out the plughole at just the same rate because all that earlier borrowing still has to be repaid. If the government did nothing then the water level would start to fall.

This is exactly what happened in the US in the great depression in 1929. In the run up to the depression people were borrowing like crazy, not to buy houses, but to buy stocks and shares – because they thought the price of them could only ever go up. Then suddenly the bubble burst, people no longer believed that share prices were going to rise and they stopped borrowing. The tap got turned off, the water was still going down the drain and governments did nothing.

During the years of the great depression, the total amount of money in the US economy shrank by a third. Note that the money wasn’t “going somewhere else” it wasn’t ending up in somebody else’s hands… it was actually disappearing out of existence. A decreasing money supply is agonising for an economy. People go round scratching their heads, wondering why everyone seems to have less money than they used to.

Now fast forward to 2007. We had an almost exact replay of 1929. Except this time all the borrowing was for housing. When the bubble burst, the government thought “oh my god, how do we stop the money supply collapsing?”… but within the current money system, the only thing they could think of doing was to desperately try and get the tap running again. So they put interest rates down to near-zero, made hair-brained schemes trying to get people to take out more mortgages and they did a whole load of borrowing themselves. All these things are very harmful to an economy, especially the near-zero interest rates. It puts retired people into poverty because they are attempting to live on the interest from their savings. People who had been saving all their lives for a decent retirement, suddenly find their pensions shrink to almost nothing.

Now imagine for a moment that all of the money in the system was converted to everlasting tokens. Under this system there is simply no such thing as a collapsing money supply! If we switched to this system, then virtually overnight we could have normalised rates of interest, we could scrap the hair-brained mortgage schemes and the government could do less borrowing. The advantages are simply enormous.

You might ask: “That all sounds good to me, but what are the arguments against?”

People who are against our proposals are almost invariably only against because they don’t understand the system. There are no coherent arguments against, that I know of, from people who properly understand both the existing and our new proposed systems.